Discovering mold in your Los Angeles home can be alarming, but the question that quickly follows is often more stressful: is mold remediation covered by insurance? Here's the frustratingly simple answer: sometimes, but it's complicated.

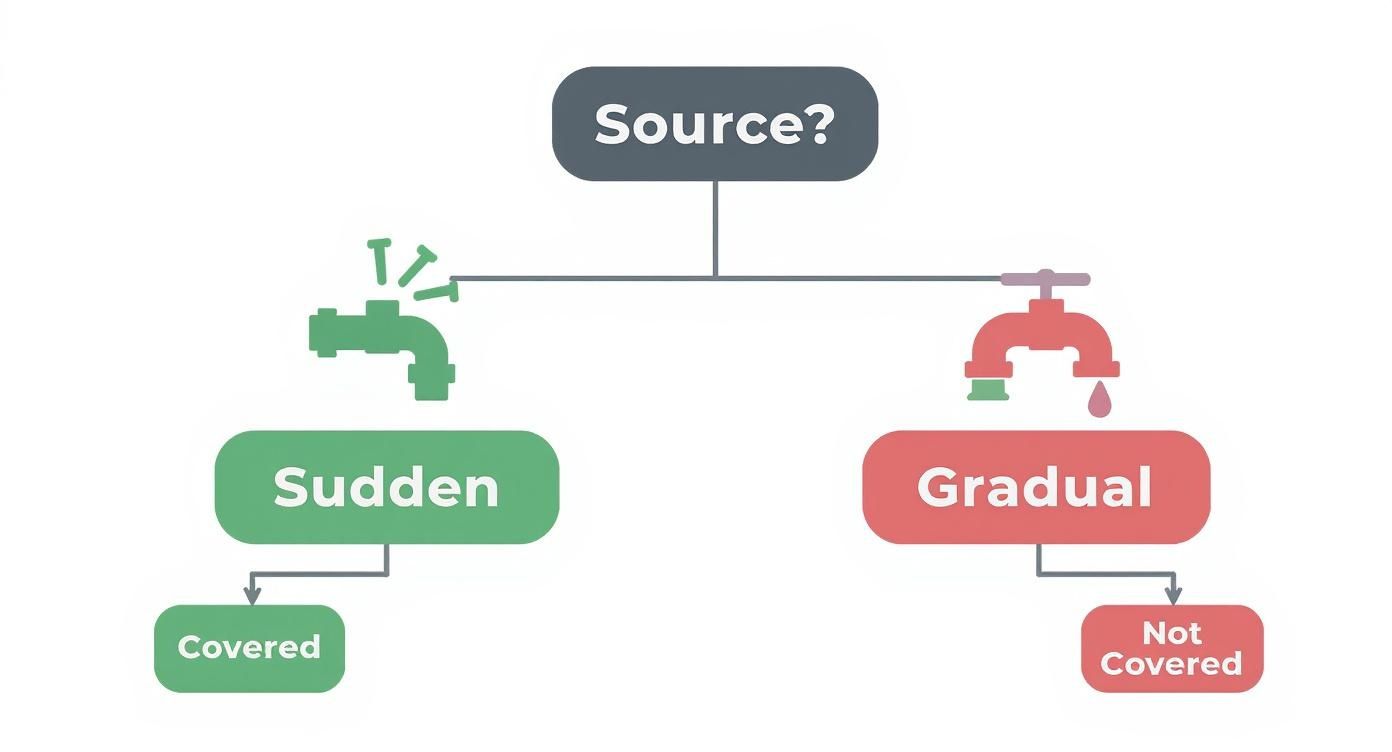

Mold remediation is typically covered by your homeowners insurance only when the mold is the direct result of a sudden, accidental event that your policy already covers—think a burst pipe flooding your basement in Sherman Oaks. But if the mold grew because of poor maintenance, a slow, gradual leak under your sink, or the persistent coastal fog in Santa Monica, your claim will almost certainly be denied. Understanding this distinction is the key to navigating your policy and getting the coverage you need.

Facing a sudden water leak or mold problem? Don't wait. Onsite Pro Restoration offers IICRC-certified services to help document your claim and restore your home.

Understanding When Your Homeowners Insurance Covers Mold Damage

Trying to decipher an insurance policy can feel like learning a new language. But when it comes to mold, the guiding principle is actually pretty straightforward: it all comes down to the source of the moisture. Insurers draw a firm line between sudden, unexpected water disasters and problems that fester over time due to neglect or environmental factors.

A solid grasp of this concept is the first step in understanding insurance agencies and how they approach these kinds of claims.

