Yes, your homeowners insurance will cover water damage, but there’s a huge catch: it all depends on how the water got in. The golden rule is that coverage for water damage kicks in for damage that is sudden and accidental, like a pipe that bursts out of nowhere in your Encino home. If the damage comes from a slow, neglected leak you could have fixed months ago, you’re almost certainly on your own.

For your insurance company, the source of the water and the speed of the damage are everything. This guide breaks down exactly what Los Angeles homeowners need to know about navigating a claim.

Call (818) 336‑1800 for Immediate Help

The Hidden Rule: Sudden vs. Gradual Water Damage

When you find water pooling in your home, the first gut-wrenching question is always, “Will my insurance pay for this?” The answer boils down to one simple idea: prevention vs. surprise. Insurance is there to protect you from the unexpected disasters you couldn’t see coming, not from problems that festered due to a lack of routine upkeep.

This is the single most important distinction that separates a paid claim from a denied one.

Imagine a pipe suddenly bursting behind the drywall in your Sherman Oaks home. That’s a textbook example of a covered event because it was unforeseen and completely accidental. Now, contrast that with a slow-dripping faucet in your Beverly Hills bathroom that you ignored for months, letting it rot the subfloor and grow mold. That’s a maintenance issue, and your claim will almost definitely be denied.

Getting this difference is the first step to successfully navigating a water damage claim. But before you can confidently know if you’re covered, it’s critical to understand how to effectively read an insurance policy and make sense of its specific terms.

