When a pipe bursts and floods your Los Angeles home, the first thought that races through your mind is always the same: am I covered?

The short answer is usually yes. Homeowners insurance is designed to cover water damage from a pipe that bursts suddenly and accidentally. But there's a critical distinction to understand right away. Your policy will almost always pay for the resulting damage—think ruined hardwood floors in your Sherman Oaks condo, soaked drywall in a Santa Monica bungalow, and soggy carpets—but not the cost to repair the broken pipe that caused the mess in the first place.

Navigating the aftermath of a burst pipe can be overwhelming. If you're facing water damage in the Los Angeles area, don't wait. Call Onsite Pro Restoration now at (818) 336-1800 for a rapid response and expert help with your insurance claim.

Understanding When Burst Pipe Damage Is Covered by Insurance

The entire answer to "does homeowners insurance cover burst pipes?" really boils down to two little words: "sudden and accidental." Think of it as the difference between an unexpected disaster and a problem that you allowed to fester over time. Your policy is there to protect you from unforeseen calamities, not from issues that pop up due to a lack of basic upkeep.

This distinction is the heart of how insurance adjusters look at these claims. For example, a pipe that freezes solid and cracks during a rare Southern California cold snap is a perfect example of a sudden event. On the other hand, water damage from a slow, dripping leak under your kitchen sink that’s been ignored for months will almost certainly be denied.

The Role of Proactive Maintenance

Insurance companies operate on the assumption that you're doing your part to maintain your property. This is where many claims run into trouble. If an adjuster finds that a pipe burst due to clear negligence—like ignoring a known plumbing issue in your Van Nuys home—your claim could be dead on arrival.

Insurers expect homeowners to take reasonable preventive steps. The National Association of Insurance Commissioners (NAIC) confirms that while sudden bursts are typically covered, claims can be denied if the pipe failed because of neglect. That "sudden and accidental" clause is the gatekeeper for your claim's approval. You can learn more about these policy conditions and find some great prevention tips over at the NAIC's consumer resources page.

To give you a clearer picture, here's a quick breakdown of what your policy likely does and doesn't cover.

Burst Pipe Insurance Coverage At a Glance

| Scenario | Typically Covered? | Reasoning |

|---|---|---|

| Pipe freezes and cracks during a sudden storm | Yes | This is a classic "sudden and accidental" event outside of your immediate control. |

| Washing machine supply hose ruptures | Yes | The failure was abrupt and unexpected, causing immediate damage. |

| Slow drip from a corroded pipe under a sink | No | This is considered a maintenance issue that developed over time. |

| Pipe bursts because you turned the heat off in winter | No | This is often viewed as negligence, not an accident. |

| The cost to repair the broken pipe itself | No | Policies cover the resulting damage, not the source of the failure. |

| Water damage to floors, walls, and furniture | Yes | This is the "ensuing loss" that the policy is designed to protect against. |

This table shows why the cause of the water damage is so much more important than the damage itself when it comes to your insurance claim.

Key Takeaway: Your insurance policy is your financial safety net for true accidents, not a warranty for your home's plumbing. Keeping records of plumbing inspections and any repairs you've made can be a huge help if you ever need to file a claim.

The Real Financial Impact of a Burst Pipe

A burst pipe is far more than a simple puddle on the floor; it's a financial time bomb. The moment that pipe gives way, the clock starts ticking. Within minutes, water soaks into drywall, seeps under floorboards, and saturates carpets, kicking off a chain reaction that can easily cost thousands of dollars to fix.

To get why your homeowners insurance is so vital, you have to look at the real numbers. The cost isn't just about patching up one broken pipe. It’s about a multi-stage restoration project that can spiral into a five-figure bill before you know it.

Breaking Down the Costs of Water Damage

The immediate aftermath of a burst pipe involves several expensive and non-negotiable steps. Each one requires specialized gear and certified pros to head off long-term structural problems and serious health hazards.

- Emergency Water Extraction: The first job is getting all that standing water out, fast. Professionals use powerful, truck-mounted vacuums to extract gallons of water quickly. This service alone can run from hundreds to thousands of dollars, depending on how much water there is.

- Structural Drying and Dehumidification: Once the visible water is gone, the real work begins on the hidden moisture. This means setting up industrial-grade air movers and dehumidifiers for days to pull moisture from wood, concrete, and drywall before it can warp and rot.

- Demolition and Debris Removal: Anything that can't be saved—like soaked drywall, ruined insulation, or buckled flooring—has to be torn out and hauled away properly.

