Let's get straight to the point: your standard homeowners insurance policy almost certainly does not cover damage from a sewer backup. It’s one of the most common—and expensive—surprises homeowners discover, often leaving them on the hook for a messy and costly disaster. Understanding if does homeowners insurance cover sewer backup requires looking beyond your basic policy and exploring a specific, crucial add-on.

This guide will walk you through why this coverage gap exists, how to protect your home with the right endorsement, and what steps to take if you ever face this messy situation.

The Hard Truth About Your Standard Homeowners Policy

Think of your standard homeowners insurance as a great umbrella. It’s perfect for protecting you from predictable things, like a fire or a windstorm. But that umbrella offers zero protection when a city water main in a neighborhood like Sherman Oaks breaks and forces contaminated water up through your drains and into your home.

This gap exists because insurers see sewer backups as a totally separate risk. Unlike a pipe that suddenly bursts inside your home, a sewer backup usually starts outside your property line. It could be a blockage in the municipal sewer system or just aging city infrastructure. Either way, these are external problems your standard policy was never designed to handle.

Why This Exclusion Matters So Much

Without specific sewer backup coverage, you are stuck with the entire bill for cleanup, repairs, and replacing damaged property. The financial hit can be devastating.

This isn't a small inconvenience; it's a major financial threat. Standard homeowners policies across the board exclude this type of water damage unless you’ve added a special rider. The stakes are incredibly high. Just one inch of water from a sewer backup can cause up to $25,000 in damage.

To see how this works in practice, let's compare what's typically covered in a standard policy versus what a sewer backup endorsement adds.

Standard Policy vs Endorsement Coverage at a Glance

| Damage Source | Covered by Standard Policy? | Covered by Sewer Backup Endorsement? |

|---|---|---|

| Pipe bursts inside your walls | Yes (Sudden & accidental) | Yes |

| Washing machine hose fails | Yes (Sudden & accidental) | Yes |

| Water backs up from a city sewer line | No (External source) | Yes |

| Sump pump fails during a storm | No (Considered a backup) | Yes (If sump pump failure is included) |

| Toilet overflows and backs up | No (Direct backup from drain) | Yes |

This quick comparison highlights the crucial difference: a standard policy covers water escaping from your plumbing, while an endorsement covers water coming into your home through it.

Understanding the Fine Print

This distinction between different types of water damage is everything. Your policy might pay out if a pipe inside your wall lets go, but it draws a firm line when water pushes its way up from an outside sewer or drain.

The core issue here is the source of the water. If water suddenly escapes from a system inside your home—like your plumbing or an appliance—it's often covered. If it flows into your home from an external sewer or drain, it's almost always excluded.

This is exactly why you have to read your policy. Don’t just skim it; understand where your protection ends. For a closer look at what is and isn't covered, our guide on homeowners insurance coverage for water damage is a great resource.

Knowing the details empowers you to find the gaps in your coverage before a disaster strikes. Ignoring this detail is a gamble that could cost you thousands.

How a Water Backup Endorsement Can Save You

So if your standard policy leaves this massive coverage gap, how do you actually protect your home and your savings from a nasty sewer backup? The answer is a specific add-on called a water backup and sump pump overflow endorsement. Think of it as a specialized tool you add to your insurance toolkit, designed for one critical, messy job.

This endorsement, often just called a rider, is your financial first line of defense. When a city sewer main gets clogged and forces contaminated water up through your drains, this is the coverage that kicks in. It’s built to pay for the aftermath—the incredibly expensive process of cleaning up, drying everything out, and repairing or replacing what was ruined.

Without it, you’re looking at the full restoration bill, which can easily rocket into the tens of thousands of dollars. With it, you have a safety net that can mean the difference between a manageable crisis and a full-blown financial catastrophe.

What This Endorsement Typically Covers

A water backup endorsement is refreshingly straightforward. Its main job is to cover the direct physical loss caused by water backing up through sewers or drains, or overflowing from a sump pump.

This means it helps pay for:

- Water Damage Restoration: The cost of hiring pros to extract the water, dry the structure, and properly sanitize affected areas.

- Damaged Personal Property: Helps you replace ruined furniture, electronics, clothing, and anything else you had stored in the flooded area.

- Structural Repairs: Pays for fixing or replacing damaged drywall, flooring, carpeting, and baseboards.

