In the chaos and confusion immediately following a house fire in Los Angeles, it's easy to feel completely overwhelmed. But the first few things you do are absolutely critical. Your priorities need to be crystal clear: confirm everyone is safe, get medical attention (even if you think you're okay), and find a secure place to stay. Everything else—the insurance claim, your belongings, the long road to rebuilding—can wait until you and your family are out of danger. This guide on what to do after a house fire will walk you through the essential next steps.

Your First 24 Hours After a House Fire

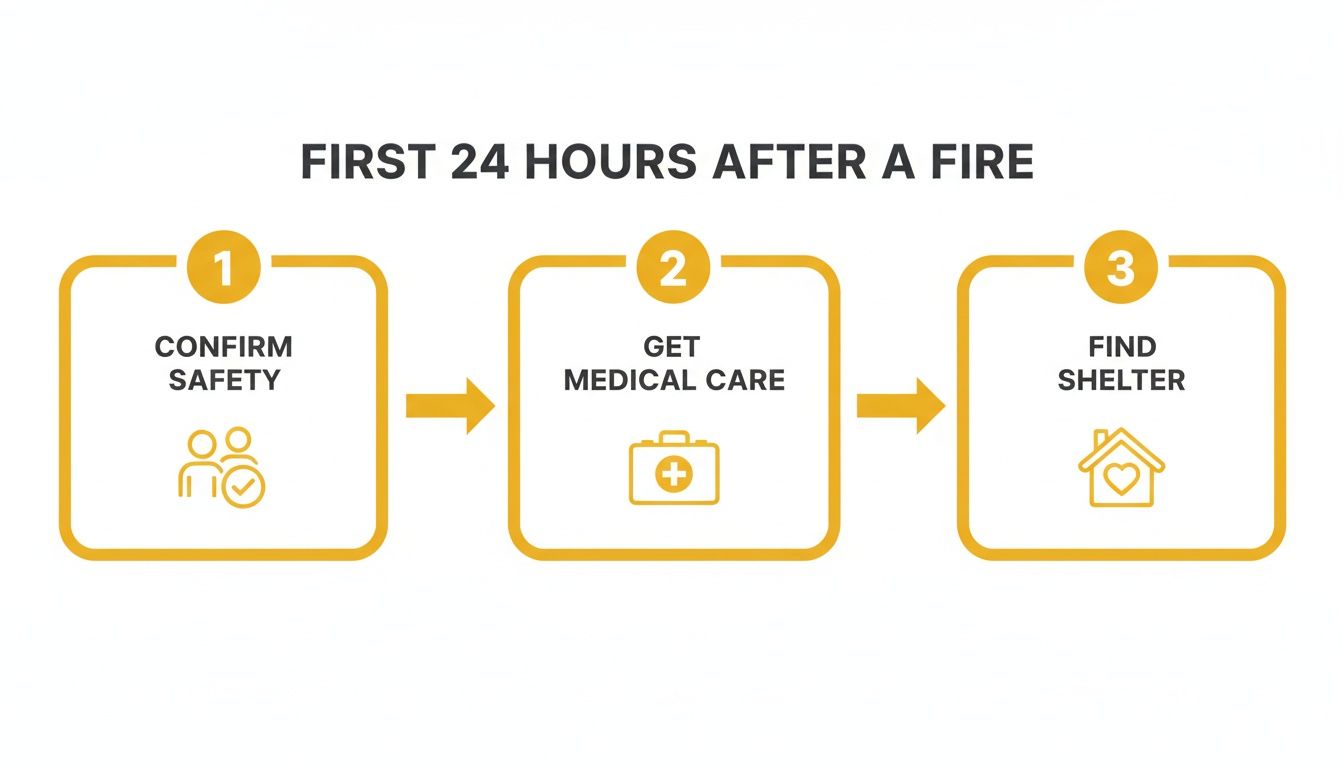

The first day is all about triage—addressing the most urgent human needs first. Shock makes it incredibly difficult to think straight, so having a simple, structured plan is your best defense against overlooking something vital. The goal here isn't to solve everything; it's to move from a state of crisis to a position of safety. That stability is the foundation for everything that comes next.

This infographic breaks down the three non-negotiable priorities you need to tackle right away.

By focusing on just these three things—safety, health, and shelter—you create a manageable path through that initial fog.

Confirm Everyone's Safety

Before you do anything else, do a headcount. Make absolutely sure every person in your household, including your pets, is accounted for and safe. If anyone is missing, tell the first responders on the scene immediately. This is, without question, the most important step you will take.