- Mold Remediation: Mold can start growing in just 24 to 48 hours. If it takes hold, you’re looking at professional mold remediation, which is a whole separate, and often expensive, process involving containment, air scrubbing, and sanitization.

These emergency services alone can hit thousands of dollars. And that’s before you even start rebuilding—replacing floors, hanging new drywall, painting, and restoring everything else that was damaged. To see the full scope of these expenses, you can check out our detailed guide on water damage cleanup costs.

The Staggering Statistics Behind Water Damage Claims

Water damage from things like burst or frozen pipes isn't just a headache; it's one of the most common and costly problems homeowners face.

Between 2019 and 2023, these incidents accounted for about 22.6% of all home insurance claims, right behind wind and hail. The average insurance payout for a single water damage claim often tops $15,000. Even a seemingly minor leak can be devastating—just one inch of flooding can lead to damages costing up to $25,000.

These numbers aren't meant to scare you, but to show the massive financial risk involved. They make it crystal clear why having a solid insurance policy is so important. You can find more detailed water damage statistics on This Old House.

The Bottom Line: A single burst pipe isn't a DIY cleanup job. It's a complex restoration project with a price tag that can easily wipe out a homeowner's savings, making your insurance policy the most important financial shield you have.

Decoding Your Homeowners Insurance Policy

Trying to read your homeowners insurance policy when there's a foot of water in your living room is a nightmare. To figure out if a burst pipe is covered, you first have to understand how your policy is put together. It isn’t just one big safety net; it’s more like a package of different coverages, each with a specific job.

Think of your policy as a toolkit. You wouldn't use a hammer to fix a leaky faucet. For water damage, three specific "tools" are most important: Dwelling Coverage, Personal Property Coverage, and Additional Living Expenses. Let’s break down what each one does.

Dwelling Coverage for Structural Damage

This is the big one. Your policy's Dwelling Coverage, sometimes called Coverage A, is there to protect the physical structure of your house itself. We're talking about the walls, floors, ceilings, and anything built-in, like kitchen cabinets or bathroom vanities.

When a pipe lets go, this is the part of your policy that pays to rip out soggy drywall, replace buckled hardwood floors, and patch up the ceiling that just caved into the room below. It's the coverage that literally rebuilds the "dwelling" after water wreaks havoc.

Personal Property Coverage for Your Belongings

Next up is Personal Property Coverage, or Coverage C. This protects all the stuff you own inside your home—the things that aren’t physically attached to the structure. This means your furniture, electronics, clothes, area rugs, and all your other movable possessions.

So, if that burst pipe soaks your brand-new sofa, fries your TV, or ruins a collection of books, this is the coverage that helps you get them repaired or replaced. Most standard policies cover these items at their actual cash value (ACV), which is a fancy way of saying it accounts for depreciation. For a little extra premium, you can often upgrade to replacement cost value (RCV) coverage, which is a much better deal.

To see how these two coverages work together, let's look at a common scenario.

Dwelling vs. Personal Property Coverage for Water Damage

The table below breaks down which coverage applies to different items damaged by a burst pipe.

| Item Damaged | Coverage Type | Example of What's Covered |

|---|---|---|

| Drywall and Insulation | Dwelling Coverage | Cost to tear out wet materials and install new ones. |

| Hardwood Flooring | Dwelling Coverage | Repairing or replacing warped or buckled floors. |

| Kitchen Cabinets | Dwelling Coverage | Replacing water-damaged, built-in cabinets. |

| Sofa and Chairs | Personal Property | Repairing or replacing ruined furniture. |

| Television & Electronics | Personal Property | Replacing electronics short-circuited by water. |

| Area Rugs | Personal Property | Cleaning or replacing saturated, non-attached rugs. |

Understanding this distinction is key to knowing what to expect when you file a claim.

Key Distinction: Your policy pays for the damage caused by the water, not for the broken pipe that caused the problem. Think of it like a faulty sprinkler at the grocery store that soaks all the produce. The store’s insurance would pay for the ruined vegetables (the resulting damage), but not for the plumber who fixes the broken sprinkler head (the initial failure). Your home's plumbing works the exact same way.

Additional Living Expenses When You Can't Stay Home

Finally, we have Additional Living Expenses (ALE), also called Loss of Use coverage. This is a benefit that many homeowners don't even know they have until they're in a real jam.

