A Geico insurance homeowners policy is your financial backstop when disaster strikes your home. Whether it’s a fire, a severe storm, or a break-in, this policy is the crucial contract standing between you and a massive repair bill. For Los Angeles homeowners, who face unique risks like wildfires and seismic activity, understanding this policy isn’t just wise—it’s essential. This guide will unpack exactly what that means for you and your property.

Get Started

Service Form

When you’re dealing with the aftermath of a disaster, you need a restoration partner who understands the insurance process. Onsite Pro Restoration works directly with GEICO adjusters to make your recovery seamless.

Understanding Your Financial Shield

It’s easy to think of your Geico homeowners policy as just another piece of paper your mortgage lender requires. But it’s much more than that—it’s a core component of your financial security.

Essentially, it’s Geico’s promise to help you pick up the pieces and rebuild after a covered disaster. It prevents a catastrophe from becoming a life-altering financial nightmare, giving you and your family critical peace of mind.

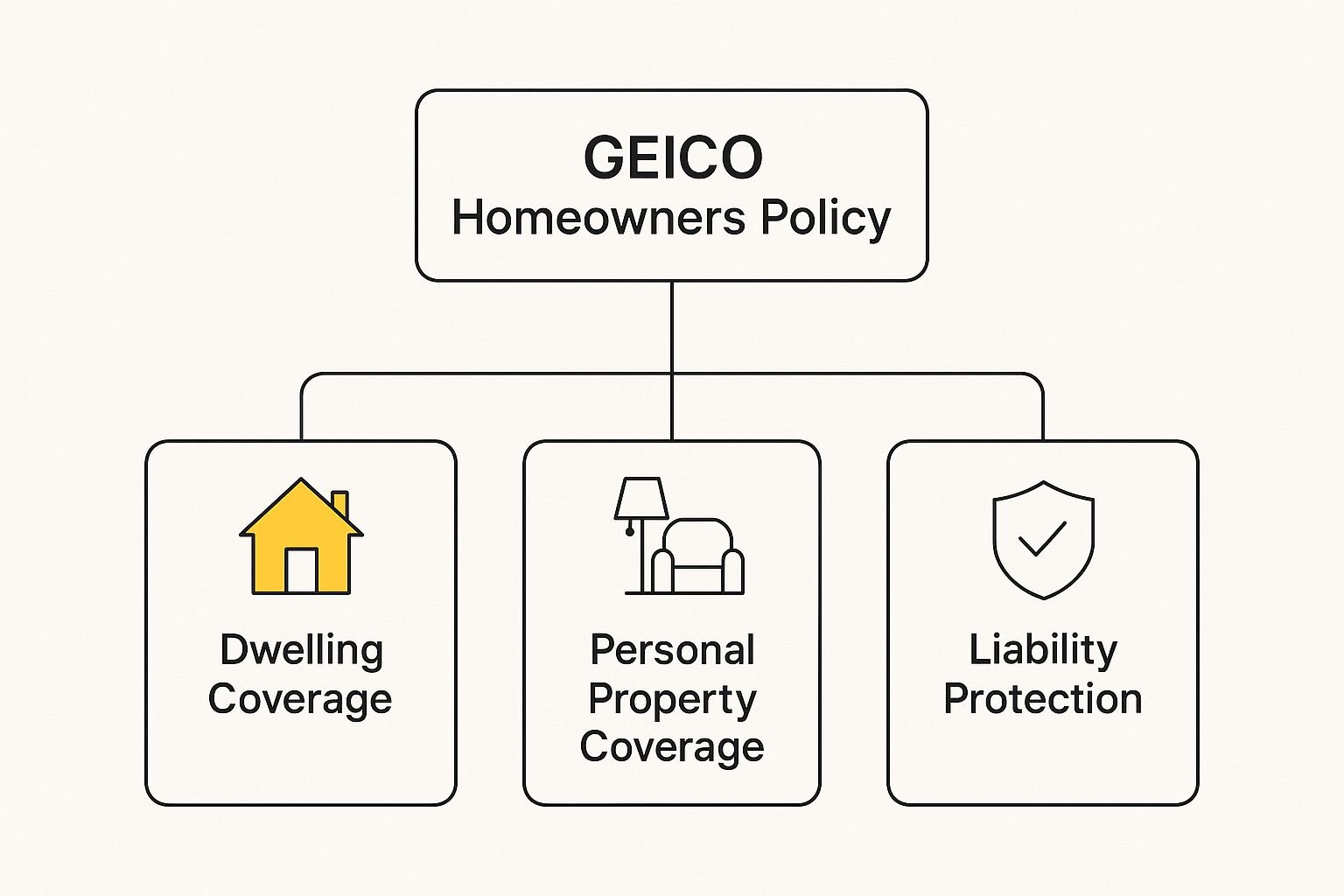

At its heart, the policy is designed to cover three main areas: the house itself, all your stuff inside it, and your personal liability if someone gets hurt on your property.

Key Pillars of Protection

Every home is different, but the fundamental structure of a Geico policy is built around these core protections:

- Protecting the Structure: This is the big one. It covers the cost to repair or even completely rebuild your house if a covered event damages or destroys it.

- Securing Your Belongings: Think about everything from your couch and TV to your clothes and pots and pans. This coverage helps you replace the personal items that make your house a home.

- Guarding Against Liability: If a guest slips on your walkway or your dog bites the mail carrier, liability protection steps in. It helps cover medical bills and legal fees, shielding your savings from a potential lawsuit.

This infographic breaks down how these pieces of a Geico insurance homeowners policy fit together to create a complete safety net. As you can see, a solid policy doesn’t just protect your physical assets; it also protects you from claims made against you.

The Power Behind the Policy

Geico’s strength isn’t just in its famous gecko mascot. The company is a part of Berkshire Hathaway, one of the biggest names in the entire insurance industry. So, while Geico is best known for auto insurance, its homeowners policies are backed by some serious financial muscle.

