When you find mold in your Los Angeles home, the first question is almost always, "Am I covered?" The short answer is, it depends entirely on where the water came from. The key to getting insurance coverage for mold hinges on whether the moisture was from a “sudden and accidental” event, like a pipe that bursts behind your drywall. If the mold grew slowly from a lack of maintenance, like a drippy faucet you never got around to fixing in your Sherman Oaks bungalow, coverage is almost always denied.

Understanding this distinction is the first step in navigating your homeowners policy. This guide breaks down the critical details so you know what to expect and how to build a successful claim.

Understanding the Basics of Insurance Coverage for Mold

Think of your insurance policy as a rulebook. For a mold damage claim to be a winner, it has to be the direct result of a specific, covered event. It’s not actually the mold itself that triggers the coverage, but the story of how it got there. Insurers trace the mold back to its origin, and that origin story is what decides whether your claim gets a green light or a hard stop.

The key difference comes down to sudden damage versus gradual damage. A pipe bursting behind a wall and flooding a room is a perfect example of a sudden and accidental event. On the other hand, mold that creeps in over months because of high humidity from a poorly ventilated bathroom is a gradual issue—and insurance companies see that as a maintenance problem you could have prevented.

Sudden vs. Gradual Damage

The source of the moisture is the single most important factor in any claim involving insurance coverage for mold.

- Sudden Damage (Often Covered): This covers events that happen unexpectedly and aren't due to neglect. Think of things like a fire hose putting out a fire, a washing machine hose suddenly failing, or a pipe freezing and bursting. The water damage and any mold that follows are typically covered.

- Gradual Damage (Often Denied): This is for problems that develop over time. We’re talking about slow leaks from plumbing, water seeping through the foundation from bad drainage, or constant condensation on windows. Insurers look at these situations and see them as preventable maintenance issues, not accidents.

