The work on your fire damage insurance claim begins the second the fire is out. Those first few hours are a blur of chaos and adrenaline, but what you do right then directly impacts your family's safety and how successfully your insurance claim will play out. In the aftermath of a fire in Los Angeles, every decision—from boarding up a window to that first call with the insurance company—sets the tone for your entire recovery. This guide will walk you through the critical steps.

What To Do Immediately After A House Fire

Standing in front of your home after a fire is a gut-wrenching experience. It's a confusing mix of shock, loss, and a sudden, overwhelming sense of urgency. While the emotional weight is heavy, taking a few methodical steps right away can protect your family and your financial future.

Whether it was a kitchen fire in a Sherman Oaks condo or a wildfire ember that landed on a roof in the hills, knowing these first moves is non-negotiable for any Los Angeles homeowner. Your safety is, and always will be, the top priority.

Prioritize Safety Above All Else

Before you even think about your belongings or the insurance paperwork, make sure everyone in your family, including your pets, is safe and accounted for. Do not—under any circumstances—go back inside your property until the fire department gives you the official all-clear.

The structure could be unstable, embers can reignite hours later, and invisible toxic gases often linger in the air. Wait for the green light from first responders.

Once you know your family is safe, you can start addressing your immediate needs. If you can't stay in your home, organizations like the American Red Cross can help with temporary shelter, food, and other essentials. This gives you the critical breathing room to handle the next steps without the added stress of just trying to get by.

Make The First Call To Your Insurance Carrier

Find a safe, quiet place and call your insurance company’s 24/7 claims hotline to report the fire. This is the official starting pistol for your fire damage insurance claims process. Be ready to give them:

- Your policy number: If you have it handy, great. If not, your name and address should be enough for them to find you.

- Date and time of the fire: Just give them your best estimate.

- A simple, factual description: Don't guess about the cause. Just state that a fire occurred at your property.

- Your current contact info: Provide a phone number and email where they can reliably reach you now that you're displaced.

During that call, they will give you a claim number. This is your lifeline. Write it down, put it in your phone, and keep it somewhere you won’t lose it. You'll need it for every conversation you have with them from here on out.

The Duty To Mitigate Further Damage

Buried in the language of your insurance policy is a clause requiring you to take reasonable steps to prevent more damage after the initial event. It’s called the “duty to mitigate.” If you ignore this, the insurance company could argue that any secondary damage—like from rain or vandalism—isn't their responsibility.