In 2024, Berkshire Hathaway’s property and casualty division earned a staggering $41.3 billion, a clear sign of its ability to pay out claims when customers need it most. You can dig deeper into the top insurance earners over at Repairer Driven News.

Breaking Down Your Core Policy Coverages

A Geico insurance homeowners policy isn’t one giant, catch-all shield. It’s better to think of it as a toolkit, where each tool is designed for a specific job. When you understand what each component does, you see exactly where your premium goes—and you can rest easy knowing you’re protected where it counts.

Let’s unpack the four foundational pillars that form the bedrock of almost every standard homeowners policy.

To give you a quick overview, here’s a simple breakdown of the standard protections and what each one does.

Your Geico Homeowners Policy at a Glance

Dwelling Protection — Protects: the physical structure of your home (roof, walls, foundation, attached systems).

Example: A windstorm knocks a tree onto your roof, causing major structural damage.Personal Property — Protects: your belongings inside the home (furniture, electronics, clothing, appliances).

Example: A kitchen fire destroys appliances, cookware, and pantry items.Personal Liability — Protects: your finances if you’re found responsible for injury or property damage to others.

Example: A visitor slips on wet porch steps, breaks an arm, and sues for medical costs.Additional Living Expenses (ALE) — Protects: extra costs if a covered loss forces you to live elsewhere temporarily.

Example: A burst pipe floods your home; while repairs happen, ALE pays for a hotel and related expenses.

That’s the foundation—next step is clarifying limits, deductibles, and common exclusions so there are no surprises during a claim.

Coverage A: Dwelling Protection

This is the big one—the coverage everyone thinks of when they hear "homeowners insurance." Dwelling Protection (Coverage A) is what pays to repair or even completely rebuild the physical structure of your home if it's damaged by a covered event like a fire, hail, or windstorm. It covers the "bones" of your house: the walls, the roof, the floors, and anything built-in, like your furnace or water heater. If it’s attached to the house, Dwelling Protection is what has its back. A critical point here: your dwelling coverage limit needs to be enough to cover the full replacement cost of your home, not just what it would sell for. The price to rebuild from the ground up can be wildly different from its market value, and getting this number right is your first line of financial defense.