Covered vs. Excluded Damage Scenarios

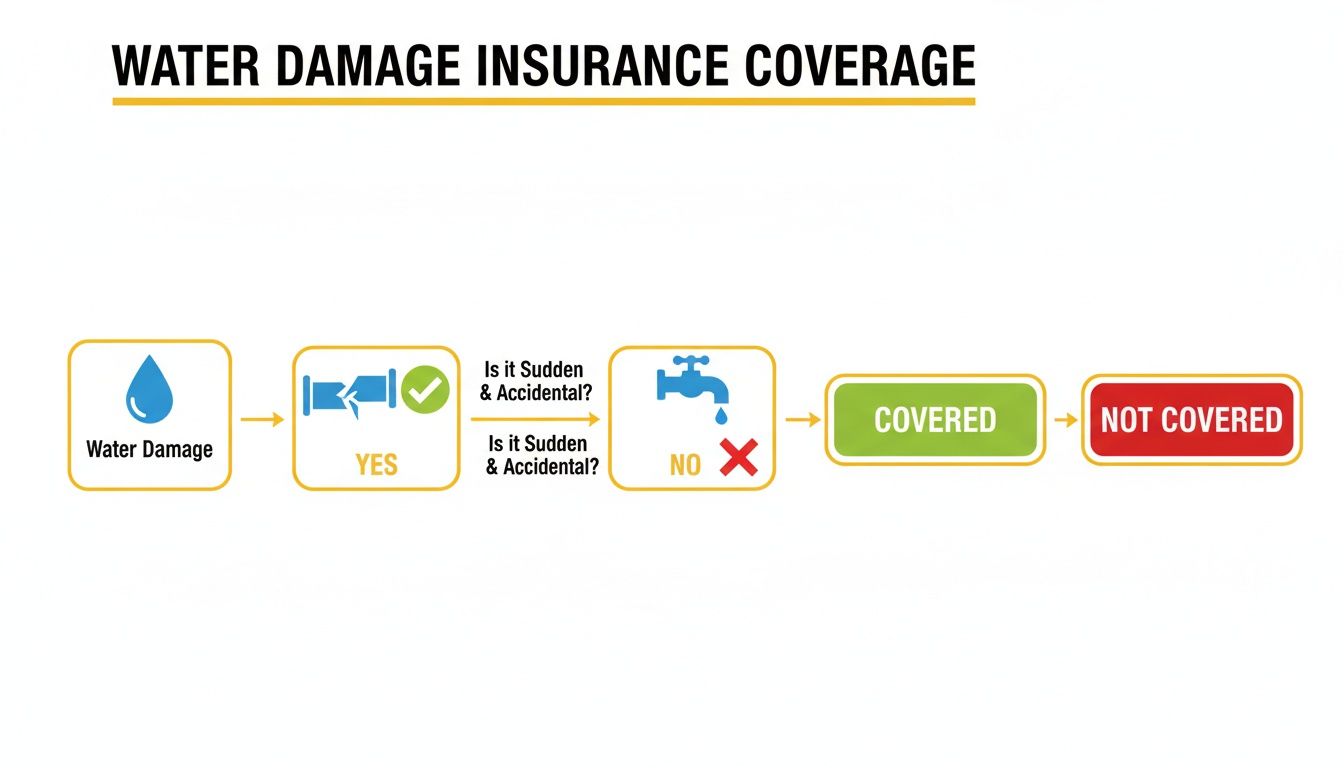

To make it even clearer, think of water damage claims as having two distinct paths.

- Sudden & Accidental (Generally Covered): This is for events that happen without any warning. Think of a washing machine hose that ruptures mid-cycle or a water heater that suddenly fails and floods your garage. This is precisely why homeowners insurance for water damage exists.

- Gradual & Negligent (Generally Excluded): This covers damage that happens over a long period because maintenance was ignored. Examples include deteriorating caulk around a bathtub, a slow roof leak you never patched, or seepage into your foundation from poor drainage. Insurers see these as the homeowner’s responsibility to prevent.

This flowchart breaks down the fundamental split between water damage events that are covered and those that aren’t.

The key takeaway? Insurers reward proactive homeowners by covering true accidents, but they draw the line at issues caused by neglect. This is exactly why getting familiar with your specific homeowners insurance policy is so crucial. It spells out exactly what qualifies as “sudden and accidental,” and knowing those rules ahead of time can save you from a nasty surprise when you need help the most.

To give you a quick reference, here’s a breakdown of common scenarios.

Homeowners Insurance Water Damage Coverage At a Glance

| Scenario | Typically Covered? | Why or Why Not? |

|---|---|---|

| Burst pipe or supply line | Yes | This is a classic “sudden and accidental” event. |

| Leaking roof from storm damage | Yes | Damage caused by a storm creating an opening is covered. |

| Appliance hose rupture | Yes | A sudden failure of a washing machine or dishwasher hose is covered. |

| Slow leak under the sink | No | This is considered a maintenance issue that developed over time. |

| Mold from long-term humidity | No | Gradual damage from neglect is almost always excluded. |

| Sewer or drain backup | Requires Endorsement | Standard policies exclude this; you need a separate “water backup” rider. |

| Flooding from outside | No | This requires a separate flood insurance policy. |

This table should help clarify things, but always remember to check your specific policy documents for the fine print. No two policies are exactly alike.

What Does “Sudden and Accidental” Really Mean to Insurers?

When you file a claim, your insurance adjuster lives by one simple phrase: “sudden and accidental.” This isn’t just industry-speak; it’s the lens through which they view your entire claim. It’s what separates an unexpected disaster from a predictable problem.

Think of it like this: a washing machine hose suddenly bursting in your Burbank laundry room is a textbook covered event. It happened out of nowhere, causing immediate damage. The same goes for a dishwasher in your Sherman Oaks kitchen that malfunctions and floods the floor overnight.

These are the kinds of unforeseen events your policy is built to handle—the ones you couldn’t have reasonably stopped.

Defining “Unforeseen Events”

The line between “sudden” and “gradual” is where most homeowners get tripped up. Your insurer sees these two scenarios as night and day.

- Sudden Damage: This is something that happens at a specific, identifiable moment. It’s the pipe that freezes and bursts during a rare SoCal cold snap or the water heater that fails without warning.

- Gradual Damage: This is damage that creeps up on you over weeks, months, or even years. We’re talking about the deteriorating caulk around your bathtub, a slow drip under a sink causing cabinet rot, or humidity leading to mold in a poorly ventilated bathroom.

Insurers see gradual damage as a maintenance issue—something a diligent homeowner should have noticed and fixed. They’re in the business of covering risk, not paying for neglect.