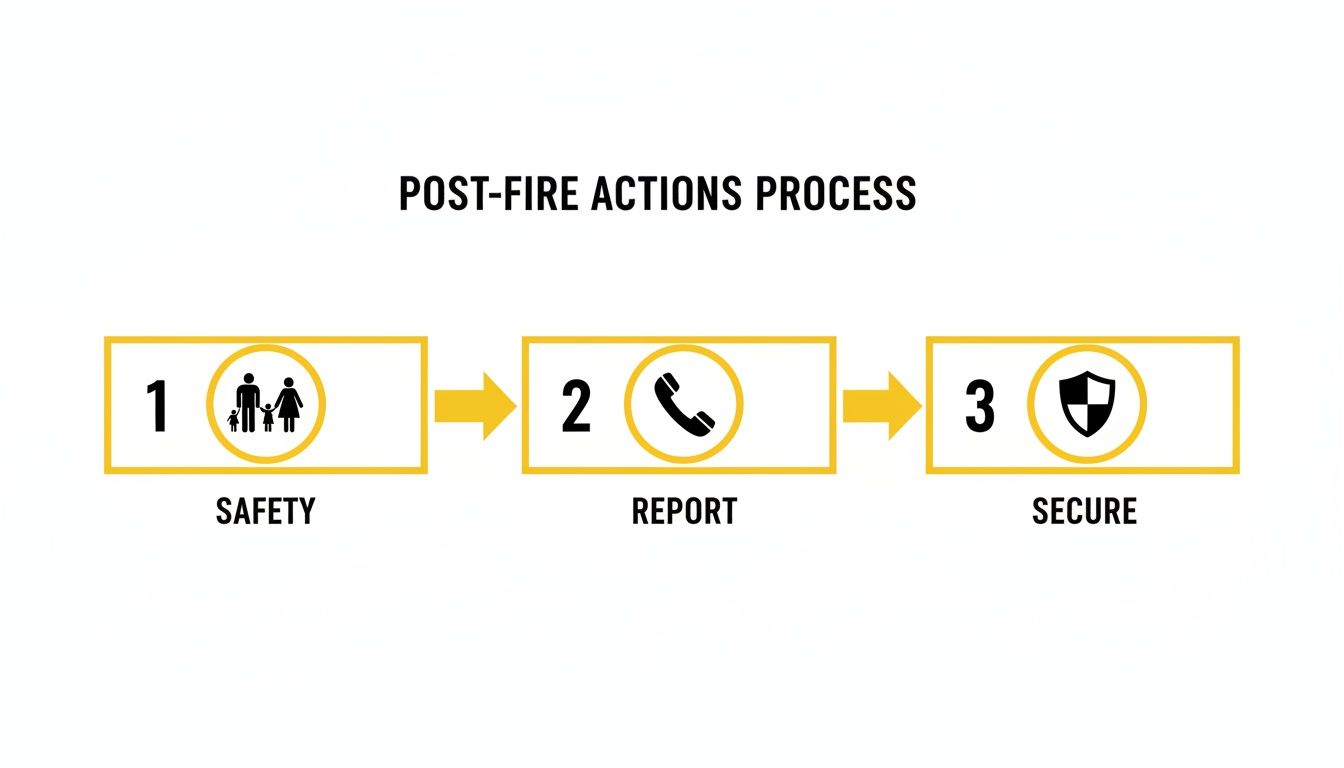

As this shows, securing your property isn't something you do later—it's an immediate step right after ensuring safety and making that first call.

For a fire-damaged home in Los Angeles, mitigation usually involves a few key actions:

- Professional Board-Up: Broken windows, kicked-in doors, and other openings need to be secured immediately to keep people out and protect what’s left inside from the elements.

- Roof Tarping: If firefighters had to cut holes in your roof or it was otherwise damaged, a heavy-duty tarp is the only thing standing between you and catastrophic water damage from the next rainstorm.

- Temporary Fencing: This is often necessary to secure the property line, keeping people away from the hazardous site and limiting your liability if someone gets hurt.

Key Takeaway: Mitigation isn't just a good idea; it's a requirement of your policy. Failing to secure your home can seriously complicate your claim and leave you on the hook for secondary damages from weather or vandalism. Hiring a professional restoration company ensures it's done right without disturbing any evidence the fire investigators might need. To get a better sense of how a full-service team handles this from start to finish, you can learn more about professional fire damage restoration services and what that process looks like.

Building An Undeniable Record Of Your Losses

Let’s be clear: the success of your fire damage insurance claim comes down to one thing—documentation. The adjuster's job is to verify every single line item you submit, and the best way to get a fair and complete settlement is to give them undeniable proof of what you lost.

This process feels massive, especially when you're still reeling from the fire. But you have to shift your mindset from an emotional one to a strategic one. Think of yourself as building a case. Every photo, every receipt, and every list you make is a piece of evidence.

Create A Comprehensive Home Inventory

The foundation of your claim is a detailed list of every single thing that was damaged or destroyed. We call this the home inventory, and it needs to be exhaustive. I’m talking about everything from the sofa down to the last spoon in the kitchen drawer.

The best way to tackle this without getting completely overwhelmed is to go room by room. Start with the big-ticket items, then work your way down.

- Living Room: Couches, television, sound system, coffee table, rugs, curtains, lamps, artwork.

- Kitchen: Refrigerator, stove, dishwasher, microwave, small appliances (blender, toaster), pots, pans, dishes, silverware.

- Bedrooms: Beds, dressers, nightstands, clothing, shoes, bedding, personal electronics.

- Garage/Studio: Tools, lawn equipment, bicycles, stored holiday decorations, hobby supplies.

For each item, jot down as much detail as you can remember: brand, model, roughly how old it was, and what you paid for it. This is the exact information the adjuster needs to assign an accurate value.

