For homeowners in Los Angeles, discovering mold sparks an immediate, high-stakes question: is mold removal covered by insurance? The answer is almost never a simple yes or no. Coverage depends entirely on what caused the mold in the first place. Think of your insurance policy as an emergency response for sudden disasters, not a maintenance plan for gradual neglect.

Understanding this distinction is the key to navigating your policy and getting the coverage you need. This guide will walk you through the critical factors that determine coverage, from the type of water damage to the fine print in your policy, so you can make informed decisions when disaster strikes.

The Core Factor: Sudden vs. Gradual Damage

When you ask, "is mold removal covered by insurance," what your adjuster really hears is, "where did the water come from?" Insurance policies are designed to protect you from unexpected, accidental events—not from problems that develop over time due to poor upkeep. This single distinction is the most critical factor in any mold-related claim.

What Insurers Consider Sudden Damage

Sudden and accidental damage is precisely what it sounds like—an event that happens quickly and without warning. It's a problem you couldn't have reasonably anticipated or prevented with standard maintenance. For Los Angeles homeowners, this is the best-case scenario for getting a mold claim approved.

Examples of covered sudden damage often include:

- A washing machine supply line suddenly bursting in your Sherman Oaks home.

- A pipe that freezes and cracks during a rare Southern California cold snap.

- A toilet or bathtub that overflows unexpectedly in a rental property.

- Water damage from firefighters extinguishing a blaze in a commercial building.

In these situations, the mold is seen as a direct consequence of a covered peril. Because the initial water event was covered, the cleanup for the resulting mold usually is, too—up to your policy's specific limits.

Why Gradual Damage Is Almost Always Excluded

On the other side is gradual damage—any water issue that occurs over weeks, months, or years. Insurance companies view this as a maintenance failure that the property owner should have addressed. It’s not an accident; it’s a result of neglect.

This isn't an arbitrary rule. The insurance industry faced a crisis in the early 2000s when a flood of lawsuits turned minor leaks into massive payouts. By 2003, over 10,000 mold claims were clogging courts in California and other states. In response, insurers drew a hard line: they would cover mold from sudden accidents but exclude mold from slow, ignored leaks.

