When Los Angeles homeowners ask, "does homeowners insurance cover mold?" the honest answer is a frustrating, "it depends."

Coverage isn't about the mold itself. It’s all about what caused it. If a sudden, covered event—like a pipe bursting in your Sherman Oaks home—soaks your drywall and leads to mold, you’re likely covered. But if that mold grew because of a slow, unrepaired leak from a faulty faucet or the persistent coastal fog in Santa Monica, your claim will almost certainly be denied. Understanding this distinction is the key to navigating your policy.

The Critical Difference: Sudden Damage vs. Gradual Neglect

When you find mold, your first instinct is to scan your policy for the word "mold." But insurance adjusters don't focus on the mold; they focus on the "why" behind it.

The entire claim boils down to one simple question: Was the water source sudden and accidental, or was it gradual and preventable?

This distinction is the single biggest reason claims get approved or denied. Insurance is designed to cover unexpected accidents, not problems that arise from a lack of routine maintenance.

- Sudden & Accidental Damage: Imagine a washing machine hose suddenly splits, flooding your laundry room. That's an unforeseen event. The water damage—and any mold that grows as a direct result—is typically covered.

- Gradual & Preventable Damage: A slow drip under a bathroom sink that goes unnoticed for months is a completely different story. An insurer sees this as a maintenance issue you could have fixed, so they will almost always deny the claim for the resulting mold.

Getting familiar with your specific homeowners insurance policy is absolutely essential here. Every policy has unique language that defines what is and isn't a covered event.

