A homeowners insurance policy isn't just a stack of papers your mortgage lender makes you buy. It’s a formal contract between you and an insurance company that acts as a financial backstop for your home and personal property when disaster strikes.

Think of it as the ultimate safety net for what is likely your biggest investment. Whether you're dealing with a flat-roof leak in Sherman Oaks after a storm or a burst pipe in a Santa Monica condo, this policy is what pays to repair or rebuild your house and replace your belongings.

If you’ve experienced property damage and need an expert assessment, we can help.

Get a Free Damage Assessment Now

What a Homeowners Insurance Policy Really Is

At its core, a homeowners insurance policy is the financial shield that guards your home. It’s a foundational piece of responsible homeownership, protecting your family’s financial future when the unexpected happens, from a kitchen fire to a major liability claim.

Without one, a single event like a house fire in the Hollywood Hills or a guest getting seriously injured on your property could be financially devastating.

The deal is pretty simple: you make regular payments (called premiums), and in return, the insurance company promises to cover specific types of losses, known in the industry as "perils."

The Core Purpose of Home Insurance

The whole point of homeowners insurance is to get you back to the same financial spot you were in before something went wrong. It's not a home warranty or a maintenance plan for your aging appliances. Its job is to handle the sudden and accidental damage that would be far too expensive for most people to cover on their own.

This protection is broader than many people realize. For instance, if a delivery person slips on your steps and decides to sue, the liability part of your policy kicks in to handle legal fees and medical bills. If a nasty storm rips off part of your roof and your home is unlivable for a week, your policy helps pay for a hotel or a short-term rental.

If you want to see how a major carrier structures these protections, you can learn more about the Progressive insurance homeowners policy and its specific features.

A Roadmap to Financial Security

Getting a handle on what your policy actually says is the first step toward real peace of mind. It creates a critical buffer between your savings account and life’s curveballs.

This guide will be your roadmap. We’ll cut through the jargon and break down each piece of the puzzle so you can feel confident that your most valuable asset is properly protected.

A standard policy isn't just about protecting the structure of your house. It covers your personal belongings, provides liability protection against accidents, and can even cover additional living expenses if you're temporarily displaced. This layered protection is what makes it so essential.

Decoding the Six Core Parts of a Homeowners Insurance Policy

Opening a homeowners insurance policy for the first time can feel like trying to build furniture with instructions written in another language. All you see are terms like "Coverage A" and "Coverage F," leaving you to wonder what any of it actually means when a pipe bursts at 2 AM.

But don't get overwhelmed. Think of your policy not as a single blanket of protection, but as a bundle of six distinct coverages. Each one is designed to protect a different piece of your life and property. Once you understand these individual parts, you’ll know exactly what you're paying for and feel confident in your financial safety net.

Let's break down the six core components you'll find in nearly every standard policy.

To make sense of it all, here’s a quick-reference table that lays out what each coverage part does in a real-world scenario.

The Six Core Coverages in a Standard Homeowners Policy

| Coverage Area | What It Protects | A Real-World Example |

|---|---|---|

| Coverage A: Dwelling | The physical structure of your house and attached structures. | A windstorm rips shingles off your roof, requiring a full replacement. |

| Coverage B: Other Structures | Standalone structures on your property, like sheds or fences. | A tree falls during a storm and crushes your detached garage. |

| Coverage C: Personal Property | Your belongings—furniture, electronics, clothing, etc. | A kitchen fire ruins your appliances, cookware, and dining room set. |

| Coverage D: Loss of Use | Extra living expenses if your home becomes uninhabitable. | A major water leak forces you to stay in a hotel for two weeks during repairs. |

| Coverage E: Personal Liability | Your financial assets if you're sued for injury or property damage. | A delivery person slips on your icy steps, breaks their leg, and sues you. |

| Coverage F: Medical Payments | Small medical bills for guests injured on your property, regardless of fault. | A friend trips over a rug in your home and needs stitches for a minor cut. |

Now that you have the big picture, let's dive into the specifics of what each of these coverages really means for you.

Coverage A: Dwelling

This is the bedrock of your homeowners policy. Dwelling coverage protects the physical structure of your house—the roof, walls, floors, and foundation. It also covers things that are permanently attached, like a deck, an attached garage, or even your built-in dishwasher.