This decision tree breaks down the basic logic your insurer will likely use.

As you can see, the path to getting your claim approved starts with a sudden water event. Anything gradual almost always leads to a denial.

Here’s a practical way to think about it:

- Covered Peril: A washing machine hose suddenly splits open in your Encino home, flooding the laundry room and causing mold to grow on the damp drywall. This is a classic "sudden and accidental" event.

- Excluded Cause: You have a slow, unnoticed drip under your bathroom sink that allows mold to thrive inside the cabinet over several months. This is considered a maintenance issue, not a covered event.

Mold Coverage At a Glance: Common Scenarios

To make things even clearer, here’s a quick table showing how insurers typically view different mold-causing scenarios. It helps illustrate that crucial difference between a sudden event and a gradual problem.

| Cause of Mold | Is Remediation Likely Covered? | Why or Why Not |

|---|---|---|

| Burst pipe or ruptured supply line | Yes | This is a classic "sudden and accidental" event covered by most standard policies. |

| Slow, dripping faucet or pipe | No | This is considered a maintenance issue, as homeowners are expected to fix leaks promptly. |

| Appliance malfunction (e.g., dishwasher overflow) | Yes | Similar to a burst pipe, this is an unexpected failure of a household system. |

| Roof leak from a major storm | Yes | The damage is tied to a specific, covered event (the storm). |

| High humidity or poor ventilation in a bathroom | No | This falls under homeowner maintenance and environmental factors, not an accident. |

| Groundwater seepage into a basement | No | This is considered flooding, which requires a separate flood insurance policy. |

Ultimately, your policy is designed to protect you from unforeseen disasters, not to pay for the consequences of deferred maintenance. Knowing this distinction is key to setting realistic expectations before you ever file a claim.

Decoding Your Homeowners Insurance Policy for Mold

So, you've found mold. The next big question is, will my insurance cover this? To figure that out, you’ll need to put on your detective hat and dig into the fine print of your homeowners policy. Insurance documents can be dense, but a few key terms will tell you everything you need to know.

First up is the concept of a "covered peril." Think of a peril as a specific disaster your policy protects you from, like a fire, a lightning strike, or a windstorm. Here's the catch: mold itself is almost never listed as a covered peril. Instead, coverage hinges on the event that caused the mold in the first place.

Sudden and Accidental vs. Gradual Damage

This is where most mold claims are either approved or denied. It's the most critical distinction to understand.

-

Sudden and Accidental Damage: This means a one-time, unexpected event. The classic example is a washing machine supply hose suddenly bursting and flooding your laundry room. Because the source was a sudden accident, the water damage and any mold that grows as a direct result are usually covered.

-

Gradual Damage: This is damage that happens slowly over a long period. Imagine a tiny, slow drip from a pipe under your bathroom sink that goes unnoticed for months. That’s gradual damage. Insurers see this as a maintenance issue you’re responsible for, so they almost never cover the resulting mold.

Key Takeaway: Your insurance policy is built to protect you from unexpected disasters, not to pay for the consequences of deferred maintenance or long-term neglect. Grasping this logic makes it easier to understand why claims get denied.

Finding the Mold Exclusion or Limitation Clause

Just about every standard homeowners policy today has a specific clause for mold. Scan your policy for sections titled "Exclusions," "Limitations," or "Fungi/Mold Coverage."

This is where you'll likely find a "sub-limit," which is just a fancy term for a cap on how much the insurance company will pay for mold cleanup. This cap is often shockingly low—think $5,000 to $10,000, no matter how high the actual remediation bill is.

Insurers used to be a bit more generous, but skyrocketing remediation costs forced them to add these tight restrictions. Because the cause of the mold is so important, it’s also a good idea to understand what your policy says about water. You can learn more in our guide to homeowners insurance coverage for water damage.

Common Reasons Insurers Deny Mold Remediation Claims

If you want to avoid getting your mold claim denied, you first have to understand how an insurance company thinks. A denial letter might feel personal, but it’s not arbitrary. It’s almost always based on specific rules and exclusions written deep inside your policy.

The number one reason for a denial comes down to one simple phrase: the water source was not "sudden and accidental." If the mold grew because of a problem that festered over time, your claim will almost certainly be dead on arrival.

Gradual Damage and Neglect

Insurance adjusters are experts at telling the difference between a sudden crisis and a problem that’s been ignored for weeks or months. They know exactly what to look for.