Coverage C: Personal Property Protection

While Dwelling Protection covers the house itself, Personal Property Protection (Coverage C) handles everything you own inside it. An easy way to think about it is to imagine turning your house upside down and giving it a good shake. Everything that would fall out? That's your personal property. This includes all your furniture, electronics, clothes, and kitchen gadgets. If your belongings are stolen during a break-in or destroyed in a covered disaster, this part of your Geico insurance homeowners policy helps you pay to replace them. Key Insight: Standard policies often have specific, lower limits for high-value items like jewelry, art, or firearms. If you have expensive collectibles, you'll likely need a separate add-on, called a "rider" or "floater," to insure them for what they're truly worth. It’s also worth noting that your coverage extends beyond the four walls of your house. For example, if you have things in a storage unit, your policy might offer some limited protection. You can find some great tips for insuring items in storage to make sure those assets are properly covered.

Coverage E: Personal liability Protection

This is your financial shield against accidents. Personal Liability Protection (Coverage E) kicks in if someone is accidentally injured on your property, or if you or a family member damages someone else’s property. Let's say a delivery driver slips on an icy patch on your walkway, or your kid sends a baseball crashing through the neighbor's picture window. This coverage helps pay for the resulting medical bills or repair costs. Even more importantly, it covers your legal fees if you get sued, protecting your savings and other assets from a potentially devastating lawsuit.

Coverage D: Additional Living Expenses

Ever wonder what you'd do if a major fire or storm damage made your home unlivable? That’s exactly where Additional Living Expenses (ALE), also known as Loss of Use (Coverage D), comes in. It’s a true lifesaver. This coverage reimburses you for the extra costs of living elsewhere while your home is being repaired, so you can maintain your normal standard of living. These costs typically include: Temporary Housing: The bill for a hotel stay or a short-term rental. Food Costs: The difference between your usual grocery spending and the higher cost of eating out when you don’t have a kitchen. Other Expenses: Things you might not think of, like laundry services, pet boarding, or storage fees. It’s a crucial safety net that keeps a disaster from turning into a full-blown financial crisis. This is especially vital when dealing with complex issues like water damage, where repairs can take a while. To get a better handle on this, you can dig into the specifics of homeowners insurance coverage for water damage and see how these coverages all work together.

How to Customize Your Policy with Endorsements

A standard Geico insurance homeowners policy is a solid starting point. It’s built to cover the common problems most homeowners face, but let’s be honest—your life isn’t “average.” You’ve got unique valuables, specific local risks, and you need a policy that fits your reality.

This is where endorsements come into play.

Think of them as upgrades or custom add-ons for your insurance. Also called riders, these additions plug the gaps in standard coverage, creating a safety net designed just for you. Without the right ones, you could find yourself paying thousands out-of-pocket for something you assumed was covered.

Covering High-Value Possessions

One of the biggest surprises for homeowners comes from the limits on high-value items. Your standard policy protects your stuff, but it puts a cap on certain categories like jewelry, art, firearms, or collectibles. For example, a typical policy might only pay out $1,500 for stolen jewelry. If your engagement ring is worth $10,000, that $1,500 limit leaves a massive financial hole. That's where a Scheduled Personal Property endorsement becomes absolutely essential. This add-on lets you "schedule," or individually list, specific high-value items with their appraised value. You’re insuring them for what they're actually worth, often with a much lower deductible (sometimes none at all). It even provides broader protection, covering you for more types of losses than the base policy.

