When it comes to homeowners insurance coverage for water damage, nearly every claim in Los Angeles boils down to one critical question: was the damage sudden and accidental?

It’s the difference between a pipe suddenly bursting behind a wall in your Sherman Oaks home (usually covered) and a faucet that’s been slowly dripping for months, causing wood rot in a Santa Monica bathroom (almost never covered). This single principle is the key to understanding your entire policy.

Navigating water damage can be stressful, but understanding your coverage is the first step toward a successful recovery. At Onsite Pro, we help homeowners manage the entire process, from emergency cleanup to insurance claims.

Understanding the "Sudden and Accidental" Rule

At its core, the "sudden and accidental" rule is the line insurance carriers draw between an unpredictable disaster and a preventable maintenance issue. Insurers are in the business of covering unforeseen risks, not paying for problems that come from a lack of basic upkeep.

Think of it like this: a lightning strike that hits your house is a surprise catastrophe. A giant, dead tree in your yard that you ignored for years before it finally fell on your roof? That’s a gradual failure.

Events like a washing machine hose abruptly failing in your Van Nuys laundry room or a toilet overflowing and flooding the bathroom floor are almost always covered because you couldn't have reasonably seen them coming in that exact moment. They happen fast and without warning.

What Insurers Consider Gradual Damage

On the flip side, gradual damage is the slow-moving enemy of a homeowner's insurance claim. This is any issue that develops over weeks, months, or even years. Because these problems usually show signs along the way and can be fixed with routine maintenance, insurers put the responsibility squarely on you, the homeowner.

Common examples of gradual damage that often lead to denied claims include:

- Slow Leaks: That persistent drip from a worn-out pipe fitting under the sink that eventually causes the cabinet floor to rot and grow mold.

- Seepage: Water slowly making its way into your basement through tiny cracks in the foundation after a heavy rain.

- Wear and Tear: An old, deteriorating flat roof in Sherman Oaks that finally starts letting water stain your ceiling over time.