If the water damage is so bad that your home is unlivable while repairs are underway—say, the entire first floor is being dried out with industrial fans or there's a serious mold risk—ALE kicks in. It helps cover the extra costs you rack up from being displaced, like:

- Hotel bills or a short-term rental

- Restaurant meals if your kitchen is out of commission

- Laundry services if your washer and dryer are inaccessible

This coverage is a lifesaver, ensuring a disaster doesn't completely drain your finances while you're waiting for your home to be put back together. For a deeper dive into policy specifics, you can learn more about homeowners insurance coverage for water damage in our detailed guide.

Don't let water damage disrupt your life. Get a free, no-obligation assessment from our Los Angeles-based team by calling (818) 336-1800 today.

Why Your Burst Pipe Claim Might Be Denied

Getting a claim denial can feel like a punch to the gut, especially when you’re already staring at a water-logged home. The best way to sidestep that outcome is to understand why insurers say "no." When you ask, does homeowners insurance cover burst pipes, the answer almost always comes down to the cause of the pipe failure, not just the water that came pouring out.

Insurers draw a thick, black line between a “sudden and accidental” event and a problem that’s been brewing for a while. If your claim gets denied, it’s likely going to fall into one of these three buckets.

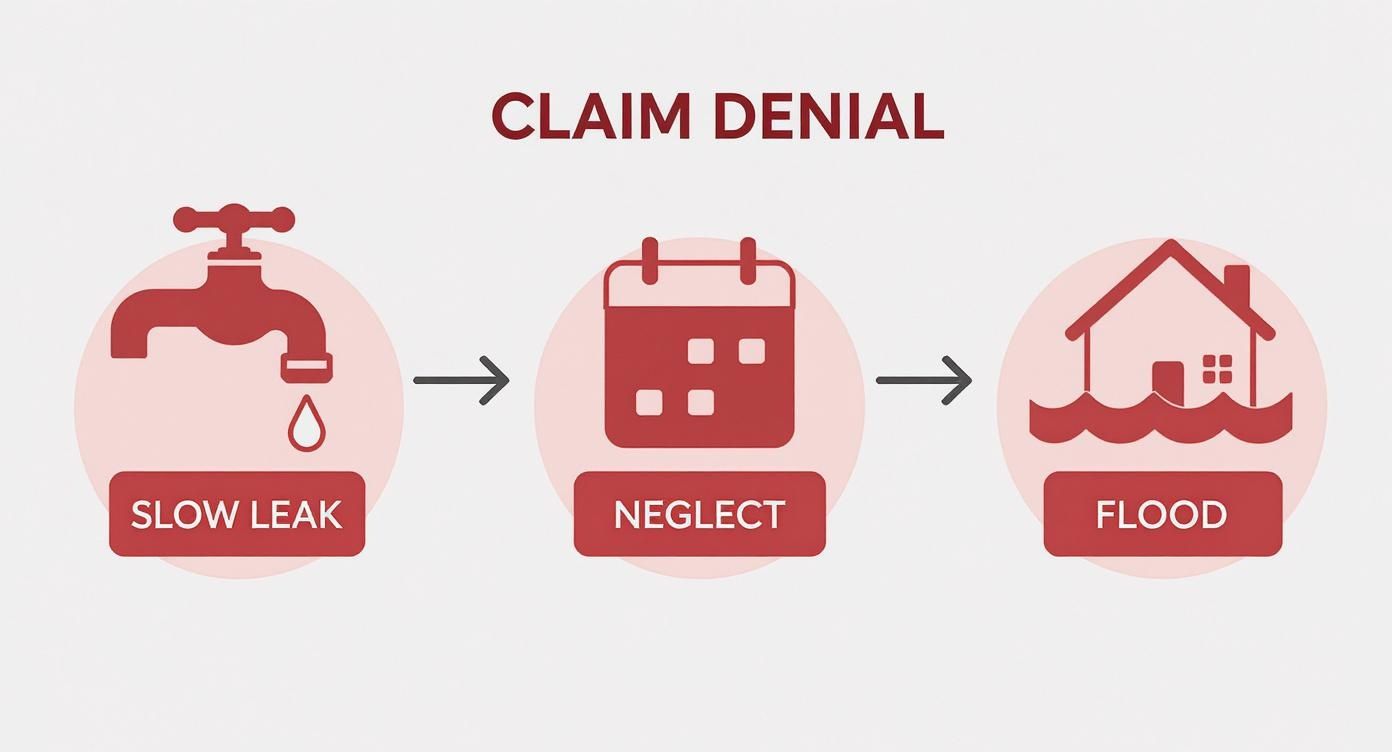

Gradual Damage from Slow Leaks

This is the number one reason for a denied claim. Think about that slow, nagging drip from a rusty pipe under your sink. That’s not an accident; it’s a maintenance issue that was left to fester.