Seek Immediate Medical Evaluation

This is a big one that people often skip. Even if you feel perfectly fine, everyone who was inside needs a medical evaluation. Smoke inhalation is a silent and serious threat that can cause major respiratory damage hours, or even days, after the fire.

The toxic cocktail of gases released in a fire, like carbon monoxide and cyanide, can have delayed and dangerous effects. A quick visit to an urgent care clinic or the ER can catch these issues before they turn into a medical emergency.

Globally, fire-related incidents lead to over 180,000 deaths each year, and a huge number of those are from smoke inhalation, not burns. In the U.S. alone, an average of 2,620 people died and 11,070 were injured annually in house fires between 2015 and 2019. These numbers really highlight the hidden dangers of smoke and soot exposure.

The invisible soot and particulates left behind are also a major health hazard. You can learn more about the dangers of soot and smoke in our comprehensive smoke damage restoration guide, which breaks down how these toxic residues affect both your family's health and your home itself.

Find a Safe Place to Stay

You will not be allowed back into your home until the fire department has officially declared it safe to enter. That means you need to find temporary shelter right away.

Here are your most immediate options:

- Family or Friends: Your first call should be to your local support network. This is usually the fastest and most comforting solution in a crisis.

- The American Red Cross: This organization is a lifeline for displaced families, providing immediate help with temporary housing, food, and basic essentials. The Los Angeles chapter is an incredible resource for those affected by a house fire.

- Your Insurance Provider: Most homeowners' policies include coverage for "Additional Living Expenses" (ALE). This is designed to pay for hotel stays and other living costs when your home is uninhabitable.

Once you have a safe roof over your head, you can finally take a breath, begin to process what happened, and start thinking about what comes next. Those first 24 hours are purely about survival and safety. Focus on these priorities, and you'll give yourself the solid ground you need to start the journey to recovery.

Securing Your Property and Making Critical Calls

After making sure everyone is safe, your focus immediately shifts to two things: protecting what's left of your home and starting the official recovery process. The first 48 hours are a blur of phone calls and decisions. Knowing who to call—and what to say—is crucial for setting your recovery up for success.

Let's get the most important rule out of the way first: never re-enter your home until the fire department gives you the official all-clear. It doesn't matter if the flames are out. The structure could be dangerously unstable, and invisible hazards like toxic gases or live wires are a very real threat. Your patience here isn't just a virtue; it's a lifesaver.

Your Immediate Communication Playbook

Once the fire marshal releases the scene, your phone is your most important tool. These first calls kick off the paper trail for your insurance claim and any financial help you might need. I tell every client to grab a notebook and write down everything—date, time, who you spoke with, and what they said.

Here’s your prioritized call list:

- Your Insurance Agent: This is call number one, no exceptions. Let them know about the fire right away to get the claims process rolling. They’ll assign an adjuster and explain your policy's next steps, including your coverage for Additional Living Expenses (ALE), which covers temporary housing.

- Your Mortgage Lender: You need to inform your bank or lender about the fire. They have a financial stake in the property and will be part of the insurance payout and rebuilding discussions.

- Utility Companies: Get your gas, electric, and water providers on the phone to shut off service. This is a critical step to prevent further dangers like gas leaks or electrical shorts in the damaged structure.

Key Takeaway: Document everything. Whether it’s a dedicated notebook or a folder on your phone, track every call, save every receipt, and keep every piece of correspondence. This detailed record will be your best friend when you're working with your insurance company.

Protecting Your Home from Further Damage

An unsecured property is a magnet for trouble—from looters and vandals to more damage from rain or wind. Fires often leave behind shattered windows, busted doors, and even gaping holes in the roof. Your insurance policy actually requires you to take reasonable steps to prevent further loss, also known as "mitigating damages."

This is not a DIY job. A professional fire damage restoration company can board up windows, tarp the roof, and put up temporary fencing. This does more than just protect your belongings; it limits your liability if someone gets hurt by entering the unsafe property. If your fire protection systems are down, you may also need to implement temporary fire watch services to keep the site secure and compliant until everything is restored.

Keep in mind, the danger isn't just structural. Fire leaves behind a toxic cocktail of soot, chemical residues, and contaminated water from the firefighting efforts. Understanding the full scope of hazardous materials cleanup is essential. Proper remediation by certified professionals isn't just about cleaning up the mess—it’s about making your home truly safe and livable again.

Navigating Your Homeowners Insurance Claim

After a fire, filing an insurance claim feels like a second full-time job you never asked for. It’s a marathon, not a sprint, and the first few steps you take can make or break your final settlement.