The key here is insuring for the rebuild cost, not the market value. Your dwelling coverage amount needs to be high enough to completely reconstruct your home from the ground up using today's labor and material prices.

Coverage B: Other Structures

This part of your policy steps in for structures on your property that aren't physically attached to your main house. It’s the coverage that repairs or rebuilds things like a detached garage, a backyard shed, a fence, or a guesthouse.

Typically, this coverage is automatically set at 10% of your dwelling coverage. So, if your home is insured for $500,000, your other structures are covered for up to $50,000.

Coverage C: Personal Property

Imagine turning your house upside down and giving it a good shake. Pretty much everything that falls out is considered your personal property. Personal Property coverage is what pays to repair or replace those belongings if they're damaged or stolen in a covered event.

This includes your furniture, electronics, clothes, and kitchenware. Most policies set this between 50% and 70% of your dwelling coverage, but you really need to do a home inventory. You might be surprised how quickly the value of your stuff adds up.

Coverage D: Loss of Use

So, what happens if a fire or major water damage makes your home unlivable while repairs are underway? That’s where Loss of Use coverage, often called Additional Living Expenses (ALE), becomes a lifesaver.

This coverage reimburses you for the extra costs of living somewhere else, like hotel bills, a short-term rental, or even restaurant meals if your kitchen is out of commission. It can also cover things like laundry services or boarding for your pets. It ensures a disaster doesn't torpedo your savings just to cover basic necessities.

Don't underestimate this coverage. After a major event like a fire in a Los Angeles home, finding temporary housing can be extremely expensive. Loss of Use coverage provides a critical financial bridge that allows your family to maintain a sense of normalcy during a stressful time.

Coverage E: Personal Liability

Think of this as your financial shield against lawsuits. Personal Liability coverage protects you and your family if you’re found legally responsible for accidentally injuring someone or damaging their property.

For example, if a guest slips and falls on your walkway, or your kid sends a baseball crashing through a neighbor's expensive picture window, this coverage helps pay for the legal fees, medical bills, and any court-ordered awards, all up to your policy limit. Most experts recommend a minimum of $300,000 to $500,000 in liability protection.

Coverage F: Medical Payments to Others

This is a close cousin to liability, but it works a bit differently. It's designed to cover small medical bills if a guest is injured on your property, no matter who was at fault.

It’s really a "goodwill" coverage. The idea is to quickly handle minor incidents and keep them from blowing up into bigger, more complicated lawsuits. A typical policy includes $1,000 to $5,000 for medical payments, which is usually enough to cover a friend's urgent care visit after they trip over a rug.

Common Exclusions: What Your Homeowners Insurance Policy Does Not Cover

While a good homeowners insurance policy acts as a strong safety net, it's definitely not a catch-all for every possible thing that can go wrong. Honestly, understanding what's excluded from your policy is just as crucial as knowing what's included. The last thing any homeowner wants is to discover a major disaster isn't covered after it’s already happened.

These exclusions aren’t random. They exist because certain risks are just too massive, too predictable, or need a special kind of policy that doesn't fit the standard model. Let's walk through the most common gaps in coverage so you know exactly where you might be exposed.

Widespread Catastrophic Events

Some natural disasters are so huge in scale that the sheer number of claims in one region would be financially impossible for a standard insurance company to handle. Because of this, they are almost always left out of a typical homeowners policy.

Here are the big ones:

- Floods: This is the number one exclusion, hands down. Standard policies will not cover damage from rising water. That includes overflowing rivers, storm surges from a hurricane, or even flash floods from heavy rain. You have to buy flood insurance separately, usually through the National Flood Insurance Program (NFIP) or a private carrier.

- Earthquakes: Damage from any kind of earth movement—tremors, landslides, sinkholes—is also a standard exclusion. If you're in an area prone to seismic activity like Southern California, you'll need a separate earthquake policy to protect your home.

Gradual Damage and Lack of Maintenance

Think of your insurance as protection against sudden, accidental disasters, not as a home warranty or a maintenance fund. Problems that creep up over time due to neglect or simple aging aren't what insurance is for.

