Think of your commercial property insurance as a financial safety net, purpose-built to catch your business when disaster strikes. It's what stands between a manageable problem and a full-blown crisis, covering physical damage to your building, its contents, and even the income you lose if you're forced to shut down.

For any Los Angeles business, this policy is your first responder for everything from a fire or major theft to certain kinds of water damage. It’s designed to give you the resources to rebuild, replace, and recover without putting your entire business on the line. Understanding what does commercial property insurance cover is the first step toward true financial protection.

Get a Free Property Damage Assessment Now

Your Financial Toolkit for Recovery

Imagine your insurance policy is a specialized toolkit. When a major pipe bursts in your West Hollywood retail space or a fire breaks out in your Burbank warehouse, this toolkit has exactly what you need to start putting things back together.

Each part of the policy is a different tool, serving a specific purpose. Together, they work to get your operations back on track and restore your financial stability.

The real goal isn't just getting a check from the insurance company—it’s about having a clear, actionable plan that gets your doors back open, fast. This is why truly understanding what does commercial property insurance cover is so critical for Los Angeles property owners and managers.

The Three Pillars of Protection

At its core, a strong commercial property policy is built on three fundamental pillars. Get these down, and you’re well on your way to mastering your coverage and being ready for anything.

- Building Coverage: This is the bedrock of your policy. It protects the physical structure itself—the walls, roof, floors, windows, and anything permanently installed, like your HVAC system or plumbing.

- Business Personal Property (BPP) Coverage: This covers just about everything inside your building that isn't bolted down. We're talking office furniture, computers, specialized equipment, and the inventory sitting on your shelves.

- Business Interruption Coverage: This is your financial lifeline. If a covered disaster forces you to close your doors for a while, this coverage helps replace the income you've lost and covers ongoing expenses like rent and payroll. It’s what keeps a temporary setback from becoming a permanent closure.

To help you see how these pieces fit together in the real world, here’s a quick breakdown.

Core Commercial Property Insurance Coverages at a Glance

| Coverage Type | What It Protects | Common Los Angeles Example |

|---|---|---|

| Building Coverage | The physical structure of your property, including the roof, walls, windows, and permanently installed fixtures. | A fire damages the exterior walls and roof of your retail storefront in Santa Monica. This coverage pays for the structural repairs. |

| Business Personal Property (BPP) | Movable items inside your building, such as inventory, office furniture, computers, and specialized machinery. | A plumbing leak ruins thousands of dollars worth of inventory and office equipment in your Downtown LA warehouse. BPP helps replace it. |

| Business Interruption | Lost income and ongoing operating expenses (like payroll and rent) when a covered event forces a temporary shutdown. | After a major storm causes water damage, your Burbank production studio must close for a month. This covers the lost revenue and rent. |

Understanding these core components is the first step toward building a policy that truly protects your assets.

For property owners, the details matter immensely. While this guide focuses on commercial property insurance, you can also explore this excellent landlord insurance comparison guide for specifics on protecting rental properties.

Ultimately, a well-built policy creates a partnership between you, your insurer, and your restoration team. When you have a loss, a professional partner like Onsite Pro Restoration works directly with your insurance provider, giving them the critical documentation and expert mitigation they need to process your claim smoothly. This guide will walk you through every component, so you know exactly how your financial toolkit works when you need it most.

Decoding Your Policy's Core Protections

To figure out what does commercial property insurance cover, you have to look past the dense legal jargon and zero in on its three main parts. Think of them as the key chapters in your policy's story—each one protecting a different, absolutely vital piece of your business. Let's dig into what these core protections actually do for your Los Angeles property.

Building Coverage: The Foundation of Your Policy

Building coverage is the most straightforward part of your policy, but it’s also the bedrock. It protects the physical structure of your property—everything from the foundation and walls of your warehouse to the rooftop HVAC unit on your Sherman Oaks office building.

This coverage is designed to pay for the cost of repairing or rebuilding your property after it’s damaged by something like a fire, windstorm, or vandalism. It also includes permanently installed fixtures, like plumbing, electrical wiring, built-in shelving, and commercial-grade lighting. Basically, if you can't easily pick it up and move it, it’s probably covered here.

One critical detail to watch for is the valuation method. Your policy will spell out one of two ways you'll get paid:

- Replacement Cost Value (RCV): This is the gold standard. It pays to rebuild your property with new, similar materials at today's prices, with no deduction for wear and tear.