The Financial Reality of Covered Claims

Getting this distinction right is everything because these sudden and accidental incidents make up a huge portion of all homeowners insurance claims. Standard HO-3 policies are designed specifically to handle these internal plumbing failures and appliance blowouts. In fact, water damage and freezing events consistently account for 19–29% of all claim payouts, according to industry reports. That number shows just how common—and expensive—these sudden messes can be. You can discover more insights about these insurance trends to see the full picture.

This is exactly why, when you ask does homeowners insurance cover water damage, the answer almost always comes back to the source and the speed. An abrupt failure is an insurable event; a slow, creeping issue is a maintenance problem you’re expected to manage. Recognizing the signs of wear and tear isn’t just good homeownership—it’s essential for keeping your insurance coverage there for you when you truly need it.

Key Exclusions: What Your Homeowners Policy Won’t Cover

Knowing what your policy doesn’t cover is just as important as knowing what it does. Far too many homeowners get blindsided, assuming their insurance is a catch-all for any water-related disaster. It’s not.

When a claim gets denied, it’s almost always because the damage falls into one of three major categories. Understanding them now can save you a massive financial headache later. It all boils down to one core principle: insurance is for sudden accidents, not problems that were predictable or widespread.

Gradual Damage From Neglect or Poor Maintenance

This is, without a doubt, the number one reason water damage claims are rejected. Insurers expect you to keep your home in good shape. When damage happens slowly over weeks, months, or even years because of neglect, it’s almost always excluded from coverage.

Think about that slow drip under your West Hollywood kitchen sink that you kept meaning to fix. The wood rot and mold that eventually show up are considered gradual damage. The same goes for deteriorating caulk around a Santa Monica shower that lets water seep into the walls over time. That’s a maintenance issue, not a sudden accident.

Your policy is designed to protect you from unforeseen disasters, not to pay for the consequences of deferred upkeep. An adjuster will look for signs of long-term moisture, such as rust, corrosion, or rot, as evidence of a gradual problem.

Overland Flooding and Storm Surges

This is a critical distinction every homeowner needs to burn into their memory: water damage from inside your house is completely different from flooding that comes from outside. A standard homeowners policy does not cover damage from rising water. Period. This includes:

- Rivers or lakes overflowing their banks.

- Heavy rains that saturate the ground and seep into your home’s foundation.

- Storm surges that push water inland from the coast.

To protect yourself from these events, you need a separate flood insurance policy, which is usually bought through the National Flood Insurance Program (NFIP) or a private company. If you don’t have one, you’re on your own for the repair costs after a natural flood.

Sewer and Drain Backups

It’s a nightmare scenario: wastewater from your home—or worse, the city’s main sewer line—forces its way back up through your drains, flooding your ground floor or basement. This disgusting and destructive event is another common exclusion in standard policies.

The logic is that the problem often starts outside your property’s plumbing system or is tied to municipal infrastructure failures. The good news? You can usually add a “water backup and sump pump overflow” endorsement to your policy for a pretty reasonable price. This little add-on provides coverage specifically for damage from backed-up sewers or drains. It’s worth looking into how homeowners insurance covers sewer backups to see if it makes sense for you. A small investment here can prevent an incredibly costly disaster.

The True Cost of Water Damage in Los Angeles

It’s easy to write off a small leak as just one of those things that happens. A little drip under the sink? Annoying, but not a catastrophe, right?

The reality is a lot harsher. The numbers behind water damage claims paint a sobering picture, showing just how common and financially crippling these events are for homeowners everywhere, from Glendale to Beverly Hills. These aren’t rare, “what if” scenarios. They happen all the time, which is why knowing the answer to does homeowners insurance cover water damage is so critical for your financial stability.

How Often Do These Claims Happen?

Think of it this way: water-related losses are one of the top reasons homeowners file an insurance claim in the first place. Industry data shows that roughly 1-2% of all insured homes file a claim for water damage or freezing each year. That might not sound like a huge number, but it adds up to millions of homes annually.

The financial toll is where it really hits home. In a recent year, insurers paid out a staggering $13 billion for water damage claims alone. The average cost to fix the mess is usually somewhere in the $8,000 to $14,000 range—a massive out-of-pocket hit for anyone caught off guard.