This category is where a lot of claims get denied:

- Wear and Tear: An old roof that finally gives out and starts leaking because it’s past its prime isn't covered. The same goes for pipes that corrode over decades or a foundation that develops cracks as the house settles.

- Pest Infestations: Damage from termites, rodents, or other pests is considered a home maintenance issue. It's up to you to keep them out.

- Slow Leaks: A pipe that’s been dripping behind a wall for months, causing wood to rot and decay, is a classic exclusion. The key phrase here is "sudden and accidental."

It's critical to distinguish between gradual and sudden damage. A pipe that suddenly bursts and floods your kitchen is a covered event. A slow, undetected drip from that same pipe over six months is considered a maintenance issue and is not.

Specific Water-Related Exclusions

Water damage can be a tricky area, and not all water issues are treated the same. Beyond the big "no" for flooding, a standard homeowners insurance policy often excludes other specific types of water problems.

For instance, a sewer backup that forces wastewater into your home is not usually covered unless you have a specific add-on (called an endorsement). Likewise, damage from a sump pump that fails during a storm is another common exclusion that requires you to buy extra coverage.

Mold is another minefield. If mold grows as a direct result of a covered event (like that burst pipe we talked about), you might have limited coverage. But mold that develops from a slow leak or just high humidity is almost always on you. Figuring out whether mold remediation is covered by your insurance means you need to read the fine print of your specific policy.

Intentional Acts and Business Use

This one might seem obvious, but your policy is there for accidents, not deliberate actions. Any damage you or someone in your household causes on purpose is excluded. It's also critical to know that your standard policy probably won't cover you if you rent out your property; you have to understand the limitations of standard homeowner's insurance for rental properties in those situations. Similarly, if you run a business out of your home, any liability or property damage related to that business is typically excluded and would require a separate commercial policy.

How to Customize Your Policy with Endorsements

Think of a standard homeowners insurance policy like a suit you buy off the rack. It’s well-made and covers the basics, but it's not a perfect fit for your specific needs. To get that custom fit, you need a good tailor. In the insurance world, that tailor comes in the form of endorsements.

An endorsement, often called a rider, is simply an add-on that modifies your policy. It provides extra coverage for things a standard contract either limits or excludes entirely. These are the tools you use to close those coverage gaps, transforming a generic policy into one that actually protects your unique life.

Without the right endorsements, you could find yourself paying out-of-pocket for some of the most common—and expensive—household disasters.

Filling the Gaps with Common Endorsements

It's a common mistake to assume your policy covers every possible disaster, but standard policies have built-in limitations for a reason. By strategically adding the right endorsements, you can buy some much-needed peace of mind for the specific risks that keep you up at night.

Here are a few of the most valuable endorsements every homeowner should consider:

- Water Backup and Sump Pump Overflow: This is one of the most critical add-ons you can get. A standard policy will not cover damage from a city sewer line backing up into your basement or a sump pump failing during a downpour. This endorsement plugs that massive, costly hole in your coverage.

- Scheduled Personal Property: Your regular policy has strict, often shockingly low, dollar limits for valuables like jewelry, art, or collectibles—usually around $1,500. This endorsement lets you insure specific items for their full appraised value, no questions asked.

- Ordinance or Law Coverage: If your older home is damaged and needs to be rebuilt, today’s building codes might demand expensive upgrades your original home never had. This endorsement provides the extra funds to cover the costs of bringing your home up to modern code.

Real-World Scenarios Where Endorsements Matter

Let’s make this practical. Picture a heavy Los Angeles rainstorm overwhelming the city sewer system. Suddenly, raw sewage backs up through your drains and floods your newly finished basement. Without a water backup endorsement, the entire cleanup and restoration bill—which could easily run into the tens of thousands—is on you.

Understanding the nuances of your policy is key. The right endorsement can mean the difference between a manageable inconvenience and a financial catastrophe. It’s about proactively identifying your risks and ensuring you have a plan.

Or, what if a fire damages half of your 50-year-old home? The city now requires upgraded electrical wiring and new plumbing standards for the rebuild. Your standard dwelling coverage only pays to replace what you had. Ordinance or Law coverage is what steps in to pay for those mandatory—and expensive—upgrades. For a deeper dive into what is and isn't covered by default, our guide on homeowners insurance coverage for water damage provides essential details.