- Actual Cash Value (ACV): This method pays the replacement cost minus depreciation. If your roof was 15 years old, ACV would only pay for its remaining useful life, leaving you to cover the difference for a brand-new one.

Getting this distinction right is everything for a full recovery. RCV policies cost a bit more, but they provide the funds you actually need to be made whole again. The concept is similar to how a homeowners insurance policy functions, but the financial stakes are usually much, much higher with commercial assets.

Business Personal Property: Protecting Your Assets Inside

While building coverage protects the shell, Business Personal Property (BPP) coverage protects everything you need to operate inside that shell. This includes all the movable contents that aren't permanently bolted down.

Think about the specialized kitchen equipment in a Santa Monica restaurant, the rows of computers and servers in a Century City tech firm, or the expensive inventory lining the shelves of a retail boutique. All of these assets fall under BPP.

Key Insight: BPP isn’t just for big-ticket items. It also covers everyday essentials like office furniture, display cases, employee uniforms, and even the artwork on the walls. Documenting these assets with photos and receipts is a game-changer for a smooth claims process.

For example, if a burst pipe floods your commercial space, building coverage would handle the damaged drywall and flooring. At the same time, your BPP coverage would kick in to pay for replacing the ruined desks, computers, and product inventory.

Business Interruption: The Lifeline That Keeps You Afloat

This might be the most critical—and most overlooked—part of a commercial property policy: Business Interruption coverage. This protection isn't about physical things; it's about time and money. It’s the financial lifeline that helps your business survive when a covered disaster forces you to shut down temporarily.

This coverage is there to replace lost net income and cover ongoing operating expenses that don’t stop just because your doors are locked. These can include:

- Rent or mortgage payments

- Employee payroll and benefits

- Utility bills

- Taxes and loan payments

Business interruption coverage has become non-negotiable. The market for these insurance lines has seen premiums climb by 8% annually over the last five years, a direct reflection of the growing and complex risks businesses face. You can read the full research on global insurance trends from McKinsey to see where the market is headed.

Without this coverage, a temporary closure for restoration can easily become a permanent one. It gives you the breathing room to repair and rebuild without bleeding your company’s financial reserves dry.

What Perils Are Actually Covered in Los Angeles?

An insurance policy is just a document until you actually need it. Its real value comes to light when it stands up against the specific, real-world threats your Los Angeles property faces every single day. Understanding what does commercial property insurance cover means connecting the legal language in your policy to tangible risks—like a kitchen fire flaring up in a North Hollywood restaurant or signage getting ripped loose by powerful Santa Ana winds.

In the insurance world, these events are called "perils," and they are what trigger your coverage. A standard commercial property policy is built to handle the usual suspects.

- Fire and Smoke Damage: This is the bedrock of property insurance. It protects against the obvious structural damage from flames and heat, but also the corrosive soot and stubborn smoke odor that follows.

- Theft and Vandalism: If your business gets broken into and inventory is stolen, or if the building is defaced with graffiti, your policy is there to cover the losses and the cost of repairs.

- Wind and Hail Damage: This is for your building's exterior—the roof, windows, and signage. It’s designed to kick in when a severe storm rolls through and causes direct physical damage.

The Tricky Details of Water Damage Coverage

Water damage is easily one of the most frequent and complex claims LA property owners face. The entire claim often hinges on one key distinction your insurer will make: was the damage sudden and accidental or was it gradual?

A pipe that bursts overnight and floods your office is a perfect example of a covered peril. It was unexpected and immediate. On the flip side, a slow, dripping leak behind a wall that causes mold and rot over several months is almost always considered a maintenance issue. Insurers will typically exclude that from a standard policy.

This is exactly why your first few moves after finding water damage are so critical. Insurers expect you to act fast to stop the problem from getting worse.

Crucial First Step: Your policy has a "duty to mitigate" clause. This isn't just jargon; it’s a requirement. You have to take reasonable steps to prevent further harm. Your very first call should be to an emergency restoration company to get water extracted, drying equipment set up, and the property secured.

If you don't take these steps, you could put your entire claim at risk. Calling a professional team like Onsite Pro Restoration not only satisfies this requirement but also provides the detailed documentation and moisture readings your insurance adjuster will need to move your claim forward without delays.

Understanding Windstorms and Regional Risks

Commercial property insurance is designed to protect businesses from natural disasters like windstorms and hail. However, policies in regions prone to specific events often come with special conditions. For example, windstorm deductibles are common in high-risk areas and can range from 1% to 5% of the property's total insured value.