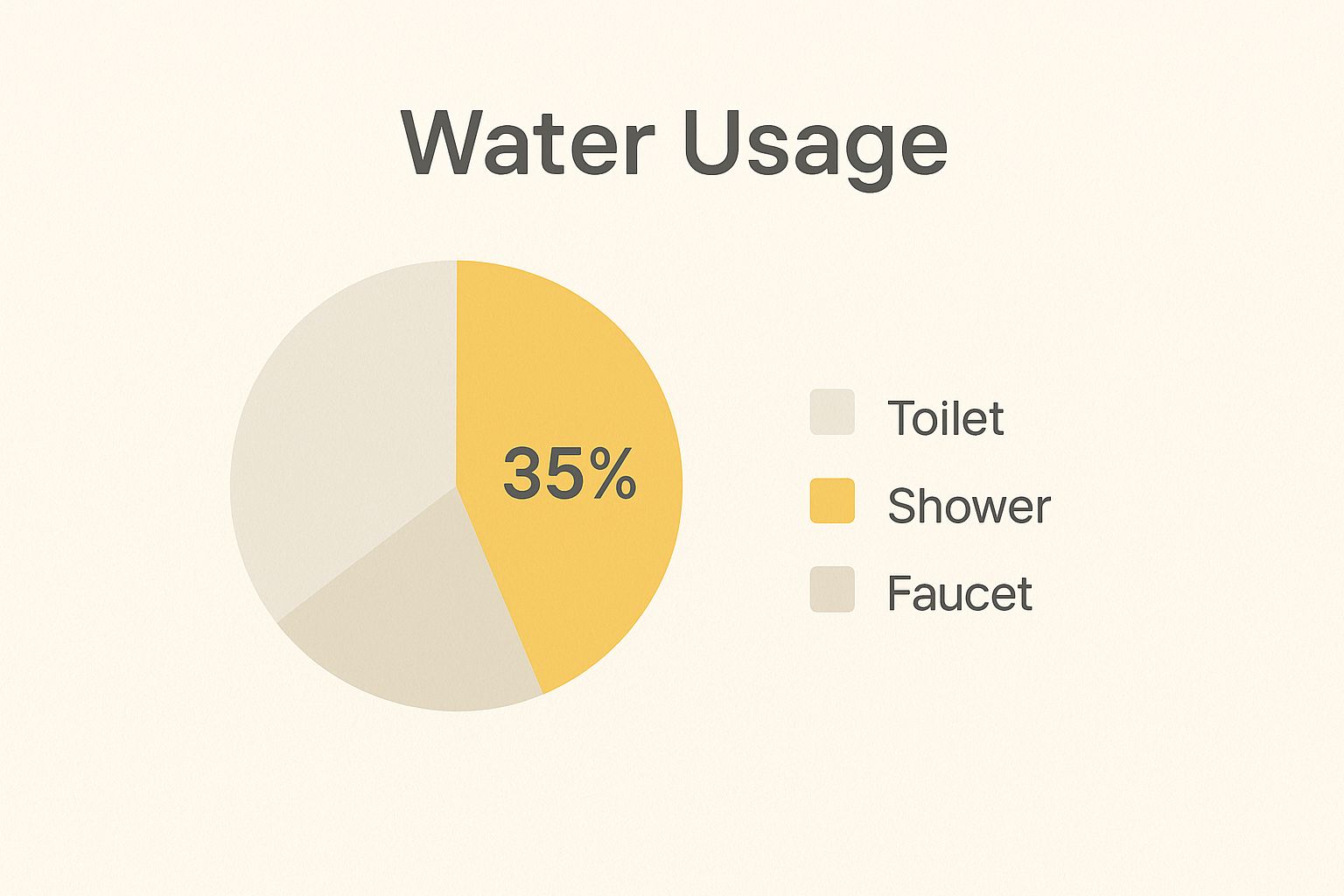

This infographic shows a perfect example of a "sudden and accidental" event: a burst pipe causing immediate and significant water damage.

This is exactly the kind of scenario a standard policy is designed to protect you from—a catastrophic failure inside your home's plumbing system that happens in an instant.

To make this crystal clear, here’s a quick breakdown of common scenarios.

Sudden vs. Gradual Water Damage Coverage Scenarios

This table illustrates how an insurer might view different types of water damage events. Notice how the "why" always comes back to whether the incident was sudden or a result of neglect.

| Scenario | Type of Damage | Typically Covered? | Reasoning |

|---|---|---|---|

| Water heater tank ruptures | Sudden & Accidental | Yes | The failure of the unit was abrupt and unforeseen, causing immediate damage. |

| Slow drip from a shower pan | Gradual | No | The leak developed over time, indicating a maintenance issue the homeowner could have addressed. |

| Washing machine supply hose bursts | Sudden & Accidental | Yes | The hose failed without warning, leading to a rapid and unexpected flood. |

| Water seeps through foundation cracks | Gradual | No | Groundwater intrusion is considered a maintenance or flood-related issue, not a sudden event. |

| A frozen pipe cracks and thaws | Sudden & Accidental | Yes | The pipe burst due to a specific, sudden event (freezing), even if the leak appears later. |

| Mold discovered under peeling paint | Gradual | No | The mold and peeling paint are signs of a long-term moisture problem that went unaddressed. |

As you can see, the origin of the water is everything. One is a covered peril; the other is a homeowner's responsibility.

The Financial Impact of Water Damage Claims

Understanding this distinction is so important because water-related incidents are incredibly common and expensive. In fact, water damage and freezing are consistently among the top reasons for home insurance claims, accounting for nearly 30% of all claims filed.

Between 2018 and 2022, the average payout for these claims was a staggering $13,954. That number alone highlights the serious financial risk you face if a claim gets denied.