- Mold Remediation: If mold grows as a direct result of the covered backup, the cost to remove it is often included.

In short, it’s designed to get your home back to the condition it was in right before the backup happened. But it’s just as important to know what this rider doesn't cover.

Understanding the Limits and Exclusions

While this endorsement is a lifesaver, it isn't a blank check. It has specific limits and exclusions that you need to understand to have realistic expectations. Knowing these boundaries is a crucial part of reviewing your homeowners insurance policy before disaster strikes.

The most important thing to know is that this rider covers the damage, not the cause.

An endorsement will pay to clean up the mess in your basement, but it won't pay to repair the broken city sewer line that caused it. It will cover damage from a failed sump pump, but it won't pay to replace the pump itself.

This distinction is critical. On top of that, these endorsements have their own coverage limits, completely separate from your main dwelling coverage. These limits often start at $5,000 or $10,000 and can be increased for a higher premium. It's vital to pick a limit that truly reflects the value of your finished basement or the property you keep down there.

By understanding both the powerful protections and the clear limitations of a water backup endorsement, you can make an informed decision and ensure your home is truly protected.

The Financial Case for Sewer Backup Coverage

When you're looking at your insurance policy, it’s tempting to skip the add-ons to save a few bucks. But is sewer backup coverage really worth the extra cost? The answer becomes crystal clear when you stack up the small annual premium against the crushing out-of-pocket costs of an uninsured disaster.

Think of this coverage as a financial shield. It's a small, fixed cost you pay each year to protect yourself from a massive, unpredictable catastrophe. A single sewer backup can easily send cleanup and repair bills into the tens of thousands. We’re not just talking about cosmetic fixes; this is structural damage often involving hazardous waste that requires specialized, professional help.

The numbers don't lie. While the bill for a single incident often blows past $15,000, some studies show that even one inch of standing water can cause $25,000 in damage to your home and belongings. Meanwhile, a solid sewer backup endorsement might only cost you $150 to $300 per year. It’s an incredibly high-value investment in your financial security.

A Simple Cost-Benefit Analysis

Let's walk through a real-world scenario. Imagine your finished basement—a common feature in millions of homes—is flooded after a city sewer line gets blocked.

- Without Coverage: You're on the hook for the entire bill. That means paying for emergency water extraction, tearing out contaminated carpet and drywall, structural drying, sanitation, and replacing everything from the sofa to the flat-screen TV. The total could easily hit $20,000 to $30,000.

- With Coverage: You pay your annual premium (let's say $250) and your deductible (a common one is $1,000). For a $25,000 disaster, your total out-of-pocket cost is just $1,250. Your insurance covers the remaining $24,000.

This simple math changes the game. The endorsement stops being an "expense" and becomes essential financial armor. You’re spending a few hundred dollars a year to avoid a potential five-figure financial disaster. Understanding the full water damage cleanup cost makes this decision even clearer.

The financial trade-off is stark when you see the numbers side-by-side.

| Cost of Coverage vs Cost of Uninsured Damage | ||

|---|---|---|

| Expense Item | Typical Cost With Endorsement | Typical Cost Without Endorsement |

| Annual Premium | $150 – $300 | $0 |

| Deductible (per incident) | $500 – $2,500 | $0 |

| Cleanup & Restoration | $0 (Covered by policy) | $15,000 – $40,000+ |

| Personal Property Replacement | $0 (Covered by policy) | $5,000 – $20,000+ |

| Total Out-of-Pocket for a $25k Loss | $1,150 – $2,800 | $25,000 |

As you can see, the endorsement transforms a potentially ruinous event into a manageable, predictable expense.

Choosing the Right Coverage Limit

Once you've decided to get the coverage, the next critical step is selecting the right limit. Insurers typically offer protection in tiers, starting as low as $5,000 and going up to $50,000 or more. Just picking the cheapest option to save a few dollars is a classic mistake that can leave you dangerously underinsured.

To make an informed choice, you need to be realistic about what’s at risk in your home.

The key is to calculate the potential replacement cost of everything in your lowest level. Don't just guess—take a detailed inventory of your basement or ground floor.

Here’s what to consider when setting your limit:

- Finished vs. Unfinished Spaces: A finished basement with drywall, custom flooring, a bathroom, and furniture needs a much higher limit than an unfinished concrete room used for storage.

- High-Value Items: Do you keep a home theater system, expensive gym equipment, a wine collection, or family heirlooms downstairs? Add up their replacement costs.