Other Powerful Policy Add-Ons

Beyond the big three, several other endorsements can provide specialized protection based on your lifestyle and property.

- Equipment Breakdown Coverage: Think of this as a home warranty for your major systems. It can help pay for repairs if your HVAC system, water heater, or major appliances have a sudden mechanical or electrical failure.

- Service Line Coverage: This protects you from the surprisingly high cost of repairing or replacing the underground utility lines you're responsible for on your property, like water, sewer, or gas lines.

- Identity Theft Protection: This add-on gives you access to funds and professional assistance to help restore your identity and recover financially from fraud.

At the end of the day, endorsements are all about giving you control. They let you stop being a passive policyholder and start actively building a financial shield that truly protects what you value most.

Navigating Rising Costs and Insurance Availability

If you’ve recently opened your homeowners insurance policy renewal and felt a bit of sticker shock, you’re not alone. Premiums are climbing all over the country. In some high-risk areas, just finding coverage has become a real challenge. This isn't just a random price hike; it's the result of powerful economic and environmental forces all hitting at once.

Getting a handle on what’s driving these changes is the first step toward becoming a more empowered homeowner. The point isn’t to cause alarm, but to give you the real-world context for why protecting your home costs more today and what you can do about it.

The Forces Behind Rising Premiums

There are a few big reasons why insurance costs are being pushed upward, and they’re all connected. These are complex issues that impact the entire industry, from small local carriers to the global giants that back them up. Sooner or later, those costs find their way to us, the policyholders.

Here are the key drivers:

- More Frequent and Severe Natural Disasters: It’s impossible to ignore. From the wildfires ripping through California to hurricanes battering the Gulf Coast, catastrophic weather events are happening more often and causing far more expensive damage. Insurers are paying out record-breaking amounts, forcing them to rethink their risk models and raise rates just to stay in business.

- Skyrocketing Construction and Repair Costs: The price of everything needed to rebuild a home—lumber, shingles, copper wiring, and skilled labor—has shot through the roof. A repair claim that might have cost $30,000 a few years ago could easily top $50,000 today, which directly increases what an insurer has to pay out.

- A Volatile Reinsurance Market: Think of reinsurance as "insurance for insurance companies." When a massive disaster hits, your insurer turns to their reinsurance partners to help cover the colossal losses. These global reinsurers have become much more cautious, charging primary insurers a lot more for that essential financial safety net.

The Impact on Homeowners

This new reality is hitting homeowners in a couple of distinct ways. The most obvious is the direct hit to your wallet from higher premiums. Recent years have seen dramatic hikes, especially in major markets, thanks to this perfect storm of climate risk and repair costs. To give you an idea, in 2024, the average deductible on homeowners insurance policies jumped by 24.5% compared to the year before. You can dive deeper into these home insurance market trends and what's behind them.

But it’s not just about cost. For homeowners in high-risk zones like parts of California and Florida, the market itself is shrinking. Some major carriers have simply stopped writing new policies in these areas. This has pushed many residents toward state-run programs as a last resort. Our guide on the California FAIR Plan for insurance breaks down how this essential program works for those who can't find coverage anywhere else.

The current insurance climate highlights a critical truth: your homeowners policy is more valuable than ever. While the costs are rising, the financial shield it offers against increasingly severe and frequent risks is absolutely essential for protecting your family’s financial future.

How to File a Claim on Your Homeowners Insurance Policy

Your homeowners insurance policy is a promise. But when disaster hits, it's the claims process that turns that promise into real, tangible help. Facing a property emergency is stressful enough without having to figure out a complicated claims system.

Don't worry, we've got you covered. Think of this as your playbook for a successful claim. Following these steps can make a huge difference in how quickly and fairly your settlement is handled.

Step 1: Contact Your Insurer Immediately

After making sure everyone is safe, your very next call should be to your insurance company or agent. It helps to have your policy number handy, but don't sweat it if you can't find it right away.

Give them a clear, factual account of what happened. Stick to what you know for sure and avoid guessing about the cause or the full extent of the damage. That initial call is what gets the ball rolling, officially starting the process and getting a claim number assigned to your case.