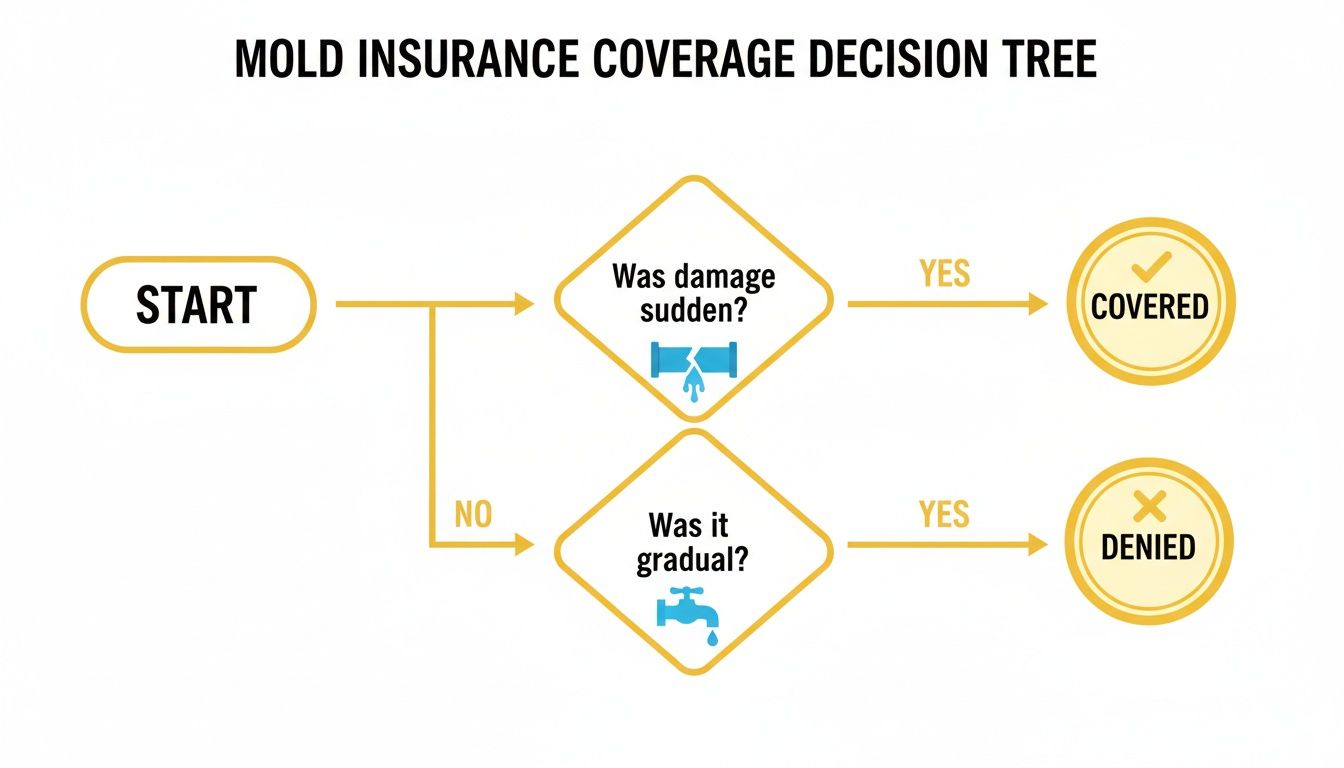

This decision tree illustrates how an adjuster will likely approach your claim.

As you can see, the path to a paid claim starts with a sudden water event. A slow leak almost always leads straight to a denial.

Common examples of uncovered gradual damage include:

- A slow drip from a worn-out shower pan in a Santa Monica condo.

- Persistent mildew in a bathroom with poor ventilation due to coastal fog.

- Groundwater seeping in over time through foundation cracks.

- A flat roof in Sherman Oaks that has been quietly leaking for months.

Since burst pipes are a frequent cause of sudden water damage, it pays to know the specifics. You might find our guide on whether homeowners insurance covers burst pipes helpful.

How to Navigate Your Policy's Fine Print

Even when mold results from a covered event like a burst pipe, the fine print in your homeowners policy dictates the final payout. For any Los Angeles homeowner, understanding this language ahead of time is key to ensuring mold removal is covered by insurance. Familiarizing yourself with these terms now will prevent major headaches and unwelcome surprises during a stressful claim.

Unpacking Sub-Limits and Endorsements

Most standard policies that offer mold coverage place a strict cap on how much they will pay. This is known as a sub-limit—the absolute maximum amount the insurance company will pay for mold remediation, regardless of the actual cost.

- Typical Sub-Limits: These usually range from $5,000 to $10,000. For a severe mold problem that has spread, that amount may only cover a fraction of the total bill.

The good news is you can often raise this cap by purchasing a mold endorsement or rider. This is an optional add-on that provides higher coverage limits specifically for mold damage. It’s a smart investment, especially in an older home with aging plumbing or in humid coastal areas like Malibu.

Understanding Common Exclusions

Every policy has a list of exclusions, and for mold, the most significant is almost always flood damage. A standard homeowners policy does not cover damage from rising groundwater, storm surges, or overflowing rivers. For that protection, you need a separate policy from the National Flood Insurance Program (NFIP) or a private flood insurer.

The insurance industry learned this the hard way. The wave of claims in the early 2000s, with over 10,000 mold lawsuits in states like California, forced insurers to adapt. They added specific mold exclusions and limits to nearly every policy. Today, coverage is almost always tied to sudden water damage—not gradual leaks, neglect, or flooding.

Key Takeaway: Never assume you're covered. Review your policy annually and ask your agent direct questions: "What is my sub-limit for mold?" and "Is a mold endorsement available for my policy?"

This proactive approach puts you in control. For guidance on protecting all your belongings, you can find expert advice on Insuring Items in Storage. Understanding all aspects of your homeowners insurance policy is the best defense against surprise expenses.

Your Step-by-Step Insurance Claim Roadmap

Discovering water damage and potential mold is overwhelming. Filing an insurance claim adds another layer of complexity. However, with a clear roadmap, you can manage the process effectively and protect your interests. The first few moments after finding a leak are critical. Acting quickly and methodically is your best defense against claim denials.

Your top priority is safety and mitigating further damage. If you can do so safely, shut off the main water valve to your property. This simple action demonstrates to your insurer that you fulfilled your responsibility as a policyholder.

What to Do Immediately

Once the immediate threat is contained, shift your focus to documentation and communication. Do not wait. Insurance companies operate on tight timelines, and delaying your call could jeopardize your claim.

Here are the first three calls to make:

- Document Everything First: Before moving or cleaning anything, use your phone to take extensive photos and videos of the damage. Capture the source of the leak, soaked drywall, ruined flooring, and any affected belongings. This visual proof is invaluable.

- Notify Your Insurer: Call your agent or the claims hotline immediately. Provide a clear, concise summary of what happened. Have your policy number ready.