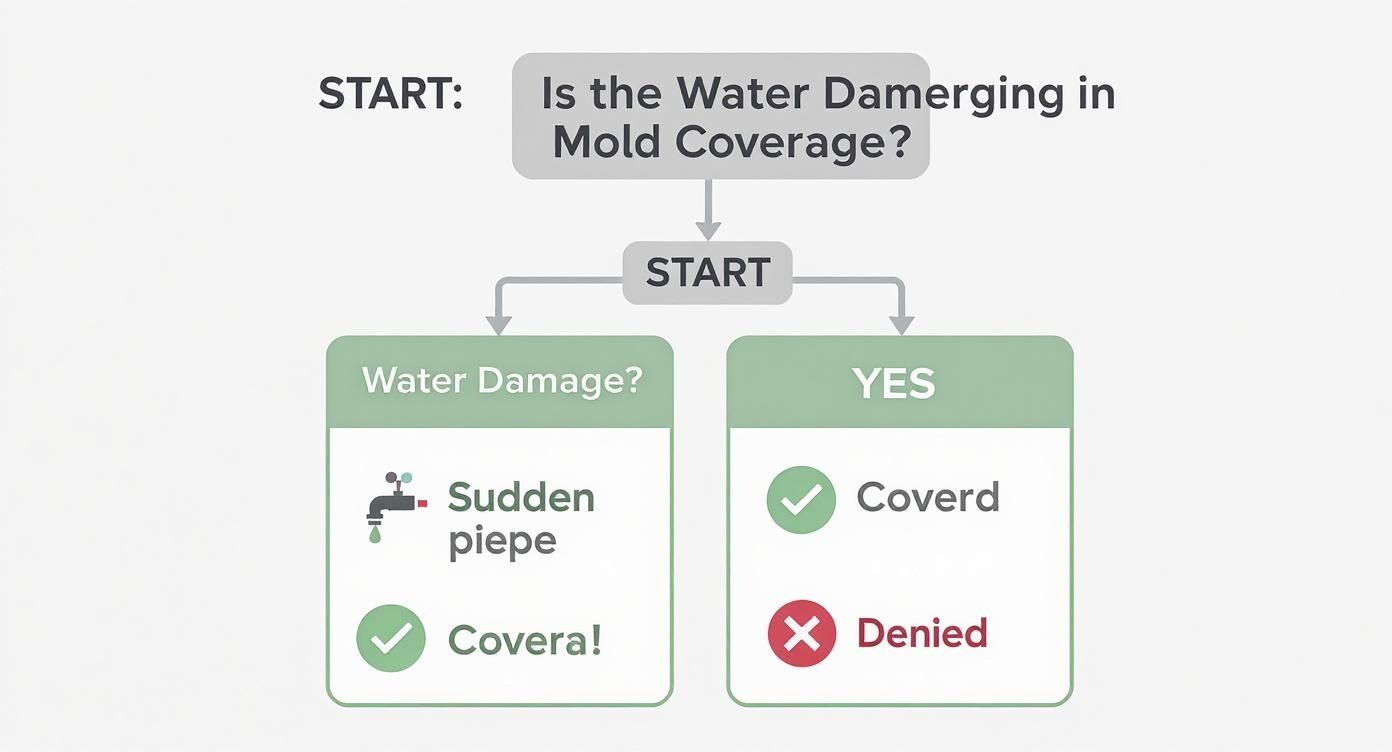

This decision tree gives you a clear picture of how an insurance adjuster thinks when they evaluate the source of water that led to a mold problem.

As the visual shows, the path to getting your claim approved starts and ends with one question: was the water damage sudden or gradual?

To help you quickly assess your situation, here's a simple guide to common mold scenarios.

Quick Guide to Mold Coverage Scenarios

| Scenario | Typical Coverage Status | Reasoning |

|---|---|---|

| Burst washing machine hose | Likely Covered | A sudden and accidental plumbing failure that falls under a covered peril. |

| Slow leak under the kitchen sink | Likely Denied | Considered a gradual problem resulting from a lack of routine maintenance. |

| Roof leak during a severe storm | Likely Covered | Storms are a covered peril; the damage was sudden and unforeseen. |

| High humidity in a bathroom | Likely Denied | Insufficient ventilation is a long-term maintenance issue, not an accident. |

| Water from extinguishing a fire | Likely Covered | The fire is the initial covered peril, making the resulting water and mold damage part of that claim. |

| Foundation seepage after rain | Likely Denied | Standard policies exclude groundwater and flood-related issues. |

Remember, this table is a general guide. Your specific policy language is always the final word.

The Role of Covered Perils

Navigating insurance coverage for mold can feel tricky because it's so dependent on your specific policy. Generally, your homeowner's insurance will only cover mold if it’s the direct result of a "covered peril," like that burst pipe or a roof damaged in a storm. But they'll almost certainly deny claims caused by poor maintenance, and that's a critical line in the sand.

The nuances between a sudden event and a long-term issue are everything. You can learn more by exploring our detailed guide on homeowners insurance coverage for water damage.

Key Takeaway: Your insurance policy is there to protect you from unforeseen accidents, not to pay for the fallout from deferred maintenance. Proving the mold is a direct result of a covered, sudden event is the bedrock of a successful claim. This is where professional documentation becomes your most powerful tool.

Decoding Your Homeowners Insurance Policy

Let's be honest: your homeowners policy can feel like it’s written in another language, full of dense clauses and confusing terms. But if you want to understand your rights and secure insurance coverage for mold, you have to know what it says. Think of it as the rulebook for your property—knowing the rules is the first step to winning the game.

Let’s translate the most important concepts from insurance-speak into plain English. Once you get these down, you can read your own policy with confidence and know exactly what you’re protected against.

Covered Perils: The Foundation Of Your Coverage

The single most important concept in any policy is the “covered peril.” These are the specific, named events your insurance company has agreed to protect you from.

Imagine your policy is a protective shield. That shield only works against the exact types of damage listed in your contract, like fire, theft, windstorms, or the weight of ice. If the event that caused your damage isn't on that list, your policy won’t cover it. Simple as that.