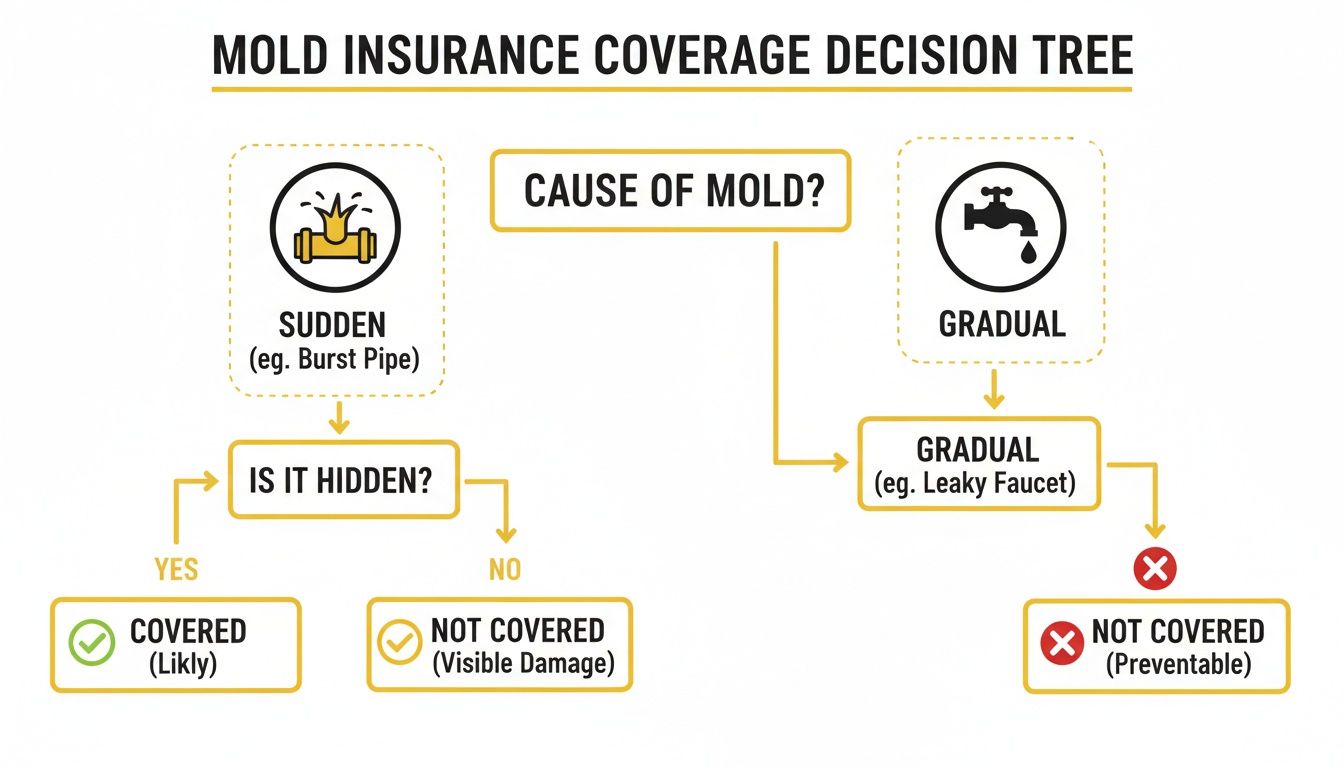

This decision tree gives you a visual of how an insurer thinks about a mold claim. It all comes back to the source of the water.

As you can see, a successful claim almost always traces back to a sudden, accidental water event—not a gradual one.

Mold Coverage Scenarios At A Glance

To make this even clearer, here’s a quick-reference table outlining common scenarios and whether you can expect coverage.

| Scenario | Is Mold Likely Covered? | Reason |

|---|---|---|

| A pipe bursts behind a wall | Yes | This is a classic "sudden and accidental" event covered by most policies. |

| A toilet overflows and floods the floor | Yes | The overflow is an unexpected incident, and resulting mold is covered. |

| Slow leak under a kitchen sink | No | This is considered a gradual maintenance issue that should have been repaired. |

| High humidity causes mildew in a bathroom | No | Insurers view this as a ventilation or maintenance problem, not a covered peril. |

| A storm damages the roof, causing a leak | Yes | The roof damage is a covered peril, so the resulting water and mold are also covered. |

| Groundwater seeps into the basement | No | Standard policies exclude flooding. You would need separate flood insurance. |

This table should help you quickly gauge where your situation might fall, but remember, the final decision always rests on the specific wording in your policy and the evidence you provide.

Understanding Covered Perils: When Does Homeowners Insurance Cover Mold?

To figure out if your homeowners insurance will cover a mold problem, you have to start with a core concept: the “covered peril.”

Think of your policy as a list of specific disasters it’s designed to handle—things like fire, a tree falling on your house, or certain kinds of water damage. A covered peril is simply an unexpected event that’s on that list.

When you find mold, the insurance adjuster’s first job isn't to look at the mold itself. Their focus is on tracing it back to its source. Was the water that fed the mold caused by a covered peril? If the answer is yes, you're on the right track for a covered claim.

The Key Difference: Sudden vs. Gradual Damage

The single most important factor for an insurer is the difference between sudden and accidental damage versus gradual damage. This one distinction is usually what makes or breaks a claim.

Insurance is built to handle sudden accidents, not problems that crop up from poor maintenance or long-term neglect.

A perfect example of a covered event is a pipe that bursts inside a wall. One minute everything’s fine, and the next, water is soaking your drywall and insulation. That’s a textbook "sudden and accidental" event.

Key Takeaway: An adjuster's main question is always: "Did the water show up unexpectedly and all at once?" If so, the resulting mess—including the mold that grows because of it—is usually covered.

On the other hand, a slow, seeping leak from an old faucet that’s been dripping for months is a maintenance issue. That kind of water damage, and the mold it causes, is seen as preventable. The insurer will almost always deny that claim.

For a deeper dive, our guide on homeowners insurance coverage for water damage breaks down more of these scenarios.

Common Covered Perils That Can Cause Mold

So, what are some of the most common “sudden and accidental” events that actually lead to covered mold claims? Knowing these can help you see if your situation fits what your policy is meant for.

Here are a few real-world examples:

- Appliance Hose Failure: The supply line on your washing machine suddenly splits, flooding the laundry room.