Your insurance policy is there to rescue you from unforeseen disasters, not problems that could have been fixed with a wrench weeks or months ago. If the adjuster finds old water stains, wood rot, or mold growing around the pipe, they'll almost certainly flag it as a maintenance failure. And that means the claim is denied.

Neglect and Poor Maintenance

Negligence is another massive red flag for insurance companies. Your policy is a two-way street—it assumes you’re taking reasonable steps to keep your home in good shape. Failing to do that can completely void your coverage for a related disaster.

A few classic examples of neglect include:

- Failing to winterize: Not insulating pipes in an unheated garage or crawl space before a deep freeze hits.

- Ignoring warning signs: Not calling a plumber about a toilet that constantly runs or a sudden drop in water pressure.

- Improper vacancy: Shutting off the heat before leaving for a two-week winter vacation, which is just asking for frozen, burst pipes.

An insurer will look at these situations and see you as having created the conditions for the disaster, rather than it being a true accident. Your best defense is keeping good records of plumbing inspections and repairs. If you have questions about what counts as neglect, it's a good idea to check out our guide on common insurance coverage questions about water damage.

Damage from External Flooding

This is a critical distinction that trips up a lot of homeowners. Your standard homeowners policy does not cover damage from flooding. We’re talking about water that gets into your home from an outside source, like:

- An overflowing river or creek

- Heavy rains that saturate the ground and seep through your foundation

- Storm surge from a coastal storm

Protecting your home from these events requires a separate flood insurance policy, usually from the National Flood Insurance Program (NFIP) or a private carrier. The numbers show just how important this is. Nearly 28% of all home insurance claims are for water damage and freezing, with the average claim hitting over $13,900.

But with U.S. flooding costs soaring as high as $496 billion a year, the risk is massive. Still, a staggering 43% of homeowners mistakenly believe their standard policy has them covered for flood damage.

A Step-by-Step Guide to Filing Your Insurance Claim

When a pipe bursts, the clock starts ticking—loudly. What you do in those first chaotic hours is absolutely critical, not just for your safety but for the success of your insurance claim. Having a clear plan to follow when you're stressed and staring at a growing puddle makes all the difference.

Taking the right steps immediately can drastically reduce the damage and smooth out the claims process. Following these essential tips for immediate action when a pipe bursts will give you a major head start.

Step 1: Immediately Stop the Water

Forget everything else for a moment. Your first and only priority is to stop more water from gushing into your home. Find your home's main water shut-off valve and turn it off right away. If you’re not sure where it is, common spots are the basement, a crawl space, or near your water heater.

Once the water is off, head to your breaker box. If it's safe to do so, kill the electricity to the wet areas to eliminate the risk of an electrical hazard.

Step 2: Document Everything Before You Clean

Before you even think about moving a single soggy box, grab your phone. This is probably the most important step for getting your claim approved.

- Take Photos and Videos: Go overboard here. Capture extensive video and photos of the standing water, the source of the leak if you can see it, and every single damaged item. Get close-ups and wide shots.

- Create an Inventory: Start a detailed list of everything that's been damaged—furniture, electronics, rugs, books, you name it. If you can, jot down the brand, model number, and a rough idea of its age.

This visual evidence is your proof of "sudden and accidental" damage. Without it, your claim is just your word against a potentially skeptical adjuster.

Step 3: Contact Your Insurance Company Promptly

As soon as the immediate crisis is under control, call your insurance agent or the company's 24/7 claims hotline. The faster you report the incident, the quicker they can get the ball rolling. Have your policy number handy and give them a clear, simple rundown of what happened.

They’ll assign a claims adjuster to your case, who will become your main point of contact. It helps to understand the typical insurance claim timeline so you know what to expect in the coming days and weeks.

This infographic breaks down the most common reasons a burst pipe claim gets denied. Notice a pattern? They all relate to gradual damage, not sudden accidents.

As you can see, insurers draw a very sharp line between a pipe that suddenly fails and one that's been slowly dripping for months due to neglect.

Step 4: Mitigate Further Damage

Your insurance policy includes a "duty to mitigate," which is a formal way of saying you have to take reasonable steps to prevent the damage from getting any worse.

Important: Do not throw away any damaged items, no matter how ruined they look. The adjuster has to see them to properly assess your loss. It's better to pile them on a tarp in the garage than to toss them in a dumpster.