When it comes to mold, the mold itself is almost never a covered peril. For a claim to have a chance, the source of the water that fed the mold must be a covered peril. A classic example is a burst pipe—that’s often a covered peril, making the resulting water damage and any mold that follows eligible for coverage.

Sudden and Accidental vs. Gradual Damage

Another critical distinction every adjuster makes is between sudden and accidental damage and gradual damage. This concept is often the final word on whether a mold-related claim gets a green light or a denial stamp.

- Sudden and Accidental Damage: This is for events that happen out of the blue, without any warning or negligence on your part. Think of a water heater that suddenly ruptures and floods your basement. It was unexpected and unavoidable.

- Gradual Damage: This describes problems that develop over weeks, months, or even years. A slow, persistent drip from a pipe under the sink or condensation that builds up on windows over a long winter are prime examples.

Insurers see gradual damage as a maintenance issue. From their perspective, it was foreseeable and preventable, so they almost always exclude it from coverage. It’s on the homeowner to fix those slow leaks before they become big problems.

Mold Exclusions and Sub-Limits

In the old days, most standard insurance policies didn’t even mention mold. But as mold claims became more common, insurers moved quickly to add specific language to limit their exposure. This is where exclusions and sub-limits come into play.

A mold exclusion is a clause that flat-out states the policy will not pay for damages caused by mold, fungus, or bacteria, no matter what caused it. It’s a complete stop sign for coverage.

More often, though, you'll find a mold sub-limit, also known as a limitation or endorsement. This is a hard cap on the amount the insurer will pay for mold remediation, even if it was caused by a covered peril.

These sub-limits can be shockingly low. It's not uncommon for a policy to cap mold coverage at just $1,000 to $10,000. Considering that professional mold remediation can easily blow past that figure, especially for a serious infestation, this sub-limit can leave you holding a very large bill.

The only way to know for sure what applies to you is to read your policy's "Declarations Page" and look for sections on "Exclusions" or "Additional Coverages." Understanding these terms—covered perils, the type of damage, and any exclusions or sub-limits—is what turns your policy from a confusing document into a clear roadmap of your protections.

When Your Insurance Policy Will Cover Mold

Here’s the single most important thing to understand about insurance coverage for mold: insurers don’t really cover mold itself. They cover the specific event that caused the mold. The policy is all about the "trigger," not the aftermath. Getting this one distinction right is the key to a successful claim.

Think of it like this: if a washing machine hose suddenly bursts in your Sherman Oaks home, the water that floods the laundry room is a covered event. Any mold that later grows on that soaked drywall is a direct consequence of that covered event, which means the mold removal should be covered, too.

What you need is a clear, unbroken chain of events. The damage must start with a "sudden and accidental" incident that your policy specifically names as a covered peril.

Call (818) 336‑1800 Now for an Expert Assessment

Proving the Link Between Water Damage and Mold

Insurance adjusters need ironclad proof that the mold is just a symptom of a larger, covered problem. They won't just take your word for it—and frankly, you can't blame them. This is where professional documentation becomes your most powerful tool.

A licensed restoration company like Onsite Pro Restoration specializes in finding the exact source of water intrusion. We don't just guess; we use advanced tools like thermal imaging cameras and moisture meters to trace the water's path, pinpointing where it started and mapping out every inch of affected material.

This evidence creates the clear, direct narrative your insurer needs to approve the claim. Without that professional validation, it’s far too easy for them to fall back on common denials like "gradual damage" or "homeowner maintenance issue."

Real-World Scenarios of Covered Mold Damage

Let's ground this in some real-world examples you might see across Los Angeles, where coverage would most likely apply:

- A Burst Refrigerator Supply Line in a Santa Monica Condo: The little plastic line feeding the icemaker splits without warning, spraying water all over the wall and floor behind the fridge. Because the pipe failure was sudden and unexpected, the resulting water damage and mold are covered. You can learn more about how insurers view these cases in our guide to insurance coverage for burst pipes.