Your homeowners insurance policy is the rulebook for this entire process. Most policies break down fire-related coverage into three key areas:

- Dwelling Coverage: This is for repairing or rebuilding the actual structure of your house.

- Personal Property Coverage: This covers everything inside—furniture, electronics, clothes, you name it.

- Additional Living Expenses (ALE): This is crucial. It pays for your temporary housing, meals, and other essentials while you're displaced.

Understanding Your Policy and Coverage Types

Before you even think about creating a list of lost items, you have to know what kind of coverage you're working with. The two main types are Replacement Cost Value (RCV) and Actual Cash Value (ACV).

The difference is massive. RCV pays to replace your damaged items with new ones. ACV, on the other hand, only pays what your stuff was worth the moment before the fire, which means depreciation gets factored in. It's the difference between getting a check for a brand-new couch versus the garage sale value of your 10-year-old one.

Call your agent right away and ask for a complete, certified copy of your policy. Yes, it’s dense and full of legal jargon, but knowing whether your homeowners insurance covers fire damage in detail is your best tool for self-advocacy.

The Power of Detailed Documentation

Here's the hard truth: the burden of proof is on you. Your insurance adjuster’s job isn't to build your claim for you; it's to validate the claim you present to them. Meticulous documentation is your most powerful asset.

The average cost to restore a home after a fire in the U.S. is around $12,900, but that number can climb exponentially with severe damage. Considering single-family homes account for over 67% of civilian fire deaths, the stakes couldn't be higher. This is why a well-documented claim is absolutely essential.

Here’s a practical look at what you need to start gathering.

Fire Damage Insurance Claim Checklist

This checklist breaks down the essential information you'll need to gather to build a strong, comprehensive insurance claim. Being organized from the start prevents delays and ensures you account for every loss.

| Action Item | Why It's Important | Pro Tip |

|---|---|---|

| Request a Certified Copy of Your Policy | This is the contract governing your claim. You need to know your exact coverage limits, sub-limits, and exclusions. | Keep a digital copy on your phone or cloud storage. You'll need to refer to it constantly. |

| Create a Detailed Home Inventory | You must prove what you lost. Go room by room and list every single item, from furniture to forks. | Use a spreadsheet. Columns for item, brand, age, and original cost will make the process much smoother. |

| Gather Proof of Ownership | Receipts, photos, and credit card statements validate your inventory list. The more proof, the fewer disputes. | Dig through old social media posts, emails for online order confirmations, and even family photos showing items in your home. |

| Photograph and Video Everything | Visual evidence is undeniable. Document the damage extensively once it's safe to re-enter the property. | Narrate your videos. Walk through each room and describe what you see, pointing out specific high-value items that were damaged. |

| Keep a Communication Log | Note every call, email, and meeting with your insurer. Record dates, times, who you spoke with, and what was discussed. | Follow up important phone calls with a summary email. This creates a written record of the conversation. |

Treating this process with the seriousness of a legal case will pay dividends when it comes time for a settlement. Don't rush it, and don't cut corners.

Pro Tip: Do not throw anything away until your adjuster has physically seen it. That pile of charred debris in the living room might feel like clutter, but to an insurer, it's proof of loss. Moving it all to the curb can seriously weaken your claim.

Working with a Public Adjuster

For a major fire, especially one that has destroyed a significant portion of your home, hiring a public adjuster is something to seriously consider.

Unlike the adjuster your insurance company sends (who works for them), a public adjuster works for you. They are licensed professionals who specialize in managing claims, interpreting policy language, and negotiating with insurance companies to get you the maximum possible settlement.

They typically work on a contingency fee, taking a percentage of the final settlement, so there are no upfront costs. In a place like Los Angeles where building codes are complex and costs are high, a local public adjuster can be a lifesaver. They take over the overwhelming task of inventory, documentation, and negotiation, letting you focus on putting your family's life back together.

Finding the Right Fire Damage Restoration Team in Los Angeles

Choosing a fire damage restoration company is probably the most important decision you'll make on the road to recovery. The team you hire isn’t just cleaning up a mess; they’re rebuilding the safety and integrity of your home.

This isn't the time to just Google "fire cleanup" and pick the first name you see. A rushed choice can lead to shoddy work, hidden hazards, and a mountain of headaches with your insurance company. You need a true partner who can expertly guide you through the chaos, from the first assessment to the final walk-through.

In a place like Los Angeles, this means finding a crew that knows local building codes, understands how our climate impacts the drying process, and has a real track record of putting homes back to the way they were.

The Non-Negotiables of a Restoration Professional

Before you even think about looking at a price tag, you need to vet a company's credentials. Think of it as a background check for the people you’re trusting with your home’s future.