- Sudden Plumbing Failure: An ice maker line cracks behind the fridge, or a pipe freezes and bursts during a cold snap.

- Accidental Overflow: Someone forgets to turn off the bathtub, and water overflows through the floor into the room below.

- Fire Extinguishing: Water from the fire department’s hoses soaks the home’s structure and everything inside.

In every one of these cases, the water damage wasn’t caused by a problem you ignored. It happened because of an unforeseen accident—exactly what a covered peril is. This is the bedrock principle that determines whether your homeowners insurance will pay for the mold cleanup that follows.

Common Exclusions: When Homeowners Insurance Will Deny a Mold Claim

Knowing what your policy covers is only half the battle. To really understand if homeowners insurance covers mold, you have to get familiar with the common exclusions that get claims denied. Insurance policies are there to protect you from sudden, unforeseen accidents—not to pay for problems that regular upkeep could have prevented.

Insurers draw a hard line between sudden damage and issues that stem from neglect. That single distinction is the number one reason homeowners get stuck paying for mold remediation out of their own pockets.

Gradual Damage From Slow Leaks

The most common reason for a denied mold claim is gradual water damage. Think about that slow, persistent drip from a pipe under your sink or a crack in the foundation that seeps water after it rains. To an insurer, that’s a maintenance issue, not an accident.

Insurance companies expect you to perform routine checks and make necessary repairs. If a leak has been silently dripping for weeks, months, or even years, they see the resulting mold as a direct consequence of deferred maintenance. The problem was preventable, even if it was hidden from plain sight.

For instance, a small, discolored spot on the ceiling that slowly gets bigger over time is a dead giveaway of a long-term leak. An insurer will almost certainly deny the claim for any mold that grows from it.

Problems From Poor Maintenance and Neglect

Beyond slow leaks, there's a whole category of exclusions that fall under the umbrella of general neglect. Your insurance policy is not a home maintenance plan.

Here are a few classic scenarios that insurers will not cover:

- High Humidity and Poor Ventilation: A bathroom without a working exhaust fan that develops mildew and mold is a textbook example of an uncovered problem.

- Failed Caulking or Grout: Water seeping behind shower tiles because of old, cracked grout is a maintenance failure, not a covered event.

- Unrepaired Roof Damage: If you put off replacing old, curled shingles and a leak eventually develops, the insurance company will likely deny the claim, pointing to neglect.

While your policy probably won't cover these gradual issues, knowing how to effectively address mildew in your carpets can help you manage moisture problems before they spiral into a bigger, non-covered mold disaster.

The Flood Exclusion Rule

This is a big one: standard homeowners insurance policies do not cover flooding. Insurers have a very specific definition of a "flood"—it’s rising water from an outside source, like an overflowing river or a storm surge.

Any mold that grows as a result of a flood will be denied under a standard HO-3 policy. You need a separate flood insurance policy, usually from the National Flood Insurance Program (NFIP) or a private insurer, to have any shot at coverage.

Even with a covered event like a burst pipe, the policy might have specific limits. In fact, many standard policies cap mold coverage at just $1,000 to $5,000, which often isn't nearly enough for a serious remediation job. If you're concerned about that scenario, you can learn more about if homeowners insurance covers burst pipes in our detailed guide.

Navigating Policy Limits And Mold Endorsements

Even after your mold claim gets the green light, you'll likely run into another wall: the policy limit. A standard homeowners policy doesn't just hand you a blank check for mold cleanup. Instead, it has a specific—and often shockingly low—sub-limit for any costs tied to mold.

This sub-limit is a hard cap on how much your insurer will pay for a covered mold claim. Think of it as a small, separate bucket of money set aside just for mold, no matter how bad the damage gets.

Unfortunately, that bucket is rarely deep enough to cover a serious remediation project, which can easily soar into the tens of thousands of dollars.

Understanding Standard Mold Coverage Limits

Most standard insurance policies put a tight leash on mold coverage, with sub-limits typically falling somewhere between $1,000 and $10,000. While that might be enough to handle a tiny, contained patch of mold, it’s almost never sufficient when the problem has crept into your drywall, insulation, or framing.