- Structural Components: Factor in the cost to replace flooring (carpet, tile, vinyl), drywall, baseboards, insulation, and any built-in shelves or cabinets.

- Cleanup Costs: Don't forget that professional restoration services are expensive. Because of the biohazard risk, the cleanup alone can cost thousands, so a higher limit ensures these critical services are fully covered.

Choosing a $10,000 limit for a basement that would actually cost $40,000 to restore still leaves you with a massive $30,000 bill. Taking the time to do a thorough assessment ensures your financial armor is strong enough to handle a worst-case scenario.

Your Step-by-Step Action Plan After a Backup

When water and sewage start creeping into your home, the immediate instinct is to panic. Don't. A clear, methodical action plan is your best defense—both for minimizing damage and for protecting your insurance claim.

Acting quickly and correctly in the first few hours can make a world of difference. This is your emergency checklist. Follow these steps to take control, ensure your family’s safety, and set the stage for a smooth recovery. The first moves you make are often the most critical.

Step 1: Prioritize Safety Immediately

Before you worry about a single wet carpet or piece of furniture, your absolute first priority is the well-being of everyone in the house. Sewer water is a biohazard, plain and simple. It's teeming with dangerous bacteria, viruses, and other contaminants you don't want anywhere near your family.

- Evacuate the Area: Get all family members and pets out of the affected rooms immediately. If you can, shut the door to contain the contamination.

- Turn Off Utilities: If there's standing water, head to your breaker box and shut off electricity to the area to prevent a serious electrocution risk. If you smell gas, leave the house right away and call your utility company from a safe distance.

- Stop All Water Usage: Do not flush any toilets or run any sinks or showers in the house. Running more water will only add fuel to the fire, making the backup worse.

Step 2: Document Everything Extensively

Before a single item is moved or any cleanup begins, you need to become a meticulous record-keeper. The success of your insurance claim hinges on the quality of the evidence you provide. Insufficient documentation is one of the fastest ways to get a claim disputed or denied.

Your goal here is to capture the scene exactly as you found it. Grab your smartphone and take extensive photos and videos of absolutely everything.

Crucial Tip: Do not clean up anything before you have thoroughly documented the damage. Your insurer needs to see the full extent of the loss as it happened. Cleaning too early can unfortunately be interpreted as you trying to hide the true severity of the situation.

This visual evidence is non-negotiable. It proves the source of the backup, shows how high the water reached, and catalogues every single item that was damaged. When you're in the middle of a sudden crisis, having a clear plan is vital. You can find a comprehensive step-by-step guide for plumbing emergencies that outlines similar crucial actions to take.

