When your home is flooded, the first question on your mind is usually about the bottom line. Nationally, the average insurance payout for water damage often lands somewhere between $11,000 and $14,000. But that number is just a starting point. Think of it as a ballpark figure for your Los Angeles property—a useful benchmark, but one that can swing wildly depending on the cause of the flood and the fine print in your insurance policy. Understanding the factors that determine your settlement is the first step toward a successful recovery.

If you're dealing with a water-related emergency, don't wait. Call Onsite Pro Restoration now at (818) 336-1800 for immediate help and a free, no-obligation assessment.

What Is the Average Payout for a Water Damage Claim?

A minor sink overflow that’s caught quickly in a North Hollywood apartment is a completely different ballgame from a burst pipe that soaks multiple rooms in a Sherman Oaks house. The average insurance payout for water damage can vary significantly. Understanding what makes one claim a few thousand dollars and another a five-figure headache is key to navigating the process successfully.

Water damage claims are a big deal for homeowners. Industry data shows they’re one of the most common reasons people file a claim. Between 2018 and 2022, the average severity per claim hit $13,954, driven mostly by plumbing system failures.

Breaking Down the Numbers in Los Angeles

So, what does this mean for you as a property owner in Los Angeles? Your final payout will really hinge on a few key variables:

- The Source of the Water: Was it a clean water line from a pipe? Or did it involve contaminated "gray" or "black" water from a drain or sewer line?

- The Extent of Damage: How far did the water travel? Did it soak into the drywall, get under the flooring, or saturate the insulation?

- Your Policy Details: What’s your deductible? And what are your coverage limits for this specific type of loss?

Each of these factors plays a huge role in how your insurance company calculates the final check. A small leak caught early might result in a payout under $5,000, while a severe flood can easily sail past $25,000. It’s crucial to remember the difference between the cleanup cost and the payout. The payout is what you receive after your deductible is subtracted. For a deeper dive, review the typical water damage cleanup cost, as this number is the foundation for your final settlement.

How Insurance Companies Calculate Your Water Damage Settlement

Ever wonder what’s happening behind the curtain when an insurance adjuster figures out your payout? It’s not magic, but it can feel like a mystery. The truth is, it’s a methodical process based entirely on the fine print of your policy. The final number on that check isn't just pulled out of a hat; it's the result of a specific formula balancing your coverage against the real-world cost of the damage.

Think of your policy as the blueprint for your financial recovery. An adjuster’s job is to follow that blueprint to the letter, factoring in several key components that shape the final structure of your settlement. Getting a handle on these pieces is the first step toward advocating for a fair and complete payout.