- An Overflowing Toilet in a Beverly Hills Home: A second-floor toilet clogs and overflows, sending water straight through the ceiling into the living room below. This is a classic "accidental discharge," and the mold remediation for the damaged ceiling and flooring would typically be covered.

- Storm Damage to a Roof in Glendale: A powerful windstorm rips shingles off the roof, letting rain pour into the attic. The water damage and mold that follows on the insulation and roof rafters are covered because the storm itself is the initial covered event.

In every one of these cases, the mold is simply a symptom. The real problem was the initial, covered water event.

Why Immediate Expert Assessment Is Critical

The insurance world has gotten much stricter about mold claims. Rising costs tied to health issues and legal liability have made carriers scrutinize these claims more than ever before. Considering that an estimated 47% of U.S. homes have problems with mold or dampness, it's a massive risk for insurers and a serious health concern for homeowners. You can discover more insights on how environmental factors are shaping the 2025 insurance market on Risk-Strategies.com.

Crucial Takeaway: The moment you find mold, your first call should be to a restoration expert, not your insurance agent. An immediate professional assessment stops the damage from getting worse, preserves critical evidence about the cause, and gives you the documentation you need to file a strong claim from the very start. Acting fast also shows you've taken steps to mitigate the loss—a requirement in nearly every policy.

Common Reasons Insurance Companies Deny Mold Claims

Knowing why an insurer might deny a claim for insurance coverage for mold is the single best way to avoid that frustrating outcome. A denial letter can feel like a slap in the face, but it’s rarely a surprise if you understand the core principle adjusters operate on: maintenance.

Insurers see your policy as a two-way street. They agree to cover sudden, unforeseen accidents, and in return, you agree to perform routine upkeep to stop problems before they start. When a claim gets denied, it’s almost always because the adjuster traced the mold back to a slow, gradual issue that falls squarely under your responsibility to maintain the property.

Negligence and Gradual Damage

The number one reason for denial? Gradual damage from neglected maintenance. Your policy is a safety net for unexpected disasters, not a piggy bank for the consequences of long-term inattention.

Think about that slow drip from the P-trap under your bathroom sink. If it leaks for months, soaking the cabinet and the drywall behind it, the mold that follows is a textbook maintenance failure. An adjuster will argue that a responsible homeowner would have noticed and fixed that tiny drip long before it mushroomed into a major mold problem.

Here are a few classic examples of maintenance-related issues that almost guarantee a denied claim:

- Persistent Leaks: A faucet that constantly drips or a toilet that runs 24/7 creates a perfect breeding ground for mold, but it’s considered a simple fix, not a sudden accident.

- Poor Ventilation: A bathroom without a working exhaust fan traps steam after every shower, leading to chronic high humidity and surface mold. That’s a design or upkeep issue.

- Window Condensation: If your windows "sweat" all winter, the constant moisture can lead to mold on sills and walls. This points to problems with insulation or humidity control—both are considered maintenance duties.

High Humidity and Poor Air Circulation

High ambient humidity is another major red flag for adjusters, especially in places like basements or crawl spaces. Insurers view managing moisture in the air as a condition you, the property owner, must control.

A damp, musty crawl space that allows mold to creep up the subfloor joists is a perfect example. Why? Because the moisture didn't come from a sudden event like a burst pipe. It came from a persistent environmental condition that wasn't managed. Proper ventilation and moisture control are the keys here. You can learn about effective solutions in our guide on crawl space dehumidification to see how staying ahead of humidity protects your property and your insurance coverage.

Pre-Existing Damage and Excluded Events

Beyond maintenance, a few other scenarios will almost always lead to a denial for your mold claim.

Key Insight: Insurers won't pay to fix problems that were already there before your policy started or that were caused by events specifically excluded in your contract.

Two major reasons for denial fall into this bucket:

- Pre-Existing Conditions: If you buy a home and later find mold that the inspector missed, you can't file a claim. The damage happened before your policy was active, making it a pre-existing issue.