Key Takeaway: Your homeowners policy is a safety net for unexpected disasters, not a maintenance plan for gradual decay. Regularly inspecting your home for signs of slow leaks, moisture, and wear can save you from a denied claim and thousands in out-of-pocket costs.

Grasping this core concept helps you not only maintain your property but also know what to expect if you ever have to file a claim. If you want to learn more, you can dive deeper into these frequently asked questions about water damage insurance coverage. This knowledge empowers you to protect your home and navigate the claims process with confidence.

What a Standard Homeowners Policy Typically Covers

Now that we’ve nailed down the “sudden and accidental” rule, let's get into the real-world situations where your standard homeowners policy actually kicks in. Knowing these scenarios is the key to getting the most out of your homeowners insurance coverage for water damage.

Here’s the most important concept to grasp: your policy covers the damage that results from the water, but not the source of the problem itself. This is a crucial distinction that trips up a lot of homeowners in the middle of a stressful claim.

Think of it this way: your insurance is there to put your home back together, not to pay for new appliances or plumbing repairs that were your responsibility.

Burst Pipes and Appliance Failures

One of the most common claims we see comes from a sudden plumbing or appliance failure. These situations perfectly illustrate that "resulting damage" rule.

-

Frozen Pipes: A nasty cold snap freezes a pipe in your attic, and it bursts. As it thaws, water pours through the ceiling and down the walls. Your policy will pay to tear out and replace the soaked drywall, install new insulation, and repaint the rooms. What it won't cover is the plumber's bill to fix the broken section of pipe.

-

Appliance Hose Failure: The supply hose on your dishwasher gives out without warning, flooding your kitchen. The policy is designed to cover the cost of professionally drying the subfloor and replacing your beautiful (and now warped) hardwood flooring. It will not, however, buy you a new dishwasher or pay for the cheap hose that failed.

These examples show how insurers think. They’ll cover the unexpected, collateral damage—not the worn-out part that finally gave way.

Water Damage from a Covered Peril

Sometimes, water damage isn't the main event; it's the consequence of something else your policy already covers. In these cases, that initial event is the trigger that makes the water damage claim valid.

A classic example is a heavy windstorm. Imagine powerful gusts rip shingles clean off your roof, leaving a gaping hole. The rain that follows pours into your attic and drips down, ruining furniture and electronics below.

Important Distinction: Here, the wind is the covered peril. Because a covered peril created the opening for the water, the water damage that followed is also covered. On the flip side, if your roof was just old and leaky, any damage from a normal rainstorm would be denied.

Another scenario is damage from firefighting. If a fire breaks out in your kitchen, the fire department is going to douse it with a lot of water. Your policy will cover not only the fire and smoke damage but also the water damage caused by putting it out.

Clarifying Coverage Nuances

You have to get familiar with the specifics of your own policy, as there can be slight but important differences between carriers. The exact definition of a covered peril or the dollar limits for certain damages can vary. If you're with a major insurer, it pays to understand their specific rules. For example, looking into the details of a policy like State Farm's insurance coverage can offer a clearer picture of how these rules are applied in practice.

The trick is to always trace the damage back to its source. Was it sudden and accidental, or was it a gradual failure from lack of maintenance? Was it kicked off by another covered event, like wind or fire? Answering those questions will almost always tell you if your claim stands a chance. This simple framework gives you a powerful way to assess any water issue in your home and navigate the claims process with a lot more confidence.

Critical Water Damage Exclusions in Your Policy

Knowing what your policy covers is just half the battle. To really protect your investment, you need to get familiar with what your homeowners insurance coverage for water damage specifically leaves out. These exclusions are the landmines of the insurance world—they're the most common reasons claims get denied, catching homeowners off guard during an already awful time.

Getting ahead of these limitations helps you spot the gaps in your coverage now so you can fill them before a pipe bursts or a storm hits. Three big ones cause the most confusion and financial pain: flood damage, gradual damage, and sewer backups.