California has seen staggering property losses from wildfires and storms, which has pushed insurers to create more specialized policies. The global market for commercial property insurance is growing fast, driven by new construction and infrastructure development. You can get more insights on the future of commercial property insurance from AXA XL. This growth just highlights how important it is for property owners to know their specific local risks and make sure their coverage is truly adequate.

Your Immediate Response Matters Most

When a disaster strikes, the clock starts ticking immediately. The actions you take in the first few hours can make or break your insurance claim and drastically affect how quickly you can get back to business.

- Safety First, Always: Evacuate the building if there's any risk from fire, structural damage, or live electrical wires. Don't take chances.

- Call for Emergency Mitigation: Get a 24/7 restoration company like Onsite Pro Restoration on the phone right away. This shows your insurer you're being responsible and is the quickest way to contain the damage.

- Notify Your Insurance Carrier: Report the loss to your insurance agent or the carrier's claim hotline as soon as it's safe to do so. Give them the basic details of what happened.

- Document Everything: Before anything is moved or repaired, take photos and videos of all the damage. This visual proof is pure gold for your claim.

Understanding Policy Exclusions and Add-On Coverages

A standard commercial property insurance policy provides a strong foundation, but it’s definitely not a magic wand that covers every possible risk. To really get a handle on what commercial property insurance covers, you have to get just as familiar with what it doesn't. These built-in limitations are called exclusions, and ignoring them can leave your Los Angeles business dangerously exposed.

Think of your policy like a well-built house. It has strong walls and a solid roof—those are your core coverages. But there are certain doors and windows that are intentionally locked. These "locked doors" are the exclusions, and you need special keys, known as endorsements or add-ons, to open them.

Common Exclusions in a Standard Policy

Insurers exclude certain perils because they're either too catastrophic to price, too predictable, or are considered a maintenance issue. For Los Angeles property owners, a few key exclusions should set off immediate alarm bells.

- Earthquake and Earth Movement: This is the big one for California. Standard policies simply do not cover damage from earthquakes, tremors, or landslides. This requires a completely separate, specialized earthquake insurance policy.

- Flooding from Natural Disasters: Similar to quakes, damage from rising bodies of water like river overflows or storm surges is excluded. Your policy might cover a burst pipe inside, but it won't touch a flood caused by heavy rains saturating the ground. For that, you need a separate policy, often through the National Flood Insurance Program (NFIP).

- Gradual Damage and Lack of Maintenance: Insurance is built for sudden and accidental events. It won’t pay for damage that results from neglect or simple wear and tear, like a roof that’s been slowly leaking for years or mold that grew from persistent humidity.

The Problem with Mold Coverage

Mold is a particularly tricky exclusion. Most policies either severely limit or completely exclude coverage for any mold-related damage. If it's covered at all, it's usually buried under a tiny sub-limit (like $10,000) and only if the mold was the direct result of a covered peril, such as a sudden pipe burst.

A slow leak that goes unnoticed and blossoms into a major mold infestation is a classic example of an uncovered claim. This is why addressing any water intrusion immediately isn't just good practice—it's essential for your financial protection. If you find mold, getting a professional on-site for commercial mold remediation is the first move. They can help document the cause and mitigate the spread, which is critical for any potential insurance claim.

Filling the Gaps with Essential Add-Ons

Knowing the exclusions is only half the battle. The other half is strategically filling those gaps with endorsements—small additions to your policy that bolt on coverage for specific risks. These are those "special keys" that unlock extra protection right where you need it most.

Ordinance or Law Coverage

This is one of the most important endorsements you can have, especially for any property in a city with strict building codes like Los Angeles. If your older building is significantly damaged, you can't just rebuild it the way it was. You’ll be legally required to upgrade everything—electrical, plumbing, accessibility—to meet current codes.

A standard policy only pays to replace what you had. Ordinance or Law coverage is what pays for these expensive, legally mandated upgrades. Without it, you could face a massive budget shortfall just to get your building compliant and back in business.

Sewer and Drain Backup Coverage

Picture this: the sewer line connecting to your building backs up, flooding your ground floor with contaminated water. This messy and expensive disaster is another common exclusion in standard policies. An affordable sewer and drain backup endorsement adds this specific protection back into your policy, covering the cleanup costs and property damage.