- Ignored Leaks: That slow drip from the upstairs faucet in your Beverly Hills home or the minor roof leak you meant to fix last summer? Those are classic examples. The mold that results is seen as a consequence of neglect, not a covered event.

- Poor Maintenance: Failing to run the fan in your bathroom, not sealing a drafty window, or ignoring condensation that builds up every winter are all considered maintenance issues. Your insurance policy is there for emergencies, not as a substitute for home upkeep.

How an Adjuster Sees It: When a claim comes in, the first thing the adjuster does is play detective to find the water’s origin. If the evidence—like water stains, rotted wood, or layers of grime—points to a long-term issue, the claim gets flagged for denial due to gradual damage.

Exclusions for Floods and Sewer Backups

This is where many homeowners get a nasty surprise. Your standard policy is not a catch-all for every type of water that enters your home. Two of the biggest exclusions are floods and sewer backups.

- Flood Damage: This causes a ton of confusion. Standard homeowners insurance does not cover damage from natural floods, like an overflowing river or a coastal storm surge. Any mold that grows from that kind of event requires a separate flood insurance policy, which is often managed through FEMA.

- Sewer or Drain Backups: It’s a similar story if a city sewer line backs up and sends waste into your basement. The water damage and resulting mold are typically excluded. To be covered, you need to have purchased a special add-on, often called a "water backup" endorsement.

Digging through these policy details can be a real headache. You can find more answers to common questions about insurance coverage for water damage to make sure you're prepared.

How to Document and File a Mold Insurance Claim

The moment you spot water damage and suspect mold, the clock is officially ticking. Your best weapon against a denied claim is a swift and methodical response. Insurers are looking for immediate action, because any delay can be framed as neglect, making the answer to "is mold remediation covered by insurance?" a lot more complicated.

First things first: stop the water. If you have to, shut off the main water valve to prevent one drop more of damage. Once that immediate threat is handled, your entire focus needs to shift to documentation.

Create a Detailed Visual Record

Before you touch, move, or clean a single thing, you need to document the scene like a forensic investigator. This evidence is the absolute bedrock of your claim.

- Take tons of photos. Get wide shots to show the overall scope of the problem, then move in for close-ups of the mold and the source of the water. Don't be shy; more is better.

- Record a video walkthrough. A video gives the adjuster powerful context that photos alone can't. Walk through the area and narrate what you're seeing as you record.

- Don't disturb the area. I know the urge to start cleaning is strong, but resist it. Altering the scene before your adjuster sees it can seriously weaken your position.

This initial evidence helps prove the damage was from a sudden event, not a slow leak you ignored for months.

Notify Your Insurer and Keep Meticulous Logs

Call your insurance agent right away to report the damage. Prompt notification is almost always a policy requirement, and it demonstrates that you're acting responsibly. From this very first phone call, start a detailed log of every single interaction.

Pro Tip: Document every phone call, email, and conversation. Note the date, time, the name of the person you spoke with, and a quick summary of what was discussed. This log can become your most valuable asset if any disputes pop up down the road.

Beyond just photos, you need to track every penny you spend. Implementing effective receipt organization will make this part of the process much less of a headache. It also helps to understand the typical insurance claim timeline to set realistic expectations. All this prep work builds a strong, undeniable case for your claim.

Why Insurers Prioritize Professional Mold Remediation

If your mold claim gets the green light, your insurance company will almost certainly require you to hire a certified professional. This isn't just about looking official; it's a cold, hard risk management strategy. For an insurer, an amateur cleanup job is just a future claim waiting to happen.

Spraying bleach on a visible patch of mold is like yanking a single weed and pretending the roots are gone. Sure, it might look better for a week, but the real problem—the microscopic spores that have already worked their way into your drywall and wood—is still there, ready to grow back.

The Professional vs. DIY Approach

Professionals don’t just clean mold; they eliminate it using a scientific process. They understand that without fixing the moisture source and containing the airborne spores, the mold is guaranteed to return.

Here’s how their work protects both you and the insurer from a repeat disaster:

- Containment: Certified technicians build containment zones with negative air pressure. This simple step is critical—it stops spores from becoming airborne and contaminating the rest of your home during removal.

- Air Filtration: They run commercial-grade HEPA air scrubbers 24/7 to capture any spores floating in the air. This cleans your air and prevents the mold from resettling on clean surfaces.

- Proper Removal: Professionals know which materials can be saved and which can’t. They safely bag and dispose of contaminated materials like drywall and insulation, following strict industry safety rules.

- Moisture Elimination: This is the most important step. They use specialized tools to find and fix the original water source, which is the only way to solve the problem for good.