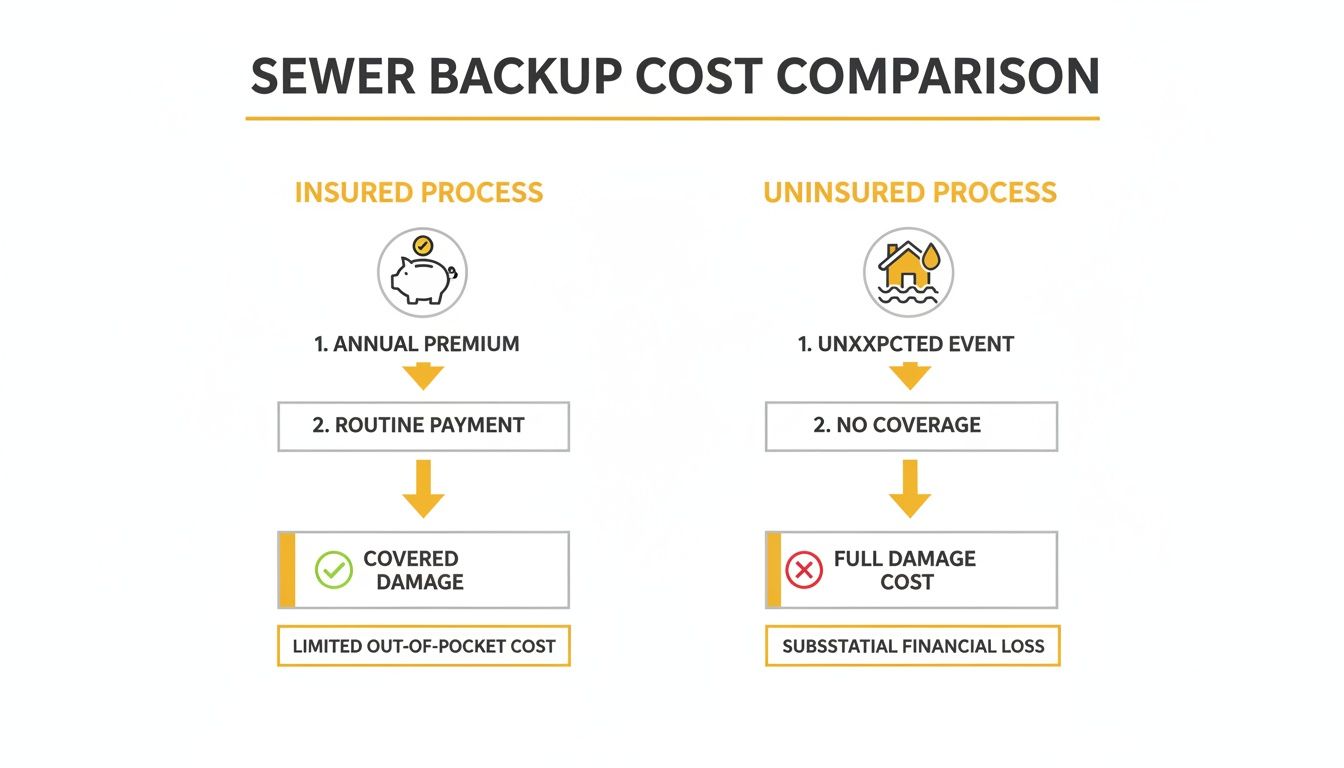

This next infographic really drives home the financial difference between paying a small annual premium for coverage and facing the full, uninsured cost of a disaster.

It’s easy to see how a small, manageable annual cost for an endorsement can prevent a catastrophic, five-figure out-of-pocket expense.

Step 3: Notify Your Insurer and a Professional

With safety secured and evidence collected, it's time to make two critical calls. First, contact your insurance company to report the incident and get your claim started. Have your policy number ready and be prepared to give a detailed description of what happened.

They will assign you a claim number and an adjuster who will guide you through the next steps. Make sure to ask them specifically about your water backup coverage and what your policy limits are.

Second, you need to call a certified restoration company. Raw sewage is a serious biohazard that requires specialized equipment and strict safety protocols to handle correctly. This is not a DIY job. For homeowners facing this crisis, understanding the nuances of professional sewage damage cleanup is the next step in restoring your home safely. They can begin the mitigation process immediately, which helps prevent secondary damage like mold growth.

Common Causes and Proactive Prevention Strategies

The best way to handle a sewer backup is to make sure it never happens in the first place. Shifting from a frantic, reactive mindset to a calm, proactive one is the single best thing you can do for your home and your sanity. Once you understand what actually causes these messy disasters, you can take simple but powerful steps to keep them at bay.

Most sewer backups aren't freak accidents. They’re the predictable result of ongoing issues. By getting ahead of these root causes, you can stop a catastrophe before it even has a chance to start.

Addressing Blockages and Clogs

By far, the most common culprit behind a sewer backup is a simple clog. It could be inside your home’s pipes or in the main sewer line connecting you to the street. These blockages don't just appear overnight; they're the result of bad habits that build up over time.

Think of your drain pipes like arteries. Every time you pour grease, oil, or fat down the sink, it’s like a dose of bad cholesterol. The grease cools, hardens, and sticks to the inside of the pipes. Over time, it grabs onto other debris, slowly choking off the flow until you have a major blockage on your hands.

Keep your pipes flowing freely with a few basic rules:

- Never Pour Grease Down the Drain: Let grease and cooking oil cool in a disposable container, then toss it straight into the trash.

- Only Flush Human Waste and Toilet Paper: So-called "flushable" wipes are a plumber's nightmare. The same goes for paper towels, feminine hygiene products, and cotton swabs—they don’t break down and are a primary cause of clogs.

- Use Drain Strainers: Put simple mesh strainers in your kitchen sink and shower drains. They're cheap, easy, and effective at catching the food scraps and hair that would otherwise go down the drain.