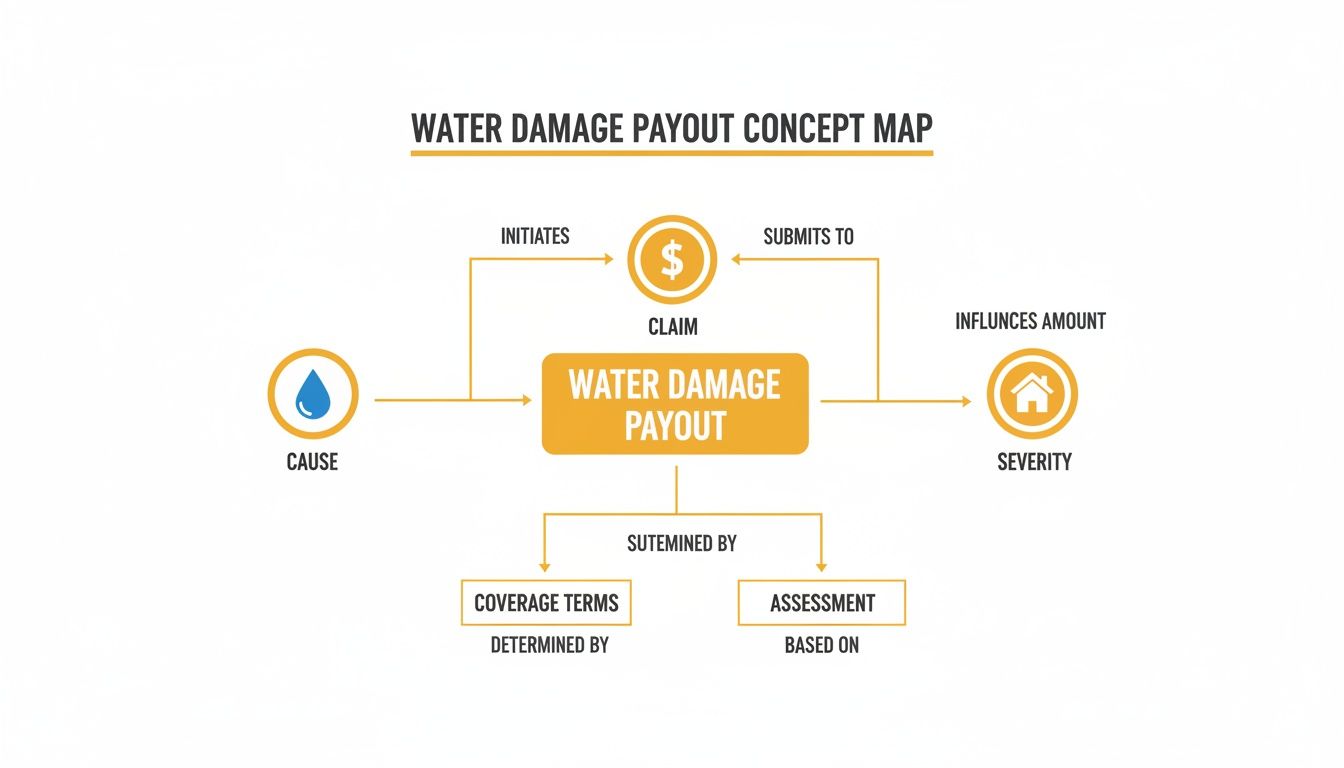

This breakdown shows how the initial cause, the details of your claim, and the severity of the damage all flow together to determine your final compensation.

As you can see, everything starts with the cause of the loss and runs through the specific terms of your policy. These elements ultimately define how severe the claim is and what it will cost to fix.

The Role of Your Deductible

The very first number that gets subtracted from your total covered damages is your deductible. This is simply the out-of-pocket amount you agreed to pay when you signed up for the policy.

For instance, if your total approved restoration cost comes to $10,000 and you have a $1,000 deductible, the most your insurer will pay out initially is $9,000. It’s like your co-pay for the repair work. Choosing a higher deductible usually means you pay a lower monthly premium, but it also means you’re on the hook for a bigger chunk of the bill when a disaster hits.

Coverage Limits: The Payout Ceiling

Every policy has coverage limits, and they act as a hard ceiling on how much your insurance company will pay for a specific type of loss. You’ll find different limits for different parts of your property, like the structure itself (Dwelling Coverage) versus your personal belongings (Personal Property Coverage).

Let’s say a major pipe burst causes $75,000 in damage to your walls and floors. If your dwelling coverage is capped at $60,000, the insurance company is only obligated to pay up to that $60,000 limit (minus your deductible, of course). This is exactly why it’s so critical to understand your homeowners' insurance policy before you ever need it.

Actual Cash Value vs. Replacement Cost

This is one of the biggest factors impacting your final check. The type of reimbursement your policy provides dictates how your damaged property is valued, and the difference can be huge.

Actual Cash Value (ACV): This pays for the depreciated value of your damaged items. If your 10-year-old hardwood floors are ruined, ACV pays you what those worn, 10-year-old floors were worth—not what it costs to install brand-new ones.

Replacement Cost Value (RCV): This pays the full cost to replace your damaged property with new items of similar kind and quality, without any deduction for depreciation.