Protecting Against Water Damage from Below

Your policy is great at covering water damage from inside your home, like a burst pipe behind the drywall. But it almost never covers water that comes from below—like a sewer backup or a sump pump failure. Imagine a heavy storm overwhelms your sump pump. Suddenly, you've got a flooded basement and tens of thousands of dollars in damage that your standard policy won't touch. A Water Backup and Sump Pump Overflow endorsement closes this all-too-common gap. It's an inexpensive add-on that typically covers: Damage to your home’s structure (think drywall, flooring, and framing). Damage to belongings you had stored in the basement. Costs for cleanup and preventing mold. Considering how expensive water damage is, this is easily one of the most important endorsements any homeowner should consider for their Geico insurance homeowners policy.

Understanding Exclusions and Separate Policies

It’s critical to know that no homeowners policy—including Geico’s—covers everything. Two of the biggest exclusions are floods and earthquakes. These disasters require completely separate policies. Flood Insurance: Typically purchased through the National Flood Insurance Program (NFIP) or a private insurer, this is a must-have if you're anywhere near a flood zone. Just one inch of floodwater can cause over $25,000 in damage. When disaster strikes, it helps to know who to call, which you can learn about in our guide on choosing a flood damage service. Earthquake Insurance: If you live in a seismically active area, you’ll need a separate earthquake policy. This is what covers structural damage and destroyed belongings after the ground starts shaking. Expert Takeaway: Your geography is the single biggest clue to what endorsements you need. A homeowner in Florida faces completely different risks than someone in California or the Midwest. While a few giants lead the U.S. insurance market—State Farm, Berkshire Hathaway (Geico's parent), and Progressive—Geico’s backing gives it the stability to offer competitive homeowners policies. Assessing your personal risks and adding the right endorsements is how you turn a generic policy into a shield that’s truly ready for anything.

Finding Every Discount on Your Geico Home Policy

Saving money on your geico insurance homeowners policy shouldn’t mean cutting corners on protection. The truth is, most homeowners qualify for at least one discount, but these savings often go unnoticed simply because people don’t know to ask for them. This is your guide to sniffing out every last dollar of savings GEICO has to offer.

By being a little proactive, you can make a real dent in your annual premium. We’ll walk through the biggest and easiest ways to save, from bundling your policies to installing a few modern safety features in your home.

Bundle and Save with Multi-Policy Discounts

The fastest and most effective way to lower your homeowners insurance cost is to bundle it with another GEICO policy—usually your auto insurance. Insurers reward loyalty because it’s more efficient for them to manage one customer with multiple policies. In return, they pass on significant savings that often hit the 10-20% mark, sometimes even more. Think of it as a loyalty discount. When you trust GEICO with more of your business, they reward you with a better price. If your car is insured with GEICO but your home isn't, getting a bundled quote should be your very first move.

Earn Savings with Protective Devices

Insurance is all about risk. The safer your home is from a potential disaster, the less risk the insurance company takes on. GEICO gives a financial nod to homeowners who take practical steps to reduce that risk by installing protective devices. You can often land a discount for having: Smoke Detectors: Working smoke alarms on every floor are a safety must-have and can shave a little off your premium. Fire Extinguishers: Keeping a fire extinguisher handy in the kitchen or garage shows you’re prepared and can add to your savings. Home Security Systems: This is the big one. A professionally monitored system that detects both break-ins and fires offers the best protection and, in turn, the biggest discount in this category. Water Leak Detection Systems: These smart devices can automatically shut off your water main if a leak is detected, preventing a catastrophic mess. Insurers love them.