- Call a Professional Restoration Company: This is a vital step. Contact a certified team like Onsite Pro Restoration. We arrive quickly to assess the damage, begin emergency water extraction, and set up professional drying equipment. Insurance adjusters look for this prompt, professional response.

Working with Your Insurance Adjuster

Soon after you file, your insurer will assign an adjuster to your case. The adjuster's job is to investigate the cause, determine the extent of the damage, and estimate repair costs based on your policy. This is where having a professional advocate on your side becomes a game-changer.

An adjuster is trained to look for specific evidence. A professional restoration company speaks their language and provides the hard data they need, such as:

- Detailed Moisture Mapping: We use tools like thermal imaging cameras and hygrometers to find hidden moisture invisible to the naked eye.

- IICRC-Compliant Documentation: We create a detailed report with moisture readings, photos, and a precise scope of work for water mitigation and mold remediation.

- Direct Communication: We can speak directly with your adjuster, answering technical questions to streamline the approval process.

Your goal is to build an undeniable case showing the mold resulted directly from a sudden, covered event. Professional, data-driven documentation is the most powerful tool you have.

For a deeper dive into what to expect, check out our guide on filing an insurance claim for water damage.

How a Professional Partner Maximizes Your Claim

Hiring a certified restoration company is a strategic move that can make or break your insurance claim. When you're asking, "is mold removal covered by insurance," a seasoned expert can be the difference between a swift approval and a frustrating denial. We partner with you to prove the damage is tied to a covered event.

Our IICRC-certified technicians are your boots on the ground, using specialized equipment that reveals what an adjuster’s visual inspection might miss. An adjuster sees the surface; we see the science behind the damage. Our data-driven approach uses tools that insurance companies know and trust.

Providing Undeniable Evidence

A successful claim is built on solid proof. We don’t just tell your insurer what happened; we show them with indisputable data.

- Infrared Cameras: These tools act like x-ray vision for moisture, detecting temperature differences behind walls and under floors to pinpoint hidden water pockets. This proves the damage is more extensive than it appears.

- Hygrometers and Moisture Meters: We obtain precise, quantitative readings of moisture within materials like drywall, studs, and subflooring. This data justifies the full scope of drying and repairs needed to prevent mold.

This detailed evidence transforms a simple request for coverage into a documented, professional report that an insurer cannot easily dispute.

Speaking the Insurer's Language

Beyond technology, we bridge the communication gap between you and your insurer. We speak their language, understand their documentation requirements, and know how to present the facts to streamline approvals. North America's $1.50 billion mold services market is driven by insurance-backed coverage in over 90% of cases, making professional documentation more critical than ever.

By partnering with a professional team, you're not just getting remediation—you're getting an experienced advocate who manages the technical details, so you can focus on getting your property back to normal.

Learn more about how a true restoration pro can help you navigate this process.

FAQ: Is Mold Removal Covered by Insurance?

Navigating property damage and insurance can be confusing. When asking, "is mold removal covered by insurance?", the details matter. Here are answers to common questions we hear from Los Angeles homeowners.

Q: What should I do if my mold claim is denied?

A: First, don't panic. Request a written explanation from your insurance company, which must cite the specific policy language used for the denial. Review this document against your policy. If you believe there's an error, you can appeal. The strongest appeals are supported by a detailed report from a certified restoration company linking the mold to a sudden, covered water event. For complex cases, consider hiring a public adjuster.

Q: Does homeowners insurance cover mold testing?

A: It depends. If mold testing is necessary to determine the extent of damage from a covered peril (like a burst pipe), the cost is usually included in the overall claim. However, if you are getting an inspection "just in case" without a specific, sudden water event, you will likely have to pay for it yourself, as insurers view this as routine maintenance.

Q: Will filing a mold claim raise my insurance premium?

A: It's possible. Any property claim can signal to your insurer that your property carries a higher risk, potentially leading to a higher premium at renewal. However, you must weigh this against the alternative. The out-of-pocket cost for professional mold remediation can easily reach thousands or tens of thousands of dollars, making a potential premium increase seem minor in comparison.

Q: Is mold from a leaky roof covered by insurance in Los Angeles?

A: Coverage depends on the cause of the leak. If a sudden event, like a severe storm, damages your roof and causes a leak, the resulting water and mold damage is typically covered. However, if the leak is due to a 25-year-old roof with worn-out shingles (i.e., gradual wear and tear), the claim will almost certainly be denied due to a lack of maintenance.

Don't navigate a mold and insurance crisis alone. The IICRC-certified team at Onsite Pro Restoration provides the expert documentation and professional remediation needed to maximize your claim and restore your peace of mind.