Breaking Down the Average Costs

The final bill for a water damage event can climb fast, and several key factors will determine just how high it goes. Getting a handle on the typical water damage cleanup cost helps you appreciate what’s really at stake.

Here’s what drives up the total expense:

- Extent of Damage: A small, contained leak in one room is a completely different ballgame than a second-story pipe bursting and flooding multiple levels of your house.

- Type of Water: “Clean water” from a supply line is the simplest to deal with. But if you’re dealing with “grey” or “black water” from something like a sewer backup, the job gets far more complex and expensive due to the need for heavy-duty sanitization.

- Materials Affected: It costs a lot more to restore beautiful hardwood floors, custom cabinets, and old-school plaster walls than it does to rip out and replace standard drywall and carpet.

- Time: This is the big one. The longer water sits, the worse things get and the more it costs. Every hour you wait invites secondary damage like mold growth and structural rot, which sends repair bills through the roof.

The bottom line is that even a seemingly minor incident can quickly spiral into a five-figure problem. This financial reality highlights why a swift, professional response and a correctly filed insurance claim are not just helpful—they are absolutely essential for protecting your property and your savings.

Call (818) 336‑1800 for Immediate Help

How to Handle a Water Damage Emergency

The second you spot water where it doesn’t belong, a clock starts ticking. Every moment matters. The steps you take in those first few minutes will massively impact the outcome of the damage—and your insurance claim.

Acting fast isn’t just a good idea; it’s a non-negotiable part of your insurance policy. Insurers expect you to take immediate, reasonable steps to mitigate further damage. In plain English, that means you have to stop the water and start the cleanup right away. If you wait, problems like mold and rotted wood can set in, and your policy might not cover that if they decide it was preventable.

Your First Three Critical Steps

Before you even think about dialing your insurance agent, your absolute first priorities are safety and stopping the mess from getting worse. Just follow these three simple steps to get the situation under control.

- Stop the Water Source: Find your home’s main water shut-off valve and turn it off. Now. If you know the leak is coming from a specific appliance, like a toilet or washing machine, you can often just use its local shut-off valve instead.

- Ensure Electrical Safety: If water is anywhere near outlets, appliances, or your circuit breaker box, kill the power to those areas. Never, ever step into standing water if you think there’s even a slight chance the electricity is live.

- Document Everything: Pull out your phone before you move a single thing. Take tons of photos and videos. Get shots of the standing water, the source of the leak (if you can see it), and every single item that’s been damaged. This initial evidence is pure gold for your insurance claim.

The moment you discover water damage, you need a clear, immediate plan. The following checklist breaks down exactly what to do to protect your property and your insurance claim.

Emergency Water Damage Checklist

| Step | Action | Critical Reason |

|---|---|---|

| 1. Safety First | Turn off the main water valve. Shut off electricity to the wet areas via the circuit breaker. | Prevents electrocution and stops more water from causing damage. This is a non-negotiable first step. |

| 2. Document the Scene | Take extensive photos and videos of the damage before moving anything. Capture the source, the standing water, and all affected items. | This is your primary evidence. Without it, the insurance adjuster has to guess the initial extent of the damage, which rarely works in your favor. |

| 3. Call a Pro | Contact a 24/7 IICRC-certified restoration company. This is your most important call. | They start professional water extraction immediately, fulfilling your duty to mitigate damage and preventing mold. Their documentation is vital. |

| 4. Move Valuables | If safe, move furniture, electronics, and important documents to a dry area. Place foil under furniture legs to prevent staining. | Protects your personal property from further damage and shows the insurer you took proactive steps. |

| 5. Notify Your Insurer | Call your insurance company to report the loss. Have your policy number ready and provide the date, time, and known cause. | This officially starts the claims process. They will assign you a claim number and an adjuster. |

| 6. Keep Records | Create a log of all communications with your insurer and restoration company. Save all receipts for any related expenses. | A detailed paper trail is your best defense if disputes arise. It keeps everyone accountable and your claim on track. |

Following these steps methodically will put you in the best possible position to handle the crisis effectively and get your claim approved without unnecessary delays.