Your Fire Damage Evidence Checklist

To make sure you don't miss anything, we've put together a checklist. This table breaks down what you need to collect and why it's so important for getting your claim approved and paid fairly.

| Evidence Type | What To Collect | Why It's Essential For Your Claim |

|---|---|---|

| Visual Proof | Photos & videos of every damaged area from multiple angles (wide shots and close-ups). | Shows the adjuster the full scope and severity of the damage before any cleanup. |

| Home Inventory | A detailed, room-by-room list of all damaged or destroyed personal property. | Forms the basis of your contents claim; without it, you can't get reimbursed for your belongings. |

| Item Details | Brand names, model/serial numbers, age, and original cost for items on your inventory. | Helps the adjuster accurately determine the Replacement Cost Value (RCV) or Actual Cash Value (ACV). |

| Proof of Ownership | Digital/paper receipts, credit card statements, owner's manuals, and bank records. | Substantiates that you owned the items you are claiming, preventing disputes. |

| Pre-Loss Condition | Old family photos or videos taken inside your home before the fire. | Provides a "before" picture, proving the existence and condition of high-value items. |

| Structural Damage | Photos of charred framing, melted siding, damaged roofing, and compromised windows. | Documents the damage to the building itself, which is a separate part of your claim from contents. |

Following this checklist methodically will build a powerful, evidence-backed claim that is much harder for an insurer to question or underpay.

The Power Of Visual Evidence

Before anything is moved or cleaned, you need to go on a photo and video spree. Seriously, do not touch a thing. If you move debris around, you could unintentionally make it harder to prove the original extent of the damage, which can complicate your claim.

Your job is to paint a crystal-clear picture for someone who wasn't there.

Pro Tip: Take way more photos and videos than you think you need. You can't go back in time to get another angle. A wide shot of a room is a good start, but it's the close-ups of melted electronics, soot-stained walls, and charred furniture that make a claim bulletproof.

When you're recording video, narrate what you're seeing. Walk through the house and verbally point out specific damage. Describe the smell of the smoke and show how far the soot has traveled—this is critical, as smoke and soot often cause extensive damage far from the fire's origin. This personal account adds a layer of context that photos alone can't capture.

Digging Up Proof Of Ownership

Alongside your photos and inventory list, you need to gather any proof of ownership and value you can find. This is what turns your list from a simple request into a substantiated claim.

Start digging for:

- Receipts: Your email inbox is a goldmine for online purchase confirmations.

- Credit Card Statements: These can prove major purchases even if the receipt is long gone.

- Owner's Manuals: They often have the exact model and serial numbers.

- Pre-Fire Photos: Old family photos or videos from holidays can be invaluable for showing items in their pre-loss condition.

Don't Forget The Exterior And Unique Features

Here in Los Angeles, especially with wildfires, the damage rarely stops at the front door. Embers can wreak havoc on your property's exterior, and these items are easy to overlook but absolutely must be included in your fire damage insurance claims.

Walk the property and carefully document any damage to:

- Detached garages, sheds, or studios.

- Patios, decks, and outdoor furniture.

- Landscaping, including trees, shrubs, and irrigation systems.

- Fencing and gates.

Building a complete record also means knowing all your potential sources of coverage. For example, if you move items off-site during repairs, look into content insurance for storage, as it can protect them from other disasters. The better you understand your homeowner's insurance policy, the more complete and accurate your record of losses will be.

Working With Adjusters And Restoration Professionals

After a fire, you’re suddenly managing a team you never wanted to hire. The two most important players in getting your life back are the insurance adjuster and the restoration company you choose. Getting a handle on their roles—and how they differ—is the key to a successful fire damage insurance claim.

The insurance adjuster works for the insurance company. It's their job to investigate your loss, figure out what's covered under your policy, and calculate a settlement. They're a necessary part of the equation, but their main goal is to close the claim efficiently and within the insurer's budget.

Your restoration company, however, works for you. They are your advocate, and their sole focus is on bringing your property back to its pre-fire condition using the right methods. This distinction is everything, and it should frame every conversation you have from day one.