Here are the absolute must-haves:

- IICRC Certification: The Institute of Inspection, Cleaning and Restoration Certification (IICRC) is the gold standard. IICRC-certified professionals are trained in the latest, science-backed methods for dealing with fire, smoke, and water damage. It's not just a fancy piece of paper; it means they know what they're doing.

- Proper Licensing and Insurance: Your contractor absolutely must be licensed by the California Contractors State License Board (CSLB). Just as critical, they need to carry both general liability and workers' compensation insurance. Ask to see the documents—any legitimate company will hand them over without a second thought.

- Local Los Angeles Experience: A team that understands the dry heat of the San Fernando Valley versus the coastal humidity in Santa Monica knows the specific challenges your property will face. That local know-how is priceless for preventing secondary issues like mold.

Understanding the Full Scope of Work

Fire damage is never just about what burned. It’s a chain reaction of problems, and a real professional team is equipped to handle every single link in that chain.

Their services should cover the whole nine yards:

- Damage Assessment: A top-to-bottom inspection to map out the full extent of fire, smoke, and water damage—including the stuff you can't see.

- Soot and Smoke Removal: Using specialized gear like HEPA vacuums and chemical sponges to get toxic residue off every single surface.

- Water Damage Mitigation: Pumping out all the water from the firefighting efforts, then using industrial-grade dehumidifiers and air movers to get the structure bone-dry.

- Cleaning and Sanitizing: A deep clean of every salvageable item and all the structural parts of your home.

- Deodorization: This is a big one. They'll use thermal foggers or ozone generators to kill those stubborn smoke smells that have soaked into everything.

Your restoration company should be your project manager, turning the chaos into a clear, step-by-step recovery plan. They’re the experts who make sure nothing critical gets missed.

Questions to Ask Every Potential Contractor

When you’re talking to potential restoration companies, treat it like an interview. You are hiring them for a massive job, and their answers will tell you everything you need to know about their competence.

Go into that meeting prepared with a list of questions:

- Can you show me your IICRC certification, state license, and proof of insurance? (This is your first question. If they hesitate or can't, the interview is over.)

- How many fire damage claims have you handled specifically in the Los Angeles area?

- Will you work directly with my insurance adjuster? (You want to hear a confident "Yes, absolutely.")

- What specific techniques and equipment do you use for soot removal and getting rid of the smoke smell?

- Can you give me a detailed, itemized estimate? (Walk away from anyone who gives you a vague, one-page quote.)

- What’s your best guess for a timeline on a project this size?

Taking the time to properly vet a contractor is one of the most important things you can do right now. For a deeper dive into what separates the real pros from the rest, our guide on finding a reliable restoration pro has a detailed checklist to help you make the right call. It will save you an incredible amount of stress and make sure your home is restored safely and correctly.

Managing Your Long-Term Recovery and Rebuilding

The journey after a house fire doesn't end when the last ember is out. In fact, that’s just the beginning. The path back to normalcy is a marathon, not a sprint, involving complex financial decisions, healing from the emotional impact, and methodically putting the pieces of your life back together. This final phase is all about managing your long-term recovery with patience and a clear head.

Here, the focus shifts from crisis management to sustainable strategies for the long haul. It’s about so much more than rebuilding walls—it's about re-establishing that sense of security and routine for you and your family.

Handling Finances and Insurance Payouts

Once your insurance claim gets the green light, don't be surprised to see multiple checks coming your way. These payments are often co-payable to both you and your mortgage lender, which adds an extra layer of complexity you need to be ready for.

Your lender has a vested interest in making sure the property is fully restored, so they'll typically hold the funds in an escrow account. From there, they'll release payments in stages as repair milestones are met and verified by their own inspectors.

Key Takeaway: Open a separate bank account just for insurance funds and rebuilding expenses. This is a game-changer for tracking every dollar and keeping a clean financial record for both your insurer and mortgage company.

Stay in constant communication with your lender. Let them know who your restoration contractor is, and give them a copy of the contract and project timeline. A little transparency here can prevent major delays in getting those funds released.

Addressing the Emotional Toll

Let's be clear: a house fire is a deeply traumatic event. The emotional aftershocks can linger long after the smoke has cleared. It's completely normal for everyone in the family, especially kids, to feel anxiety, have trouble sleeping, or struggle with a profound sense of loss.

Seeking support is a sign of strength. It's one of the most important steps you can take.

- Professional Counseling: Look for therapists who specialize in trauma or PTSD. They can provide invaluable tools to help you process what happened.

- Support Groups: There's real power in connecting with other families who have been through this. It can make you feel a lot less isolated.