Equipment Breakdown Coverage

This add-on is absolutely vital for any business that relies on complex machinery. It basically acts like a warranty for your critical equipment, covering losses from sudden mechanical or electrical failures. This protection goes far beyond what standard property insurance covers, protecting assets like:

- HVAC systems

- Boilers and pressure vessels

- Refrigeration units

- Electrical panels

For a restaurant in West Hollywood or a manufacturing plant in Burbank, an unexpected equipment failure can shut down operations in an instant. This coverage helps pay for repairs or replacement, getting you back online much faster. Building a truly resilient insurance plan means looking beyond the basics and customizing your policy to tackle the unique risks your property actually faces.

The Property Damage Insurance Claim Process Step by Step

When your commercial property takes a hit, having a clear game plan is everything. It transforms a chaotic, high-stress situation into a series of manageable steps. Knowing what does commercial property insurance cover on paper is one thing, but putting that knowledge to work during a real crisis is what truly matters.

Here’s a counterintuitive but critical piece of advice: your first call shouldn't be to your insurance agent. It needs to be to an emergency restoration team. Your policy includes a clause called "duty to mitigate," which means you're required to take immediate, reasonable steps to stop the damage from getting worse. Calling a team like Onsite Pro Restoration to start pulling water or securing the building is the most important first move you can make.

Step 1: Contact a Restoration Professional Immediately

Before you even think about your policy number, get a certified restoration company on-site. Their only job at this stage is to contain the damage, which is non-negotiable for both your property’s safety and the strength of your insurance claim.

Taking this immediate action shows your insurer you're acting responsibly to control the loss. The documentation that the restoration team gathers—photos, moisture readings, initial notes—becomes the foundation of your claim file.

Step 2: Notify Your Insurance Carrier

Once the professionals are managing the immediate threat, it’s time to get the official claim process started. Call your insurance agent or use the carrier’s 24/7 claims hotline to report the loss.

Have this information ready to go:

- Your policy number.

- The date and time the damage happened.

- A short, factual description of the event (e.g., "a fire sprinkler head on the third floor activated").

- The name of the restoration company you hired and the steps you’ve already taken to mitigate the damage.

Step 3: Document Everything Thoroughly

In the world of insurance claims, comprehensive documentation is your absolute best friend. Before a single thing gets moved or torn out, grab your smartphone and take an overwhelming number of photos and videos. Get shots of every affected area and damaged item from multiple angles, both up close and from a distance.

Your restoration partner, Onsite Pro Restoration, will be doing their own professional documentation, including things like moisture maps, thermal imaging scans, and a detailed list of damaged materials. This expert-level evidence is exactly what adjusters need to see to understand and approve the full scope of the loss. For a closer look, check out our guide on handling commercial water damage restoration and the documentation that makes or breaks a claim.