Navigating The Adjuster's Inspection

The adjuster’s first visit to your property is a huge moment in your claim. They'll walk through, snap photos, and create an initial scope of the damage. This is your first and best chance to guide their eyes and make sure they see the complete picture.

You absolutely need to be there for this inspection. Walk with them, room by room, and point out damage they might otherwise miss. Don’t forget the subtle stuff—lingering smoke smells in closets, soot in the attic, or residue inside the HVAC system. Hand them a copy of the home inventory and all the photos you’ve already taken.

Key Insight: Never just assume the adjuster's assessment is complete. Especially after a major Los Angeles wildfire, they're often juggling dozens of claims and can easily miss hidden damage. An adjuster might note a stained wall, but a restoration expert sees the potential for smoke particles trapped inside the wall cavity that will cause odors for years if not handled correctly.

Your Restoration Company Is Your Advocate

A top-tier, IICRC-certified restoration company does way more than just cleanup and repairs. They serve as a critical check and balance against the insurance company's initial, often conservative, damage assessment. While an adjuster estimates costs, a professional restoration team builds a highly detailed, line-item scope of work based on what’s actually required to restore your home safely.

They typically build this scope using the same software as the insurance carriers, like Xactimate, but it's created from a completely different perspective: what’s truly needed to do the job right.

- Spotting Hidden Damage: Smoke and soot get everywhere. A pro knows to look inside wall cavities, behind electrical outlets, and deep into your ductwork—places adjusters often skip.

- Providing IICRC-Standard Estimates: Their estimate will break down every necessary step, from specialized cleaning for smoke-damaged electronics to full-scale deodorization, ensuring nothing gets left out.

- Fighting for Proper Repairs: When the adjuster's first offer comes in low (and it often does), your restoration company's detailed scope becomes the evidence you need to negotiate a fair settlement that covers the entire cost of restoration.

The difference in perspective is huge. An adjuster might approve a simple cleaning of a smoke-damaged surface. But a restoration pro knows that acidic soot, common in house fires, requires sealing and repainting to prevent long-term corrosion and odor problems. To see what separates a qualified team from the rest, it’s worth understanding what a true restoration professional brings to the table.

Communication Is Your Most Powerful Tool

Clear, consistent, and documented communication with your adjuster is non-negotiable. It's simple: after every phone call, send a short follow-up email summarizing what you discussed and any decisions that were made. This creates a paper trail that becomes your best defense against misunderstandings.

Keep a dedicated claim journal. In it, note the date, time, and name of every person you talk to, plus a quick summary. If you ask for something, put it in writing. If they promise you something, ask them to confirm it in writing. This simple discipline prevents frustrating "he said, she said" arguments and keeps your fire damage insurance claims process on track.

You Have the Right to Choose Your Own Contractor

Your insurance company will probably give you a list of their "preferred vendors" or recommended contractors. They might even frame it as being faster or easier to use one of their guys. While that can sound helpful when you're overwhelmed, you are never obligated to use their contractor.

You have the absolute right to hire your own licensed, insured, and qualified restoration company. By choosing an independent professional, you ensure their loyalty is to you and the quality of your home's recovery—not to the insurance company's bottom line. This might be the single most important decision you make, as it puts you back in control of the outcome.

Decoding Your Insurance Settlement And The Repair Process

The moment your insurance company sends over their settlement offer feels like a huge step forward in your fire damage insurance claim. But honestly, this is where a lot of homeowners get tripped up by confusing jargon and complicated math. Getting this part right is absolutely critical—it sets the entire budget for putting your property and your life back together.

This settlement isn't just a single lump-sum check. It's a detailed breakdown of what the insurance company thinks it will cost to repair or replace everything you lost. Your job now is to go through that document with a fine-toothed comb and make sure it lines up with the real-world costs of rebuilding here in Los Angeles.

Understanding Key Settlement Terms

Before you can even start reviewing the offer, you need to speak the language. Two of the most important terms you’ll see are Actual Cash Value (ACV) and Replacement Cost Value (RCV). The difference between them is massive.

- Actual Cash Value (ACV): This is what your damaged property was worth the moment before the fire, factoring in depreciation for age and wear. The first check you get from your insurer is almost always for the ACV.