Step 2: Document Absolutely Everything

Before you touch, move, or clean a single thing—unless it's to stop the damage from getting worse—grab your phone. Your smartphone is your single most important tool right now.

- Take Photos and Videos: Go overboard here. Get wide shots of every affected room and then zoom in for close-ups of specific damage. Think water lines on the wall, soot stains on the ceiling, or broken personal items.

- Create an Inventory of Damaged Items: Make a list of everything that was damaged or destroyed. For each item, jot down a description, the brand, its approximate age, and what you paid for it if you can remember or find a receipt.

- Keep All Receipts: From this moment on, save every single receipt for any related expense. This includes tarps for the roof, materials for a temporary patch, or even hotel bills if your home is unlivable.

This collection of visual and written proof is the bedrock of a strong claim. It leaves very little room for debate.

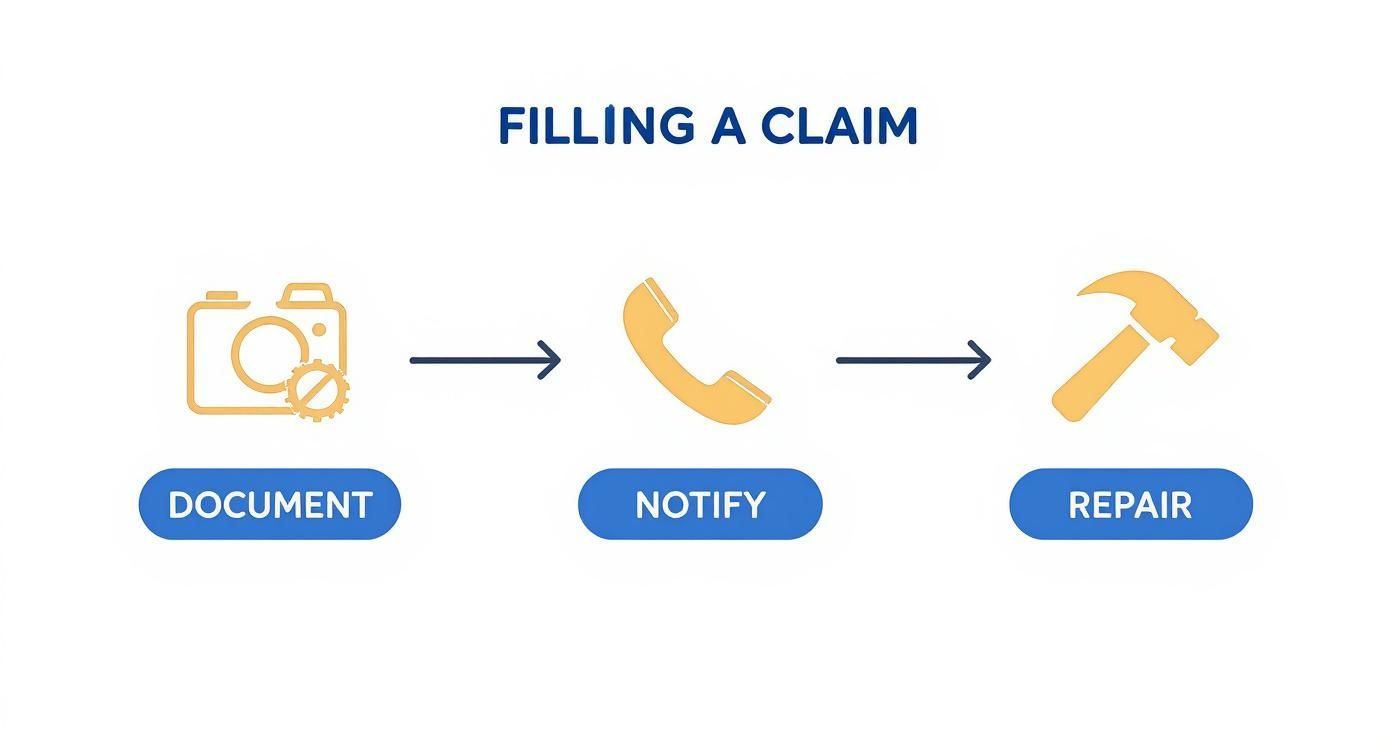

The entire claims process really boils down to a simple, logical flow.