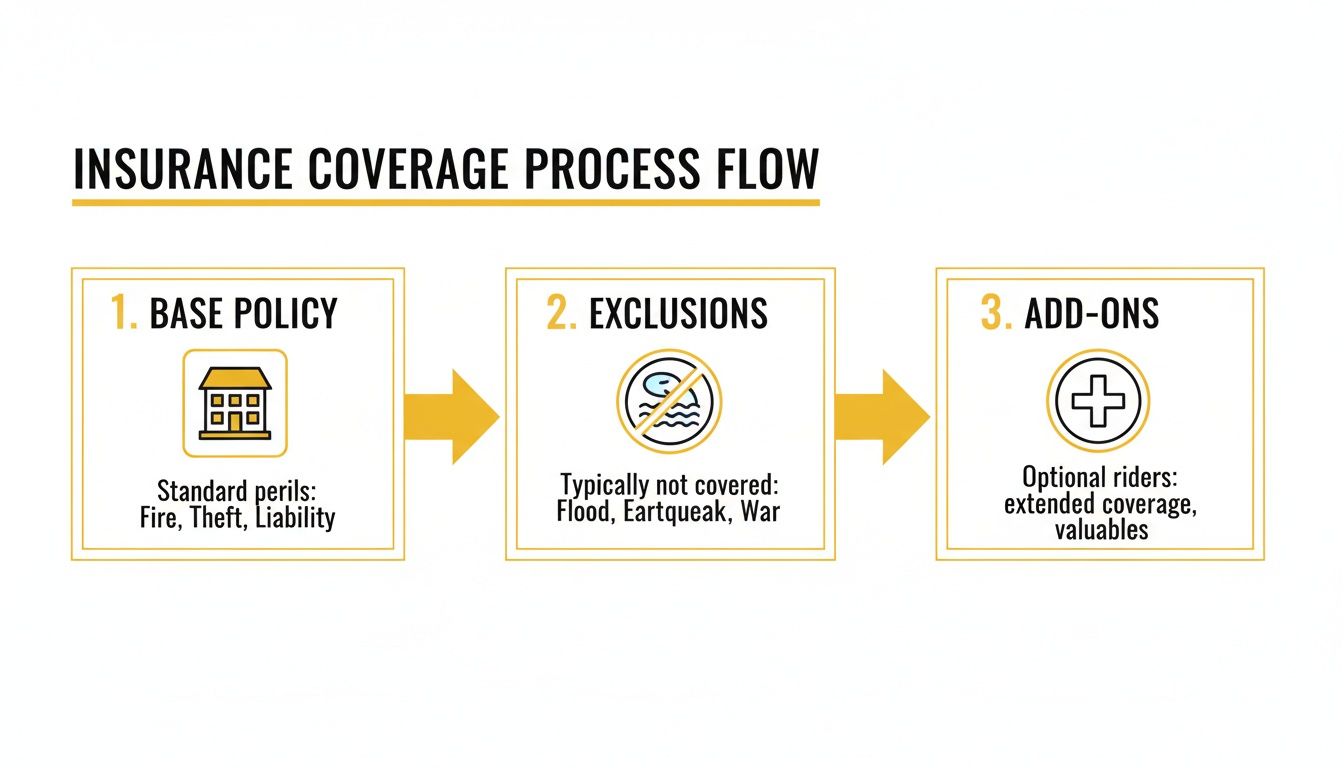

This visual shows how the different parts of your policy work together to provide complete coverage.

It all begins with your base policy. From there, you identify what’s excluded and then strategically layer on endorsements to plug any critical gaps.

Step 4: Meet the Insurance Adjuster

Next, your insurance company will assign an adjuster to your claim. Their job is to inspect the property, review all the evidence, and determine the value of your claim. You absolutely want your restoration project manager there for this meeting.

Having your Onsite Pro Restoration manager on-site allows them to walk the adjuster through the damage in person, explain the necessary restoration plan using industry-standard language, and present their professional estimate. This kind of collaboration gets everyone on the same page from day one, which goes a long way in preventing delays and misunderstandings.

Key Takeaway: The relationship between your restoration company and the insurance adjuster is pivotal. When you have a trusted restoration partner who speaks the adjuster's language and uses the same estimating software (like Xactimate), the approval process moves faster and the assessment is more likely to be fair.

Step 5: Review and Finalize Your Settlement

After the inspection is complete and all the documentation has been reviewed, the adjuster will present you with a settlement offer. This is the total amount the insurance company agrees to pay for all covered damages, minus your deductible.

Go over this offer carefully with your restoration company. They can double-check that the scope of work is accurate and confirm that the settlement is enough to get your property back to its pre-loss condition without cutting corners. Once you agree to the terms, the funds are released, and the full restoration work can be completed.

How Underinsurance Can Jeopardize Your LA Business

For a Los Angeles property owner, one of the most dangerous financial traps isn't a policy exclusion—it's having the right policy but not enough of it. This is called underinsurance, and it's a silent risk that can turn a recoverable disaster into a financial catastrophe.

The worst part? Most business owners don't realize they have this problem until a claim is filed, and by then, it's far too late.

The root of the issue is often a policy clause called a coinsurance penalty. Think of it as a deal you make with your insurer: you promise to insure your property for a certain percentage of its full replacement value (usually 80-100%), and in return, they give you a better rate. But if you fail to hold up your end of that bargain, the insurer can slash your claim payout.

The Coinsurance Penalty Explained

Let's walk through a real-world LA scenario. Imagine your commercial building in Glendale has a true replacement cost of $2 million. Your policy has an 80% coinsurance clause, which means you're required to insure it for at least $1.6 million. But you've only kept the coverage at $1.2 million, likely because construction costs have quietly crept up over the years. You're short of the requirement.

Now, a fire breaks out, causing $500,000 in damages. Instead of paying the full amount (minus your deductible), the insurance company is going to penalize you. They will calculate the percentage you're underinsured by and apply that same ratio to your payout, leaving you with a fraction of what you actually need to rebuild.

Why Is Underinsurance So Common in LA?

The Los Angeles market creates a perfect storm for underinsurance. Construction materials, labor prices, and permitting costs are in a constant state of climb. A policy that was perfectly adequate three years ago could be dangerously low today.