Managing Invasive Tree Roots

Believe it or not, that beautiful, mature tree in your front yard could be your plumbing’s worst enemy. Tree roots are naturally wired to seek out moisture and nutrients, and your sewer line is a prime target. They can work their way into tiny, hairline cracks in older pipes, then expand until they crush or completely block the line.

This is a silent threat that usually gives no warning signs until it's far too late. The blockage forces raw sewage back into your home, resulting in contaminated and destructive flooding. It’s a frequent cause of claims related to basement water damage, which is often the first place a backup shows up.

You can get ahead of this risk by:

- Knowing Where Your Sewer Line Is: Before you plant anything new, find out where your sewer lateral is buried. Avoid planting directly on top of it.

- Choosing "Sewer-Safe" Trees: If you have to plant near the line, pick trees known for having less aggressive, non-invasive root systems.

- Scheduling Regular Inspections: Have large, older trees on your property? It's smart to have a plumber run a video camera inspection of your sewer line every few years to check for root intrusion before it becomes a crisis.

Investing in a Backwater Prevention Valve

For anyone living in a neighborhood with an aging municipal sewer system or in a low-lying area, a backwater prevention valve is one of the smartest investments you can make. This device gets installed right on your sewer line and acts like a one-way gate.

It lets wastewater flow out of your home as it should, but if the city's main line starts to back up toward your house, the valve automatically slams shut. It's a simple piece of plumbing that offers powerful protection from external problems you have zero control over. While it's a proactive step, it directly answers the question so many homeowners end up asking: "does homeowners insurance cover sewer backup?" by preventing the need to ask it in the first place.

FAQs: Does Homeowners Insurance Cover Sewer Backup?

Even with a solid grasp of endorsements and prevention, you probably still have some nagging questions about how this all works in the real world. Let's tackle the most common ones we hear from homeowners to clear things up.

Q: What Is the Difference Between a Sewer Backup and a Flood?

A: This is one of the most important distinctions in insurance. A sewer backup is when water comes up and into your home through your own pipes—think toilets, floor drains, or shower drains. A flood, on the other hand, is when surface water from outside invades your property (e.g., from heavy rain or an overflowing river). Flood damage is never covered by a standard homeowners policy or a sewer backup rider; it requires a separate policy from the National Flood Insurance Program (NFIP).

Q: Will My Endorsement Cover a Failed Sump Pump?

A: In most cases, yes. A good water backup endorsement is written to cover "sump pump overflow." So, if your pump dies during a heavy storm and the pit overflows into your basement, the endorsement should cover the resulting water damage. However, the policy pays to repair the damage caused by the water, not to replace the pump that failed.

Q: How Much Sewer Backup Coverage Do I Actually Need?

A: There isn’t a one-size-fits-all answer, but the default $5,000 or $10,000 limit is often dangerously low for a finished basement. To get a realistic figure, inventory the replacement cost of your basement's structure (drywall, flooring), your belongings (furniture, electronics), major appliances, and the potential cost of professional cleanup services. A realistic limit for a finished space often falls in the $30,000 to $50,000 range.

Q: Does the Endorsement Cover Mold Damage After a Backup?

A: Generally, yes—as long as the mold is a direct consequence of the covered sewer backup. Most policies will pay for mold remediation if it stems from a covered event. However, be aware that mold coverage is often capped at a specific sub-limit (e.g., $5,000), which can be much lower than your total water backup limit. Check your policy for the specific amount.

Q: Can My Insurance Company Cancel My Policy After a Claim?

A: Filing a single sewer backup claim is very unlikely to get you canceled, especially if you have a good claims history. The risk of non-renewal increases with multiple water claims in a short period, as it may signal unresolved maintenance issues to the insurer. The best defense is to be proactive about maintaining your plumbing.

Q: Is Sewer Backup Coverage Expensive?

A: Not at all, especially when you weigh the small annual cost against the financial catastrophe it prevents. A basic $10,000 limit might only add $50 to $100 per year to your premium. Even increasing that coverage to a more realistic $25,000 or $50,000 is still incredibly affordable, typically costing an extra $150 to $300 annually.

If you're facing the aftermath of a sewer backup in the Los Angeles area, you need professional help—fast. Onsite Pro Restoration offers 24/7 emergency services for sewage cleanup and water damage restoration. Our IICRC-certified team has the expertise and equipment to safely restore your property and will work directly with your insurance company to make the claims process as smooth as possible. Don't wait—contact us now for a free assessment at https://onsitepro.org.