An RCV policy is the gold standard for homeowner protection and almost always leads to a higher payout. It might cost a bit more in premiums, but it provides the funds you actually need to be made whole again. Many RCV policies work in two steps: they pay the ACV first, then release the rest of the funds once you provide receipts showing you’ve completed the repairs.

Key Factors That Influence Your Water Damage Payout

Not all water damage is created equal, and your insurance payout will reflect that. While an "average" claim gives you a ballpark idea, the specific details of your situation can make the final settlement swing wildly. Knowing what those factors are is the first step toward setting realistic expectations and building a solid claim.

A minor supply line leak in a Burbank home that’s caught immediately is a world away from a sewer backup that contaminates an entire Santa Monica property. The real difference comes down to the type of water you’re dealing with and the secondary damage it causes.

The Category Of Water Involved

The single biggest variable that drives the cost of a claim—and therefore the payout—is the contamination level of the water. In the restoration world, we classify water into three distinct categories. Each one demands a different level of cleanup, safety gear, and material replacement, which directly impacts the bottom line.

To understand why a sewer backup costs so much more than a clean pipe burst, you need to know the three categories of water damage.

How Water Category Affects Restoration Costs and Payouts

| Water Category | Common Sources | Restoration Requirements | Impact on Payout |

|---|---|---|---|

| Category 1 (Clean Water) | Burst supply lines, overflowing sinks, rainwater. | Extraction and rapid drying. Materials can often be saved. | Lowest Cost. Payouts are generally smaller and focused on drying and minor repairs. |

| Category 2 (Gray Water) | Washing machine overflows, dishwasher leaks, toilet overflows (urine only). | Requires disinfection. Porous materials like carpet pads must be removed. | Moderate Cost. Higher payouts due to mandatory removal of some materials and sanitization needs. |

| Category 3 (Black Water) | Sewage backups, rising floodwaters, stagnant water from any source. | Full biohazard remediation. All porous materials (drywall, carpet, insulation) must be removed and replaced. | Highest Cost. These claims result in the largest payouts to cover extensive demolition, sanitization, and reconstruction. |

A claim involving Category 3 black water will almost always result in a higher payout. There's no trying to "save" materials in these situations; everything porous it touches, from drywall and carpet to insulation and wood trim, has to go. Add in the specialized disinfection process, and you can see why the costs climb so fast.

Secondary Damage And Your Response Time

What happens after the initial leak is just as critical as the event itself. The longer water sits, the more damage it does, and your insurance company will be looking closely at your response time.

The biggest secondary threat is mold growth, which can start developing in as little as 24-48 hours in the damp, humid conditions of a Los Angeles home. While a standard policy might cover mold remediation if it's a direct result of a covered water event, it drastically increases the claim's value and complexity.

Even more important is how fast you act to stop the damage from getting worse. Insurers expect you to take reasonable steps to prevent further harm—a process we call mitigation. You can learn more about what water mitigation is in our detailed guide, but the takeaway is simple: delaying this critical first step can give an insurer grounds to reduce your payout, arguing that your inaction made the problem worse.

A Step-by-Step Guide to the Water Damage Claims Process in Los Angeles

That moment you discover water damage is pure stress. But what you do next doesn't have to be. Having a clear, actionable game plan can be the difference between a nightmare ordeal and a smooth recovery. Think of this as your emergency checklist—follow it, and you won’t miss a single step needed to protect your property and your claim.

You're essentially building a case for your insurance company. Every step you take provides the evidence and justification they need to approve a fair settlement. The more thorough you are right from the start, the fewer headaches you'll have later on.

Step 1: Take Immediate Safety Measures

Before you touch anything else, your first priority is safety. Period. If there’s significant water, head straight to your circuit breaker and shut off the main power to the affected rooms. Water and electricity are a lethal combination.