This flowchart nails it. Solid documentation is the fuel that powers a smooth process with your insurer, all the way through to the final repairs.

Step 3: Mitigate Further Damage

Your policy actually requires you to take reasonable steps to prevent the problem from getting worse. This is known in the industry as your "duty to mitigate."

For example, if a storm shatters a window, you need to board it up to keep the rain out. If a pipe bursts under the sink, you have to shut off the main water valve. If you don't, your insurer could argue that the additional damage that happened after the initial event isn't their responsibility.

Step 4: Work with the Adjuster

Next, the insurance company will send an adjuster out to inspect the damage in person. Make sure you're there for this appointment. Walk them through the property, point out the damage, and show them the photos and inventory list you prepared.

Answer their questions honestly and get them any information they request as quickly as you can. Having a good grasp of the typical insurance claim timeline can really help you understand what to expect during this phase.

For specific situations like storm damage, a detailed resource can be a lifesaver. This storm damage roof insurance claim guide is a fantastic example, offering deep insights into a very common type of claim.

Step 5: Review the Settlement and Begin Repairs

After the adjuster finishes their assessment, you'll get a settlement offer. This document will break down what they've deemed to be covered damage and the amount they're willing to pay. Read it carefully.

If the offer seems low or misses something important, don't be afraid to push back. You can provide your own contractor's estimates to support your case. Once you and the insurer agree on a fair settlement, you can hire a trusted contractor to start the permanent repairs. Just be sure to get a written contract, and never sign off that the job is complete until you are 100% satisfied with the work.

FAQs on Understanding Your Homeowners Insurance Policy

A homeowners insurance policy can feel complicated, but it doesn't have to be. Let's break down some of the most common questions we get from property owners just like you.

How much coverage do I really need in my homeowners insurance policy?

Think of it this way: you need enough dwelling coverage to rebuild your house from the ground up if it were completely destroyed. This isn't about market value; it's about today's construction and labor costs. For your personal belongings, a safe bet is to start with 50-70% of your dwelling coverage. But the best approach is to create a home inventory to get a truly accurate number. When it comes to liability—the coverage that protects you if someone gets hurt on your property—most experts recommend a minimum of $300,000 to $500,000.

What is the difference between Replacement Cost and Actual Cash Value?

This is one of the most important details in your policy. Replacement Cost Value (RCV) is straightforward: it pays to replace your damaged items with new, similar ones without deductions for age or wear and tear. Actual Cash Value (ACV), on the other hand, only pays you what your stuff was worth the second before it was damaged, which means it takes a big chunk out for depreciation. ACV leaves you with a financial gap you have to cover yourself, while RCV makes you whole again. Always choose Replacement Cost Value when you can.

Will filing a claim make my insurance premium go up?

It's possible. Whether your rate increases depends on your insurer, your claims history, and the type of claim you file. A major liability claim or significant water damage is far more likely to trigger a rate hike than a small claim for a few missing roof shingles. That's why it's smart to handle smaller, manageable repairs yourself and save your homeowners insurance policy for major disasters you couldn't afford to cover on your own. This keeps your record clean and your premiums more stable.

Are damage from floods or earthquakes covered?

No, a standard homeowners insurance policy explicitly excludes damage from floods and earth movement (including earthquakes, landslides, and sinkholes). You must purchase separate, specialized policies for these risks. In a place like Los Angeles, an earthquake policy is a critical consideration for any homeowner.

What should I do if my insurance company denies my claim?

First, carefully read the denial letter to understand the exact reason they provided. Often, it's a specific exclusion or limitation in your policy. If you believe the denial is unfair, you can gather more documentation (like a third-party contractor's report) and file an appeal with the insurance company. If that fails, you have the option to contact your state's department of insurance or consult with a public adjuster or an attorney.

If you’ve experienced property damage and need someone in your corner, Onsite Pro Restoration is here. We work directly with every major insurance carrier, making sure your restoration is done right and your claim is handled smoothly. Contact us 24/7 for a free assessment.