- Flood Damage: Standard homeowners policies are crystal clear: they do not cover damage from floods. This includes groundwater seeping into a basement or storm surge. Mold caused by a flood requires a separate flood insurance policy, usually from the National Flood Insurance Program (NFIP).

As homeowners have become more aware of mold risks, the remediation service market has grown—and insurers have gotten much more cautious in response. According to market trends on CoherentMarketInsights.com, this rise in claims has pushed many insurance carriers to add new limits or exclusions for mold. This makes it more important than ever to know your policy inside and out. By staying on top of maintenance, you protect your home and make sure your policy is there for you when a true accident happens.

How To File A Successful Mold Damage Claim

The moment you find mold in your home or business, especially after a water event, the clock starts ticking. Getting your insurance coverage for mold approved isn't just about making a phone call—it's about building a rock-solid case with clear, undeniable proof.

Think of it like you're a detective preparing evidence for a trial. A sloppy, disorganized approach gives your insurance company easy openings to delay, downplay, or deny your claim. We've seen it happen. This guide is your playbook for getting it right from the start.

Step 1: Immediately Mitigate Further Damage

Your very first responsibility under almost any insurance policy is to stop the problem from getting worse. In industry terms, this is called "mitigating the damage."

As soon as you find the water source, shut it down. That might mean turning off the main water valve to the property or just the specific shut-off for a leaky appliance. Taking this step immediately shows the insurer that you’re a responsible property owner and keeps them from arguing that your inaction made things worse.

Step 2: Document Everything Meticulously

Before you move, clean, or throw anything away, grab your smartphone. It's your most powerful tool right now.

- Take Photos and Videos: Start with wide shots of the entire affected area, then get detailed close-ups of the mold growth and water damage. The more, the better.

- Narrate a Video: Record a walkthrough of the space. As you film, describe what you see, when you found it, and what you think caused it. This creates a valuable, timestamped record of the initial discovery.

- Preserve the Evidence: Don't toss that burst pipe or the broken washing machine hose. These items are your physical proof that the event was "sudden and accidental"—the magic words for insurance claims.

This documentation is the absolute foundation of your claim. Without it, you’re left in a "he said, she said" argument you're unlikely to win.

Step 3: Call a Professional Restoration Company First

This might seem backward, but your first call shouldn't be to your insurance agent. It should be to an IICRC-certified restoration company like Onsite Pro Restoration. There’s a very good reason for this.

We provide an independent, expert assessment of the cause and extent of the damage. Using moisture meters and other professional tools, we can find where the water came from and track how far it has spread, creating a detailed scope of work. This gives you a powerful, unbiased baseline before the insurance adjuster even steps foot on your property. Knowing the full scope of repairs is a critical part of the water damage restoration process.

Expert Insight: An estimate from a trusted restoration company arms you with the facts. When the insurance adjuster conducts their inspection, you'll have a professional, data-driven report to compare against their assessment, preventing them from potentially downplaying the severity of the damage.

Step 4: Notify Your Insurance Company

With your initial evidence gathered and a professional assessment in motion, it’s time to officially file the claim. Call your insurance agent or the company's claims hotline to report the loss.

Give them the basic facts: what happened, when you discovered it, and where the damage is. They’ll give you a claim number—write it down and keep it handy for every future conversation.

For a more detailed overview of the entire claims journey, this general guide to navigating home insurance claims is a fantastic resource. By following these steps, you turn a stressful situation into a managed process, dramatically improving your chances of getting the coverage you paid for.