Next, find and turn off your home's main water valve to stop the flow right at the source. This one move is your most critical first step in preventing more damage—something your insurance policy actually requires you to do.

Step 2: Document Everything Extensively

Once the area is safe, it’s time to play detective. Before you move or clean a single thing, start documenting the scene like your claim depends on it—because it does.

- Take Photos and Videos: Use your phone to get wide shots of every room that’s been hit. Then, zoom in for close-ups of specific damaged items. A video walkthrough where you talk about what you're seeing can be incredibly powerful.

- Create an Inventory: Start a detailed list of everything that's damaged, from furniture and electronics to personal belongings. For each item, note its age, brand, and what you think it was worth.

This initial documentation is your most powerful tool. It creates an undeniable "before" picture that proves the full extent of the loss to your insurance adjuster, leaving little room for dispute.

Step 3: Report the Claim and Mitigate Damage

With your initial evidence in hand, call your insurance agent immediately to report the loss. The sooner you get that claim number, the sooner the official process kicks off. Prompt reporting is a policy requirement and shows you’re acting responsibly. Our guide on the insurance claim process for water damage has more details on this.

At the same time, you must take reasonable steps to stop the damage from getting worse. In insurance lingo, this is called mitigation. That means calling a professional restoration company like Onsite Pro Restoration to start emergency water extraction and drying. Waiting can lead to mold and structural problems, which might not be covered if the insurer decides the delay was negligent. Knowing the common insurance claim denial reasons is half the battle, and acting fast is your best defense.

Real Payout Scenarios for Los Angeles Homeowners

Policy terms and numbers are one thing, but seeing how they play out in the real world is another. Let’s walk through a few realistic situations you might face as a Los Angeles homeowner.

These stories help show why the average insurance payout for water damage is anything but average—every claim is unique, and the details matter.

Scenario 1: Burst Pipe in an Older Sherman Oaks Home

Picture a classic 1950s Sherman Oaks home with its original copper plumbing. A supply line hidden in the bathroom wall decides to give out overnight. Clean water (Category 1) soaks the bathroom, seeps into the hallway’s beautiful hardwood floors, and saturates the drywall in both areas before anyone notices.

- Initial Damage: The vanity is ruined, drywall is soaked through, and those original hardwood floors are now warped and cupping. The subfloor is also completely saturated.

- Payout Influencers: The homeowner has a Replacement Cost Value (RCV) policy—a huge win here. Under an ACV policy, the depreciation on those old floors would have been massive. Because the leak was hidden, there’s also a high risk of mold, which could add serious remediation costs to the claim.

- Potential Payout Range: $15,000 – $30,000. This estimate covers demolition, intensive structural drying, replacing the drywall and classic hardwood, and installing a new vanity, all after the deductible is paid. If mold is discovered, that number could jump, depending on the policy’s specific mold coverage limit.

Scenario 2: Washing Machine Overflow in a Glendale Condo

Over in a newer Glendale condo, a washing machine supply hose fails during a cycle. Soapy, gray water (Category 2) floods the laundry closet and spills into the living room, soaking the laminate flooring. The owner is home, acts fast, and gets the water shut off within the hour.

- Initial Damage: Saturated laminate flooring, soaked baseboards, and water damage to a shared wall with the next-door unit.

- Payout Influencers: The quick response definitely helped limit the spread. But since it’s Category 2 water, the laminate and its underpadding can’t just be dried—they have to be torn out and replaced. The condo setting also complicates things, as the HOA’s policy and the neighbor’s insurance might get involved for that shared wall.

- Potential Payout Range: $8,000 – $18,000. This payout would likely cover the removal and replacement of all affected flooring and baseboards, professional drying of the structure, and the necessary repairs to the shared wall.

The industry has a system for classifying water damage that really drives home the financial risk. The average covered claim in the U.S. lands around $12,500. But a minor Class 1 incident might only cost a few hundred dollars to fix, while a catastrophic Class 4 event can easily blow past $20,000. It just goes to show how wide the range of potential costs can be. You can discover more key facts about these water damage classifications to understand what you might be up against.