The Most Important Phone Call You Can Make

Once the area is safe, your next call shouldn’t be to your insurance agent—it should be to a professional restoration team. An IICRC-certified company provides 24/7 emergency water cleanup services and is built for rapid response.

Getting professional help on-site within hours is the single best way to fulfill your duty to mitigate damage. A restoration company provides the immediate water extraction and structural drying needed to prevent secondary damage like mold, which is often a point of contention in insurance claims. They also provide the detailed documentation required by adjusters, strengthening your case from the very beginning.

How to File a Successful Water Damage Claim

When you find water damage, filing an insurance claim can feel overwhelming. But a methodical approach makes all the difference. Your success really comes down to acting fast, documenting everything, and communicating clearly. The goal is to give your adjuster a clean, straightforward case that shows the damage was sudden, accidental, and that you did everything you could to stop it from getting worse.

As soon as you’ve stopped the water and documented the scene, your very next call should be to an IICRC-certified restoration team. This is a non-negotiable step. Insurers expect you to “mitigate damages” immediately, and bringing in pros shows you took responsible action to prevent mold and further structural issues.

Partnering with Professionals for a Stronger Claim

An experienced restoration company is your biggest ally in this process. They don’t just dry things out; they build the evidence your insurer needs to approve the claim. We’re talking detailed moisture readings, thermal imaging reports, and standardized documents that adjusters know and trust.

This professional backup is often what separates a smooth claim from a denied one. Insurers routinely recommend a 24–48 hour emergency response to prevent secondary problems like mold—a core service for restoration pros, especially in a dense area like Los Angeles. Fast, professional mitigation doesn’t just cut down on repair costs; it simplifies the whole claims journey.

Working with Your Insurance Adjuster

Your insurance adjuster will schedule a time to come out and inspect the damage. Be ready to walk them through exactly what happened, showing them your initial photos and the reports from your restoration company. Having a pro on your side offers a credible, third-party assessment that backs up the scope of work you’re claiming.

An adjuster’s job is to verify the loss against your policy’s fine print. A professional restoration company speaks their language, providing the standardized data and estimates they need to process your claim efficiently and fairly.

By following these steps, you can turn a chaotic situation into a manageable one. For a deeper dive into the claims process, especially for related issues, check out this guide on mastering the roof insurance claim process. We also have a dedicated guide with more insurance claim tips for water damage to make sure you’re fully prepared.

FAQs About Water Damage and Insurance

When you’re dealing with a water emergency, trying to decipher your insurance policy is the last thing you want to do. Let’s cut through the confusion. Here are some of the most common questions we hear from Los Angeles homeowners, with straightforward answers from our years of experience on the ground.

Q: Will my insurance pay to fix the burst pipe that caused all the water damage?

A: No, typically not. Your policy covers the resulting damage—the wet drywall, soaked carpets, and ruined cabinets. However, the cost to repair the actual section of pipe or replace the faulty washing machine hose is considered a maintenance expense and falls on you.

Q: Is mold from a covered water leak also covered?

A: It depends. If the mold is a direct result of a sudden, covered event (like a burst pipe) and you acted quickly to mitigate the damage, there is often limited coverage. However, if the mold grew over time from a slow leak or high humidity, it’s almost always excluded as a maintenance issue.

Q: What exactly is a “water damage sublimit”?

A: A sublimit is a cap on how much your policy will pay for a specific type of claim, regardless of your overall policy limit. For instance, your home may be insured for $500,000, but your policy might have a $10,000 sublimit for mold remediation. It’s crucial to check your policy for these caps.

Q: Do I need a separate flood insurance policy?

A: Yes, if you want coverage for water entering your home from the outside. Standard homeowners policies explicitly exclude damage from natural flooding, storm surges, or heavy rains seeping in from saturated ground. You must purchase a separate flood policy, usually through the NFIP.

Don’t try to navigate a messy water loss and a confusing insurance claim on your own. The IICRC-certified team at Onsite Pro Restoration is on call 24/7 across Los Angeles to stop the damage, document everything your insurer needs, and get your home back to normal.

Call us for a free, no-obligation assessment of your situation.