- Replacement Cost Value (RCV): This is the full, no-deductions-for-depreciation cost to replace your damaged property with a new item of similar kind and quality.

The difference between these two numbers is called recoverable depreciation. You typically claim this money only after you’ve finished the repairs and can provide receipts proving you spent the funds.

Reviewing The Adjuster's Estimate Line By Line

Whatever you do, don't just glance at the final number on the adjuster's estimate. You need to compare it, line by line, against the detailed scope of work your restoration company gave you. This is where you'll catch the discrepancies.

Keep an eye out for missing items or underestimated costs. Did the adjuster include the special primer needed to seal smoke odors inside the wall cavities before the drywall goes up? Did they budget for updated L.A. building codes that now require different materials than what you had before?

A Critical Comparison: An adjuster's estimate might just say "paint bedroom." A professional restoration scope will break that down into "wash all surfaces, de-grease soot stains, seal with a shellac-based primer to block odors, and apply two coats of premium paint." That second process is far more expensive—and it's the correct one for fire damage.

If you find big differences, don't panic. This is normal. Immediately send your restoration company's detailed estimate to the adjuster as your counter-proposal. That professional documentation is your best tool for negotiating a fair settlement. For a closer look at what your policy should cover, it's worth reading up on how homeowners insurance typically covers fire damage.

The Journey From Damage To Restoration

Once you've agreed on the settlement and the first check arrives, the real physical work can finally kick off. A professional fire restoration isn't a simple cleanup; it's a careful, multi-stage process designed to bring your home back to how it was before the fire—or even better.

The process usually follows a specific order:

- Water Removal and Drying: If firefighters used water, that's the first problem to tackle. We bring in industrial-grade air movers and dehumidifiers to stop secondary damage like mold from taking hold.

- Soot and Smoke Removal: This is meticulous work. Our technicians use specialized sponges and cleaning solutions to lift acidic soot from every surface, including walls, ceilings, and personal belongings.

- Cleaning and Sanitizing: Anything that can be salvaged is thoroughly cleaned and deodorized. This might involve ultrasonic cleaning for delicate items or special laundering techniques for fabrics.

- Structural Repairs: This is the reconstruction phase. We repair or replace damaged drywall, flooring, cabinets, and any other structural components based on the agreed-upon scope of work.

- Deodorization: Getting rid of that lingering smoke smell for good requires serious technology. We often use thermal fogging or ozone generators to neutralize odor particles at a molecular level.

This systematic approach makes sure nothing gets missed. It deals with the obvious visible damage while also eliminating the hidden threats of soot and odors, ensuring your Los Angeles home is truly safe, clean, and ready for your family again.

Common Mistakes That Can Derail Your Claim

Filing a fire damage insurance claim is like walking a tightrope. One wrong move, and the whole thing can come crashing down. In the chaos and exhaustion after a fire, it’s all too easy for Los Angeles homeowners to make critical mistakes—errors that can slash a settlement, drag out the process for months, or even get a claim denied outright.

These aren't just hypothetical warnings. We see these missteps happen on the ground every single week. From a well-meaning homeowner who starts cleaning too soon (and throws out crucial evidence) to someone signing a form that ties their hands later, knowing the pitfalls is the first step to avoiding them.

Starting The Cleanup Too Soon

Your first instinct after a fire is to restore order. You'll want to start bagging up debris, wiping down surfaces, and clearing out the mess. Stop. This is one of the single most damaging things you can do to your claim.

Every single piece of charred furniture, every soot-stained wall, and every melted personal item is evidence. It's the proof your insurance adjuster needs to see the full scope of your loss. If you clean it up or throw it away before it's been documented, you’re essentially destroying your own evidence. You're giving the insurance company an easy reason to argue that the damage wasn't as severe as you claim.

Crucial Takeaway: Don't throw away or clean anything until it has been inspected and photographed by you, your restoration team, and the insurance adjuster. Your only immediate job is to prevent further damage, like boarding up a broken window. Leave the scene as is.

Underestimating Smoke And Soot Damage

What you see burned is only part of the story. The real villain is often the smoke. Its tiny, acidic particles are invasive, working their way into your HVAC system, behind drywall, and deep into porous materials like wood, upholstery, and clothing.