How a Professional Restoration Team Maximizes Your Insurance Payout

When you're dealing with water damage, filing an insurance claim can feel like you’re on your own, up against a massive company. Bringing in a professional restoration company like Onsite Pro Restoration completely changes that dynamic. You get an expert advocate on your side, one whose entire job is to get you the maximum possible settlement.

We do a lot more than just dry out your house; we build a rock-solid, undeniable case for your insurer.

Our process is built on IICRC-certified methods and industry-standard software like Xactimate. This isn't just about getting the repairs done right—it's about speaking the exact same language as your insurance adjuster. Xactimate generates transparent, line-item estimates that insurance carriers know and trust, which cuts down on the frustrating back-and-forth that stalls so many claims.

Comprehensive Documentation Is Your Strongest Asset

The single most important factor in getting a fair average insurance payout for water damage is meticulous, undeniable proof. Our technicians are trained to create a complete evidence package that leaves no room for adjusters to guess or lowball.

This documentation isn't just a few photos. It includes:

- Moisture Mapping: We use specialized meters to create a map showing exactly how far water has wicked into your walls, floors, and structural materials.

- Photo and Video Logs: We capture everything—detailed images and video of the damage before, during, and after the mitigation work.

- Detailed Work Logs: Every action we take is recorded, from the moment we start extracting water to the final dehumidification readings.

When water damage strikes, quick action like getting immediate and accurate professional water leak detection is crucial. This proactive approach shows your insurer you did everything possible to prevent the damage from getting worse, which is a key part of any successful claim.

By presenting a claim backed by professional data and industry-standard pricing, you move from a position of asking to a position of demonstrating. This fundamentally changes the dynamic, ensuring you receive a complete settlement that covers all necessary repairs.

Our role is to turn a crisis into a fully resolved recovery. We handle the claims complexities so you can focus on what matters most—getting your property, and your life, back to normal. Find out more about how a professional restoration company can be your greatest ally during this process.

Frequently Asked Questions About Water Damage Insurance Claims

When your home is underwater, you've got questions. Here are some of the most common ones we hear from Los Angeles homeowners, with straightforward answers to help you see the path forward.

Q: Will my insurance rates go up after a water damage claim?

A: It's possible. Filing a single water damage claim can lead to a rate increase, often around 10-20% in California. However, the cost of professional restoration for significant damage almost always dwarfs a potential premium hike. Ignoring a serious water issue to avoid a rate bump can leave you with thousands in out-of-pocket repairs and a mold problem that could complicate future claims.

Q: What is the difference between water damage and flood damage?

A: This is a crucial distinction. Standard homeowner's policies cover "sudden and accidental" water damage originating inside your home, like a burst pipe or appliance failure. "Flood damage" refers to water from a natural source rising and entering your home from the outside. This requires a separate flood insurance policy, usually from the National Flood Insurance Program (NFIP).

Q: How long do I have to file a water damage claim in Los Angeles?

A: While California law provides a statute of limitations, your insurance policy requires you to report damage "promptly." Waiting weeks or months can give the insurance company grounds to argue your delay worsened the damage (e.g., causing mold growth), potentially leading to a reduced payout or denial. Act as quickly as possible.

Q: Can I choose my own water damage restoration company?

A: Yes, you have the absolute right to choose your own licensed and certified restoration company. While your insurer may provide a list of "preferred vendors," you are not obligated to use them. Hiring an independent expert like Onsite Pro Restoration means you have an advocate working for you, focused on correctly restoring your property, not just on the insurance carrier's bottom line.

If you're facing water damage and need a team that will document your claim meticulously and restore your property right, trust Onsite Pro Restoration. We work for you, not the insurance company. Get your free, no-obligation assessment today by visiting https://onsitepro.org or calling (818) 336-1800 now.