For an insurance company, paying for a professional once is far cheaper than paying for a recurring problem caused by an incomplete DIY cleanup. Their insistence on professional work is a financial decision designed to close the claim permanently.

Mitigating Long-Term Risk

At the end of the day, insurers view professional remediation as a non-negotiable step to limit their long-term liability. The global mold remediation market is now valued at over $1.25 billion, driven by a greater understanding of the health risks involved. The EPA even recommends professional help for any mold outbreak larger than 10 square feet because a botched cleanup can actually make things worse.

By hiring a certified team, the insurer gets the documentation they need to prove the job was done right. This protects them from future claims related to the same issue and closes the book on the problem. To see what this comprehensive process looks like, learn more about our professional mold remediation service.

Why Is Mold Insurance Coverage So Complicated? A History

If you've ever tried to figure out whether mold remediation is covered by insurance, you know how frustrating it can be to get a straight answer. There’s a reason for that: the rules of the game have changed dramatically over the last 20 years. Insurance policies aren't set in stone; they evolve based on risk, and mold has become a huge financial headache for the industry.

It wasn't always this way. Years ago, coverage was much more straightforward. But after a wave of powerful hurricanes and superstorms, insurers were hit with an explosion of water damage claims. The mold that followed cost them billions, forcing a major re-evaluation.

How the Insurance Industry Responded

In reaction to those massive payouts, insurers started tightening their policies across the board. They began writing in specific mold exclusions or adding very low coverage caps—often called sub-limits—as a standard part of most homeowners policies.

This wasn't a random decision. It was a direct response to the rising frequency of large-scale water disasters. This shift has turned mold remediation insurance into a massive global market, now valued at around $2.3 billion in 2024, with North America making up over 40% of that figure. You can learn more about these market trends to see the scale of the issue.

This industry-wide change directly affects you. It means you can no longer just assume your policy has your back when it comes to mold.

Key Takeaway: Standard homeowners policies are now intentionally designed to limit payouts for mold. Relying on default coverage without reading the fine print is a serious financial gamble, especially if you live in a humid or storm-prone area.

Getting familiar with how a specific provider like Progressive handles its homeowners policy can give you a clear picture of these modern coverage limits. Ultimately, this new reality puts the responsibility on you to check your policy and buy extra coverage—called an endorsement or rider—if you need it.

Frequently Asked Questions About Mold and Insurance

Here are quick, clear answers to the most common questions homeowners have when trying to figure out if mold remediation is covered by insurance. Let’s clear up the confusion so you can navigate your situation with confidence.

Q: Does my homeowners insurance policy cover mold testing or inspection?

A: It depends. If the inspection is a direct result of a covered claim—say, a washing machine floods your laundry room and you need to see if mold started growing—the cost is often rolled into the overall claim. It’s seen as a necessary step to figure out the extent of the damage. However, your insurance company won't pay for proactive or "just in case" testing. If you just have a hunch because of a musty smell but can’t point to a specific, sudden water event, you'll likely have to cover the inspection costs yourself.

Q: What is a mold rider or insurance endorsement?

A: Think of a mold rider (also called an endorsement) as an optional upgrade to your standard homeowners policy. It’s designed to provide or increase your coverage for mold damage, which is often severely limited in a base policy. Most standard policies cap mold payouts at just $5,000 to $10,000, which barely covers a small remediation job. A rider lets you buy a much higher coverage limit, often up to $50,000, for a small increase in your premium. It's a smart way to buy back essential protection, especially if you live in a damp or high-risk area.

Q: What are my options if my mold claim is denied?

A: Don't panic if you get a denial—it isn't always the final word. Your first step is to request a formal denial letter from your insurer. Make sure it specifically quotes the policy language they’re using to justify their decision. Next, pull out your own policy and compare their reasoning to the actual text. If you spot a conflict or a gray area, you can file an internal appeal with the insurance company. If that doesn't work, you can contact your state's department of insurance for help or hire a public adjuster to fight on your behalf.

Q: Will my insurance rates go up after a mold claim?

A: It's possible. Filing any type of claim, including one for water damage and mold, can lead to an increase in your premium at renewal time. Insurers may see your property as a higher risk. However, the potential increase should be weighed against the significant out-of-pocket cost of professional mold remediation, which can easily run into thousands of dollars.

Facing a sudden water or mold emergency? Don't wait for it to get worse. Onsite Pro Restoration provides 24/7 IICRC-certified remediation services to assess the damage, document everything for your insurance claim, and get your Los Angeles-area home back to normal fast. Contact us now for a free on-site assessment.