This is a huge oversight many homeowners—and frankly, some adjusters—make. They focus on the visible charring and miss the widespread contamination. That lingering soot will corrode electronics over time, and the odor can get trapped for years, releasing that awful smoky smell every time you turn on the heat. A claim that just covers a new coat of paint without proper sealing and deodorization is a failed settlement.

Signing Documents Without Full Understanding

In the days following a fire, you'll be handed a stack of paperwork. Forms from your insurer, authorization sheets from contractors—it can feel overwhelming. It is absolutely critical that you read and understand every word before you sign.

Be especially wary of signing a "release of all claims" form. This document could permanently close your claim, even if you discover more damage later on. Likewise, with contractors, make sure their work authorization clearly defines the scope and doesn't sign away your right to control the repair process or receive insurance funds directly. If you're not 100% sure what a document means, don't sign it. A one-day delay to get advice is far better than signing away your rights in a moment of stress.

Working with a seasoned professional makes all the difference. After recent major California wildfires, homeowners who brought in an IICRC-certified restoration company to handle documentation and repairs had their claims settled, on average, 30% faster and for 15-20% more than those who tried to manage it all alone. The right documentation is your best defense against disputes. You can learn more about navigating wildfire damage claims from the IICRC.

Frequently Asked Questions About Fire Damage Claims

When your world is turned upside down by a fire, the questions come fast. Trying to understand the ins and outs of a fire damage insurance claim can feel impossible, especially when you’re dealing with so much stress. Here are the straight answers to the questions we get most often from Los Angeles homeowners.

How Long Do I Really Have to File a Fire Damage Claim in California?

Legally, the statute of limitations for a breach of contract lawsuit in California is four years. But that number is a red herring in the immediate aftermath of a fire. Your insurance policy is a contract, and it has a critical clause requiring you to report a loss "promptly" or "as soon as reasonably possible."

If you wait, the insurance company has an easy excuse to argue that you didn't hold up your end of the deal. The absolute best practice is to notify your insurance company immediately—we’re talking within 24 hours—to get a claim number and get the ball rolling.

Can I Start Cleaning Up Before the Adjuster Shows Up?

No. Please, do not do this. It's one of the most common and damaging mistakes a homeowner can make. Every single piece of charred furniture, every soot-covered wall, and every melted personal item is evidence.

When you clean up or throw things away before they've been professionally documented, you're essentially destroying the proof of your own claim. The only exception is your responsibility to "mitigate further damage"—like boarding up a shattered window to keep rain out. A professional restoration company knows exactly how to do this without compromising the scene. For a deeper dive into what's covered, check out our fire damage FAQ page.

How Does Additional Living Expenses (ALE) Coverage Actually Work?

Additional Living Expenses, or ALE, is the part of your policy that becomes a lifeline when you can't live in your home. It’s designed to cover the increase over your normal, day-to-day living costs. It doesn't pay your whole rent, just the difference.

Here’s a real-world example: Let's say your mortgage and utilities come to $4,000 a month. The temporary apartment you have to rent costs $5,000. ALE is there to cover that extra $1,000. It also helps with other reasonable costs like extra money for food if you have to eat out, laundry services, or renting furniture.

The key to getting reimbursed? Keep every single receipt. Meticulous records are non-negotiable for getting your ALE funds.

Am I Forced to Use My Insurance Company's Recommended Contractor?

Absolutely not. This is a crucial point where you, the homeowner, have control. Your insurance company will almost certainly have a list of "preferred vendors" they work with all the time. It might feel easier to just go with their guy, but you have the legal right to choose any licensed, insured, and qualified restoration company you trust.

When you choose your own contractor, you know their first loyalty is to you and to restoring your home correctly—not to the insurance company’s bottom line. This single decision puts you back in the driver's seat. For more great insights into the claims process, check out this guide on navigating home insurance claims.

Getting through a fire damage claim is a marathon, not a sprint, but you don't have to run it alone. Having an expert advocate in your corner from day one can change everything. The team at Onsite Pro Restoration is here to help you document your loss, handle the insurance company, and restore your property with the care and skill you deserve.