Additional Ways to Reduce Your Premium

Beyond the big two—bundling and safety gear—several other factors can chip away at the cost of your geico insurance homeowners policy. Many people overlook these, but they add up. It’s a good idea to bring these up with your agent once a year. See if you qualify for these discounts: Claims-Free History: If you’ve gone a few years (typically three to five) without filing a claim, GEICO may reward you with a discount for being a low-risk homeowner. Newer or Renovated Home: A brand-new house or one with a recently replaced roof is less likely to have problems, which often translates to a lower premium. Higher Deductible: Your deductible is what you pay out-of-pocket on a claim before insurance pays the rest. Choosing a higher deductible will immediately lower your premium. Just make sure it’s an amount you could comfortably pay if something happened. GEICO's reputation for cost-effective policies comes from a long history of efficient operations. Founded in 1936 to serve government employees, the company has since grown by focusing on delivering solid value to a wide range of customers. You can find more details about GEICO's history and mission on their corporate site. It's also smart to see how your options stack up against others, like those covered in our guide to a Progressive insurance homeowners policy, to get a full picture of the market.

Navigating the Geico Claims Process Step-by-Step

When a pipe bursts or a storm rips through the neighborhood, the aftermath is pure chaos. A solid Geico insurance homeowners policy is built for these moments, but knowing how to actually start the claims process can make or break your recovery. Having a clear roadmap isn’t just about paperwork; it’s about cutting through the stress and getting your life back on track fast.

The process starts the second disaster strikes, long before you ever pick up the phone. It’s all about securing your home and documenting everything like a pro.

The Critical First Steps After an Incident

Forget about insurance for a minute—your first job is safety. Get your family and pets out of harm’s way. If you’re dealing with fire risk, downed power lines, or a sagging ceiling, evacuate immediately and call emergency services.

Once everyone is safe, your next priority is to stop the damage from getting worse. This is a key part of your responsibility as a policyholder. If a storm shattered a window, get a tarp over it. If a pipe let go, shut off the main water valve. Taking these immediate steps shows the insurance company you’re doing your part to control the loss.

Documenting the Damage The Right Way

This is where you build the foundation for your entire claim. Before you clean up, move anything, or throw a single item away, grab your phone and switch into detective mode. Your photos and notes are the most powerful tools you have.

- Take Photos and Videos: Get every angle you can think of. Start with wide shots that show the big picture, then move in for close-ups of specific items or structural problems.

- Create a Quick Inventory: Start a running list of everything that’s damaged or destroyed. Jot down the item, brand, and a rough idea of its age and value. You can fill in the details later.

- Don’t Throw Anything Away Yet: Unless something is a clear health hazard, hang onto the damaged items. Your adjuster will need to see them to properly assess the loss.

This initial evidence is gold. It creates a timestamped record of the damage right after it happened, which helps eliminate any guesswork down the road.

Initiating Your Claim with Geico

With your first batch of photos and notes ready, it’s time to get the ball rolling with Geico. They make it pretty easy to file, so you can pick what works for you.

You can usually file in one of two ways:

- Online: The Geico website or their mobile app is almost always the fastest way to get your claim into the system.

- By Phone: Call their 24/7 claims hotline to speak directly with a person.

Make sure you have your policy number handy. You’ll need to give them a clear, simple rundown of what happened, including the date and time. Once you report it, you’ll get a claim number—write it down and keep it somewhere safe. You’ll need it for every conversation from here on out.

Key Takeaway: Your first report doesn’t need to be perfect. You can always add more information later as you find more damage. The main goal is to get the process started and have an adjuster assigned to your case.

What to Expect from the Claims Adjuster

After you file, Geico will assign a claims adjuster to your case. This person is now your main point of contact. Their first step will be to schedule a visit to your property to see the damage firsthand.

Try to be there when the adjuster inspects your home. Walk them through the damage and point out things they might otherwise miss. They’ll be taking their own photos and measurements to build an estimate for the repairs. Knowing the general insurance claim timeline can help you understand what’s happening and how long it might take.

After the inspection, the adjuster will put together a detailed repair estimate. This document is the basis for your settlement offer, which will have your deductible subtracted from it. The more detailed and organized your own records are, the smoother and more accurate this whole process will be.

Even with a detailed guide, some practical questions always seem to pop up when you’re staring at your Geico insurance homeowners policy. This section cuts through the jargon to tackle the common concerns we hear from homeowners every day, giving you direct answers to feel confident about your coverage.