Mitigation could mean moving undamaged belongings to a dry room, mopping up puddles, or even calling a 24/7 restoration company to start the drying process. Remember to keep every receipt for any supplies you buy—they might be reimbursable.

How to Prevent Burst Pipes in Your Home

Let’s be honest: the absolute best way to deal with a water damage claim is to never file one in the first place. While it’s smart to understand if homeowners insurance covers burst pipes, being proactive is the ultimate strategy for protecting your home and your sanity.

A few simple steps can save you from a catastrophic mess and the headache of a major restoration. Think of your plumbing like your home’s circulatory system—it needs a little care to keep everything flowing smoothly, especially when the weather turns nasty.

A Practical Checklist for Winterizing Your Plumbing

When the temperature plummets, your pipes are at their most vulnerable. The biggest risks are in unheated areas like basements, crawl spaces, attics, and garages.

Here’s a simple checklist to protect your plumbing from the cold:

- Insulate Exposed Pipes: Wrap any pipes in unconditioned spaces with foam pipe sleeves or heat tape. This is a cheap and easy fix that creates a critical thermal barrier.

- Seal Up Air Leaks: Take a walk around your home's exterior and look for any cracks or holes near your water pipes. A little caulk or insulation can stop cold air from sneaking in and freezing your plumbing.

- Keep Your Thermostat Consistent: Never let your heat drop below 55°F, even if you’re heading out of town for the weekend. A slightly higher heating bill is nothing compared to the cost of repairing a burst pipe.

Using Modern Tech for an Extra Layer of Protection

Beyond the basics, smart home technology offers a powerful defense against water damage. These devices are like an early warning system, catching small problems before they become full-blown disasters.

Smart water sensors can be a total game-changer. You can place these small gadgets near potential trouble spots like water heaters, sinks, and washing machines. If one detects moisture, it instantly pings your phone, letting you act fast.

Even better, you can install an automatic shut-off valve that slams the brakes on your home's water supply the second a leak is detected. This can turn a potential flood into a minor cleanup. It also helps to learn the subtle signs of water damage so you can spot issues before they become emergencies.

Burst Pipe Insurance Questions We Hear All the Time

Even after you get a handle on your policy, real-life situations always bring up tricky questions. Here are some of the most common scenarios we help homeowners navigate after a pipe lets go.

Q: Does insurance cover a burst pipe in a vacant home?

A: This is a huge grey area, and the answer is often no—at least not without special arrangements. Your standard homeowners policy is written with the assumption that someone is living there. If you know your home will be empty for an extended time, usually 30 to 60 days, you absolutely must tell your insurance company. They’ll likely require a “vacancy endorsement” or a completely different policy to keep you covered. If you don't, and a pipe bursts while you're gone, the insurer can easily deny the claim, arguing it was negligence because no one was there to maintain heat or catch the problem early.

Q: Will filing a water damage claim increase my premium?

A: It’s very likely, yes. Filing any claim, especially for something as significant as water damage, signals higher risk to an insurer. You can almost certainly expect your premium to go up at your next renewal. But let's put that in perspective. While the exact increase depends on your provider and how bad the damage was, it's almost always a drop in the bucket compared to paying for a major water damage restoration project out of your own pocket.

Q: What if a neighbor’s burst pipe damaged my condo?

A: Figuring out who pays for what in a condo building can get complicated fast. In most cases, your own homeowners insurance (an HO-6 policy) is your first line of defense for damage to your personal belongings and interior finishes. Damage to shared structures, like the drywall between units or the subfloor, is where it gets messy. It could fall under your policy, your neighbor's, or the master policy held by the Homeowners Association (HOA). The first thing you should do is call both your insurance agent and your HOA to get the ball rolling and clarify who is responsible for what.

Q: Is mold damage from a burst pipe covered?

A: Generally, yes, but with limitations. If the mold is a direct result of a "covered peril," like a sudden burst pipe, your policy will typically cover the cost of remediation up to a specific limit (often $5,000 to $10,000). However, if the mold resulted from a slow, neglected leak, the claim will almost certainly be denied. Speed is crucial; the faster you start the water extraction and drying process, the lower the risk of a major mold problem.

Dealing with a burst pipe is a stressful mess, but you don't have to handle it alone. If you're in the Los Angeles area, the certified experts at Onsite Pro Restoration can take charge of the entire process. We manage everything from emergency water extraction to full-scale repairs, all while working directly with your insurance company.

We’re on site in about an hour to get your property back to the way it was, fast. For a free, no-obligation assessment, visit us at https://onsitepro.org or call our 24/7 emergency line at (818) 336-1800.