- Community Resources: Many local organizations in Los Angeles offer free or low-cost mental health services for residents hit by disasters.

Putting your family’s mental well-being first is just as critical as rebuilding the physical structure of your home.

Replacing Your Essential Documents

One of the most tedious and frustrating parts of the recovery process is replacing all the crucial documents that went up in flames. The best way to tackle this without getting overwhelmed is to make a systematic list.

Start with the absolute must-haves:

- Driver's Licenses and IDs: Head to a local California DMV office. Bring any proof of identity you still have, like a passport or a copy of your birth certificate that was stored somewhere else.

- Social Security Cards: You can request a replacement online through the Social Security Administration's website or by visiting a local office.

- Birth and Marriage Certificates: You'll need to contact the vital records office in the county and state where those events took place.

- Passports: The U.S. Department of State has a specific process for replacing lost or destroyed passports. It's straightforward, but you need to follow their steps exactly.

- Financial Records: Call your banks, credit card companies, and investment firms. They can get you replacement cards and statements quickly.

As you navigate the long-term recovery and start rebuilding, you'll also have to deal with clearing out damaged items and debris. Our guide on fire damage and restoration services breaks down how certified professionals handle this safely. Learning how to select the right pros, from restoration experts to finding a great junk removal company, can be a huge help.

A house fire can spread from its source in just 30 seconds, and families typically have only about three minutes to escape. In England, the average total response time to primary fires for the year ending March 2023 was 9 minutes and 13 seconds. This is a stark reminder of how fast a fire moves, leaving lasting consequences that demand a thoughtful and thorough rebuilding process.

Common Questions After a Los Angeles House Fire

After a fire, your mind is probably racing with a thousand questions. The path forward can feel incredibly foggy, and it’s completely normal to feel lost about what to do first. We've been there with countless Los Angeles homeowners, so we've put together straightforward answers to the most urgent questions we hear every day.

Getting a handle on these key points early on will help you make clear-headed decisions and sidestep common pitfalls during the recovery. Our goal is to cut through the confusion so you can focus on getting your life back.

Q: Can I Start Cleaning Up the Fire Damage Myself?

A: This is almost always the first question people ask, driven by the desire to do something. But the answer is a firm no. We strongly advise against trying to clean up any fire damage on your own. What you're dealing with isn't just dirt; it's a toxic cocktail of soot, vaporized chemicals, and acidic particles that pose a serious health risk. DIY cleaning attempts usually create bigger problems. Using store-bought cleaners on soot-covered walls will smear the oily residue, pushing it deeper into porous materials like drywall and wood. This can cause permanent staining and make professional restoration much harder. To protect your health and your home, always leave soot and smoke cleanup to IICRC-certified professionals who have the proper training and personal protective equipment (PPE).

Q: How Long Does Fire Damage Restoration Usually Take?

A: There's no single answer here, as the timeline is tied directly to the extent of the damage. For a minor kitchen fire in a Studio City apartment, the process might take a few weeks. For a more serious fire that caused structural damage to a home in the Santa Monica mountains, you could be looking at several months. Major structural fires can easily take over a year, involving architects, city permits, and extensive coordination. A reliable restoration contractor will give you a detailed project schedule after a thorough assessment.

Q: What Is Additional Living Expenses or ALE Coverage?

A: Additional Living Expenses (ALE) coverage is one of the most critical parts of your homeowners insurance policy after a fire. Its purpose is to cover the extra costs you rack up when you can't live in your home because of a covered event. Think of it as the bridge that covers the difference between your normal monthly budget and your new, temporary expenses. This can include hotel bills, rent for a temporary apartment, increased food costs from eating out, and even pet boarding. You must keep meticulous records and receipts for every single expense to get reimbursed.

Q: Will My Insurance Cover the Full Cost to Rebuild My Home?

A: This is the million-dollar question, and the answer is buried in the fine print of your policy. It all comes down to the type of coverage you have. Replacement Cost Value (RCV) is designed to pay the full cost of rebuilding to its previous state, using today's material and labor prices, up to your policy limit. Actual Cash Value (ACV) is less ideal, as it only pays you the depreciated value of your home—what it was worth the moment before the fire. This is almost always less than what it will cost to rebuild. It is vital that you review your policy documents with your agent to get a realistic financial picture.

Facing the aftermath of a fire is overwhelming, but you don't have to navigate it alone. The certified professionals at Onsite Pro Restoration are on call 24/7 to help Los Angeles homeowners. We handle everything from the initial hazardous cleanup to billing your insurance directly, letting you focus on what matters most—your family.