Your Documentation Checklist

Having organized, thorough documentation is the single most important factor in getting your claim approved quickly and fairly. It removes ambiguity and gives your adjuster everything they need to move forward. Use this table as your guide.

| Item/Action | Description & Why It's Important | Status (Checkbox) |

|---|---|---|

| Photos & Videos | Capture wide-angle and close-up shots of all affected areas. A narrated video creates a timestamped record of the scene as you found it. | ☐ |

| Proof of Cause | Keep the failed part (e.g., burst pipe, broken hose). This proves the "sudden and accidental" nature of the loss. | ☐ |

| Mitigation Receipts | Save receipts for any emergency repairs, plumbing calls, or supplies you bought to stop the water source. | ☐ |

| Professional Report | Get an independent scope of work from a restoration company. This provides an expert baseline for damage and repair costs. | ☐ |

| Claim Number | Write down the claim number provided by your insurer and use it in all communications. | ☐ |

| Communications Log | Keep a simple log of every phone call and email with your insurer: date, time, who you spoke to, and what was discussed. | ☐ |

Taking the time to check off each of these items puts you in control of the claims process and demonstrates to your insurer that you are serious, organized, and prepared.

Navigating Your Insurance Claim with Professional Help

You don’t have to go it alone when facing a complex insurance coverage for mold claim. An IICRC-certified restoration company like Onsite Pro Restoration isn't just a contractor; we become your most valuable ally. We translate the dense language of insurance policies and provide the exact proof adjusters need to say "yes."

We work directly with insurance providers every day. We speak their language and deliver the detailed, systematic documentation they require to process a claim smoothly. This partnership turns what feels like a stressful, confusing ordeal into a managed and efficient recovery.

The Power of Professional Documentation

Insurance companies don't operate on guesswork—they run on data and hard evidence. Our ability to pinpoint the exact water source is often the single most important factor in getting a claim covered. We don't just give you an estimate; we build a solid case on your behalf.

Using industry-standard software like Xactimate, we generate the kind of precise, line-item estimates that adjusters recognize and trust. This detailed report leaves no room for gray areas, clearly defining the scope of work and ensuring you get compensated fairly for the full extent of the damage.

Key Takeaway: Think of a professional restoration report as an impartial, expert testament to the cause and severity of the damage. It provides the clear, undeniable link between a covered peril and the resulting mold growth that your insurer requires.

Your Advocate from Start to Finish

From the minute we step on-site for the initial inspection to the final walkthrough, our team handles the technical side of things so you can focus on getting your property—and life—back to normal. We provide comprehensive support for your first onsite property restoration, making sure every step is documented and aligns perfectly with your policy's requirements.

Our goal is to take the weight off your shoulders. By partnering with an expert, you gain an advocate who ensures all necessary evidence is gathered, deadlines are met, and every conversation with the adjuster is handled professionally. This teamwork is designed to secure the full coverage you deserve with as little stress as possible.

If you hit a wall or feel your claim was unfairly denied, getting professional advice is critical. For more complex situations, you can consult resources offering legal assistance with insurance disputes.

FAQ: Insurance Coverage for Mold

Q: What is a mold exclusion in an insurance policy?

A: A mold exclusion is a clause that explicitly states the insurer will not pay for any damages caused by mold, fungus, or bacteria, regardless of the cause. More common is a "mold limitation" or sub-limit, which caps the payout for mold remediation at a specific amount, often between $1,000 and $10,000.

Q: Should I buy a special mold rider for my policy?

A: If your standard policy has a low limit or excludes mold, you can often add a "mold rider" or endorsement. This is an optional upgrade that provides a higher, separate coverage limit specifically for mold damage. It can be a smart investment, especially in humid climates or older homes with aging plumbing.

Q: Will my insurance company pay for mold testing?

A: Generally, insurers will only cover mold testing if it's a necessary part of a valid, covered claim. For example, if a pipe bursts (a covered event), testing the resulting wet drywall for mold is usually covered. They are unlikely to pay for a test based on a musty smell alone without a covered water loss event.

Q: What should I do if my mold damage claim is denied?

A: First, request a formal denial letter that explains exactly why the claim was denied, citing specific policy language. Do not accept a verbal denial. If you believe the denial is unfair, you can appeal. A professional restoration company can provide the expert documentation needed to prove the source of loss and strengthen your case.

If you're staring down a water or mold problem and need a partner to cut through the confusion of your insurance claim, trust the team at Onsite Pro Restoration. We bring the expertise and documentation you need for a successful outcome. Get a Free Assessment Now.