This isn't just a minor issue; it's a massive, widespread problem. A shocking 90% of appraised commercial buildings are underinsured, often by 25% or more. That's a huge exposure for any business owner during a claim. A recent study from the Insurance Information Institute on commercial property trends highlighted that property replacement costs are often only re-evaluated every few years, which simply can't keep pace with rapid inflation.

Key Insight: The value on your property tax statement or the market sale price is not the same as its replacement cost. The cost to rebuild from the ground up—meeting modern LA building codes—is almost always significantly higher.

How to Protect Your Business from This Major Risk

Being proactive is the only real defense against underinsurance and that dreaded coinsurance penalty. The good news is, the solutions are straightforward and give you peace of mind that your coverage will actually perform when you need it most.

Here are a few actionable steps you can take right now:

- Get Regular Property Valuations: Hire a professional appraiser to determine your property's current replacement cost value every two to three years. This gives you a rock-solid, accurate benchmark for your insurance coverage.

- Talk to Your Agent About an 'Agreed Value' Provision: This is a powerful endorsement you can add to your policy. It completely suspends the coinsurance clause. You and your insurer agree on the property's value upfront, and as long as you insure it for that amount, you'll never face a penalty.

- Consider an Inflation Guard Endorsement: This is a simple but effective feature that automatically increases your coverage limit each year by a set percentage. It helps your policy keep pace with inflation without you having to remember to do it manually.

Understanding the fine print around underinsurance is just as critical as knowing what perils are covered. After all, a covered event like a burst pipe can easily lead to mold, and you need to be prepared for how your policy will respond. You can learn more by checking out our guide on insurance coverage for mold damage.

FAQ: What Does Commercial Property Insurance Cover?

As a Los Angeles property owner, you've probably got questions about what your insurance really covers. We hear them all the time. Here are some straight-up answers to the most common ones we get.

Q: Does Commercial Property Insurance Cover Mold Removal?

A: This is a big one. Standard policies are notoriously stingy with mold coverage. You might see a small sub-limit, maybe $10,000, and that’s only if the mold grew because of a covered event, like a sudden pipe burst. Mold that creeps in from a slow, nagging leak or general humidity? That’s almost always excluded. If you want real protection, you'll need to ask your agent for a specific mold endorsement.

Q: What Is the Difference Between Replacement Cost and Actual Cash Value?

A: Understanding this difference is crucial for your financial recovery. Think of it this way:

- Replacement Cost Value (RCV) is the good stuff. It pays to replace your damaged property with brand-new materials of similar quality. No deductions are made for how old your stuff was.

- Actual Cash Value (ACV) is RCV minus depreciation. It pays you what your damaged property was worth the second before the disaster, factoring in age and wear-and-tear.

An RCV policy gives you the funds to actually rebuild and replace what you lost, making it far superior for property owners.

Q: How does a coinsurance penalty work in commercial property insurance?

A: A coinsurance penalty reduces your claim payout if your property is insured for less than a required percentage (usually 80-100%) of its full replacement value. For example, if you're required to insure a $1M building for $800K but only insure it for $600K, the insurer may only pay 75% of your claim, leaving you with a significant financial shortfall.

Q: Will my policy cover the cost to upgrade my LA property to current building codes after a loss?

A: Not automatically. A standard policy only covers restoring your property to its previous condition. To cover legally mandated upgrades to electrical, plumbing, or accessibility standards, you need a specific add-on called "Ordinance or Law" coverage. Without it, you pay for those expensive code upgrades out-of-pocket.

Q: How Does Hiring a Restoration Company Affect My Claim?

A: Calling a professional restoration company right away is one of the smartest moves you can make. It sends a clear signal to your insurance carrier that you’re serious about preventing further damage—something all policies require. A certified team provides the kind of documentation adjusters need to see: detailed moisture logs, industry-standard estimates, and photographic evidence. This professional approach can seriously speed up your claim approval. We cover this in more detail in our guide on insurance claim tips for water damage.

Q: What should I do immediately after my commercial property is damaged?

A: First, ensure the area is safe for everyone. Your next call should be to a 24/7 emergency restoration company to mitigate further damage. This fulfills your policy's "duty to mitigate" and protects your claim. After that, notify your insurance carrier to formally open a claim and begin documenting all the damage with photos and videos.

Don't let a small issue spiral into a catastrophic loss. The experienced team at Onsite Pro Restoration is on call 24/7 to give you a free, no-obligation assessment and immediate help to secure your property.