These limits aren't universal; they change based on your state and insurer. For instance, in hurricane-prone states like Florida, recent reforms have pushed for more substantial mold coverage options. In other states, the caps can be much, much lower. You can get more details on how these policy limits are structured and find other key insights on how insurance policies handle mold.

Key Takeaway: Getting your claim approved is just step one. You need to immediately find out your policy's sub-limit for mold, because that number dictates your entire budget for professional remediation.

The Solution: A Mold Endorsement

If your policy’s standard sub-limit looks dangerously low, you do have an option: a mold endorsement, sometimes called a rider. This is an optional add-on you can purchase to raise your coverage limit for an extra premium.

A mold endorsement essentially buys you a much bigger "bucket of money" for a covered mold situation. Instead of getting stuck with a $5,000 cap, an endorsement could boost your limit to $25,000, $50,000, or even more, depending on what your insurer offers.

Should You Invest in a Mold Endorsement?

Deciding whether to add a mold rider really comes down to your home's unique risk profile. A few key factors can point you in the right direction.

You should seriously consider an endorsement if your property fits any of these descriptions:

- You Live in a Humid Climate: Homes in damp regions, like the coastal parts of Los Angeles, are in a constant battle with moisture.

- You Have an Older Home: Older houses often come with aging plumbing or structural quirks that make them more prone to leaks.

- You Have a History of Water Issues: If your home has dealt with leaky pipes, a damp basement, or roof problems before, your risk is already higher.

- You Have Certain Building Features: Properties with flat roofs, finished basements, or heavy landscaping right up against the foundation are prime candidates for water intrusion.

Paying a little more in your premium now can save you from a massive out-of-pocket disaster later. It's an investment in real financial protection and peace of mind.

How To File A Successful Mold Damage Claim

Finding mold is a pain. Filing the insurance claim shouldn't be. While every policy has its quirks, following a simple, methodical process can make all the difference between a denial and an approved claim. Your goal is to build a clear, undeniable case for your insurer, leaving no room for questions.

The clock starts the second you find water damage or even suspect mold is growing. What you do next is critical, and it all starts with stopping the problem at its source.

Step 1: Immediately Mitigate The Damage

Before you even glance at your policy documents, you need to stop the water. If a pipe under the sink bursts, find the main water shutoff for your house and turn it off. If the washing machine drain hose gives out, shut off the supply valves behind the machine.

This is called mitigation, and it’s a non-negotiable requirement in virtually every homeowners policy. If you don't take reasonable steps to stop the damage from getting worse, your insurer has grounds to deny the claim, arguing that you let the problem escalate.

Step 2: Document Everything Before You Touch A Thing

Once you've stopped the leak, your next job is to play detective. Do not start cleaning, tearing out wet drywall, or moving damaged items yet. Your first move is to grab your smartphone and document everything with photos and videos.

- Go Wide: Take pictures of the entire affected room from several different angles. This shows the adjuster the full scale of the problem.

- Get Close: Zoom in on the visible mold, the water stains on the ceiling, the warped floorboards—any material that’s been damaged.

- Shoot Video: A quick video where you walk through the area and explain what you’re seeing is incredibly effective. It provides context that photos alone can't capture.

This visual record is your single most important piece of evidence. It proves the condition of your home before any cleanup started, creating a baseline of the damage that can't be disputed later.

Step 3: Notify Your Insurance Company Promptly

With your first batch of photos and videos saved, it's time to call your insurance agent or the company's 24/7 claims hotline. Don't wait. Almost every policy includes a clause requiring you to report a loss "in a timely manner."

When you make the call, have this info ready:

- Your policy number.

- The date you discovered the damage.

- A straightforward description of what happened (e.g., "The supply line to our toilet on the second floor broke and water ran down into the living room ceiling.").

From here on out, keep a log of every conversation. Note the date, time, and the name of the representative you spoke with. Staying organized is key to navigating the insurance claim timeline and making sure nothing falls through the cracks.

Why Insurers Are So Cautious With Mold Claims

It can definitely feel like insurance companies are looking for any reason to deny a mold claim. But from their perspective, mold isn't just a cleanup job—it's a perfect storm of unpredictable costs and massive financial risk.

Unlike a fire, which is a single, contained event, mold is a slow-motion disaster. A tiny, hidden leak behind a wall can quietly fester, leading to a remediation bill that rivals the cost of rebuilding an entire room. This creeping nature makes it almost impossible for insurers to accurately price their risk.

The Financial Impact of Water and Mold

The numbers tell the whole story. In 2022, water damage and the resulting mold accounted for a jaw-dropping 27.6% of all homeowners insurance losses in the country. That makes it one of the most expensive claim categories they handle, and that cost gets passed down to everyone through policy language and higher premiums. United Policyholders offers a great explanation of why the coverage gap for mold still surprises homeowners.

This history of enormous payouts is the exact reason modern insurance policies have become so restrictive. Insurers now see any unmanaged moisture as an unbounded financial threat.

From Risk Management to Policy Exclusions

Facing this financial pressure, insurance companies made a strategic shift. They reclassified mold from a standard covered problem to a high-risk exclusion that needs special, added-on coverage.

In doing so, they moved the responsibility for preventing gradual water issues squarely onto the homeowner's shoulders.

By setting low default limits—often just $1,000 to $10,000—and then selling endorsements for better coverage, they've created a system where you have to actively opt-in and pay more for real protection. Understanding this mindset makes it clear why proactive maintenance isn't just good homeownership; it's a critical part of protecting yourself financially.

Frequently Asked Questions About Mold Insurance

Q: Does homeowners insurance cover mold testing or inspection costs?

A: It depends on the cause. If the mold resulted from a covered event (like a sudden pipe burst), your policy will likely pay for the necessary testing to assess the damage. However, if you simply suspect mold due to general humidity or a slow leak, the insurer will consider the inspection a maintenance cost you must cover yourself.

Q: What if the mold was hidden behind a wall?

A: Coverage still hinges on the source of the moisture. If a hidden pipe suddenly burst, causing mold to grow unseen, your claim has a strong chance of being approved because it was a "sudden and accidental" event. But if the mold grew from a slow, seeping leak over months or years, it will almost certainly be denied as a preventable maintenance issue.

Q: Will filing a mold claim increase my insurance premium?

A: Filing any claim, including one for mold, can potentially raise your premium when your policy renews. Insurers view claims as an indicator of higher risk. While a single water damage claim might only cause a small increase, multiple claims in a short period are a major red flag that could lead to a significant rate hike or even non-renewal of your policy.

Q: Is mold from a sump pump failure covered?

A: A standard homeowners policy almost always excludes water damage from a drain or sump pump backup. To get coverage, you need a specific add-on called a "water backup and sump pump overflow endorsement." Without this optional rider, you will have to pay for the cleanup and any resulting mold remediation out of pocket.

Q: What should I do if my mold claim is denied?

A: First, carefully review the denial letter to understand the insurer's exact reason. Compare it to the language in your policy. If you believe the denial is unfair, gather all your documentation (photos, repair receipts, a timeline of events) and file a formal appeal. If the appeal is also denied, you can contact your state's department of insurance or consult with a public adjuster or attorney who specializes in insurance claims.

Q: Are the rules different for a rental property?

A: Yes. While the principles of "sudden vs. gradual" damage are similar, the type of insurance is different. A landlord's policy covers the structure of the building, while a renter's policy covers their personal belongings. If you own an investment property, you'll need to understand the unique protections and liabilities covered by landlord insurance.

If you're dealing with a mold issue in the Los Angeles area and need a team that knows how to navigate this process, Onsite Pro Restoration is here to help. We provide expert mold inspections and remediation and work directly with insurance companies to make your claim as smooth as possible.