The Misconception of Flood Damage

This is, without a doubt, the single biggest misunderstanding in home insurance. Let's be clear: a standard homeowners policy does not cover damage from floods. Period. Insurers have a very specific definition of a "flood"—it's water that comes from an outside source and rises to enter your home.

This includes things like:

- Natural Disasters: An overflowing river, a coastal storm surge, or just a torrential downpour that pools on the ground and seeps through your foundation.

- Surface Water: Even runoff from your neighbor's overzealous sprinkler system or melting snow that floods your basement counts as a flood.

It’s a shocking statistic, but only about 4% of homeowners nationwide have a separate flood insurance policy. This leaves millions of families completely exposed. To get protected, you have to buy a separate policy, usually through the National Flood Insurance Program (NFIP) or a private company. Without it, federal disaster assistance is a drop in the bucket, averaging just $3,000. Compare that to the average flood claim payout of $66,000, and you can see how financially devastating that gap is. For a deep dive into what to do when this kind of disaster strikes, our guide on choosing a flood damage service offers critical advice.

The Pitfall of Gradual Damage

Like we touched on earlier, insurance companies see your policy as a safety net for sudden accidents, not a maintenance plan. Any damage that happens slowly over weeks, months, or years is considered a "gradual" problem and will almost always be denied. The responsibility for preventing slow decay falls squarely on you, the homeowner.

Think of it this way:

- A window seal that’s been rotting for a year, letting rainwater seep in and destroy the wood frame? That’s a maintenance issue.

- That faint, musty smell in the bathroom that turns out to be a massive mold colony behind the wall from a slow, persistent pipe drip? That’s a gradual issue.

Expert Insight: When an insurance adjuster shows up, their first mission is to figure out the timeline. If they spot evidence of long-term moisture—like rust, corrosion, or layered water stains—it’s a huge red flag for gradual damage. That’s a one-way ticket to a claim denial.

Your best defense here is simple diligence. Regularly walk your property, check under sinks, inspect your attic, and look for small leaks or signs of moisture.

The Dangers of Sewer and Drain Backups

Picture this all-too-common nightmare: a heavy storm overwhelms the city sewer line, and raw sewage starts gushing up through the drains into your newly finished basement. It soaks the drywall, ruins the carpet, and destroys furniture. You’d think your homeowners policy would cover something so catastrophic, right? You'd probably be wrong.

Standard policies explicitly exclude damage from water that backs up through sewers or drains. They also exclude overflows from a sump pump. The logic is that the source of the water isn't from your home’s own plumbing system. The only way to shield yourself from this incredibly destructive and unsanitary mess is to buy a specific add-on, known as an endorsement. Without that extra coverage, you’re on the hook for every last cent of the cleanup and restoration.

How to Fill Coverage Gaps with Policy Endorsements

After learning about the major exclusions in a standard homeowners policy, you might feel a little exposed. The good news is you can strategically patch these holes in your homeowners insurance coverage for water damage by adding specific endorsements, often called riders. These are surprisingly affordable add-ons that customize your policy to handle risks your base plan simply ignores.

Think of your standard policy like a pre-built house. It has a solid foundation and a good roof, but the windows might be basic and the locks standard. Endorsements are the equivalent of upgrading to impact-resistant storm windows and a state-of-the-art security system—they fortify your protection right where you need it most. Without them, you’re left vulnerable to some of the most common and costly disasters.

Water Backup and Sump Pump Overflow Coverage

This is, without a doubt, the most critical endorsement for any homeowner with a basement or even a ground-floor level. As we’ve established, a standard policy won't pay a dime for damage when a sewer line or drain backs up into your home. This add-on closes that massive, and frankly dangerous, gap.

It’s designed specifically to cover the cleanup, repairs, and property replacement when:

- A city sewer line backs up and floods your home with raw sewage.

- Your sump pump gives out during a torrential downpour, turning your basement into a pool.

- A floor drain on your property overflows, sending water across your floors.

For a finished basement filled with furniture, electronics, and carpeting, a single sewer backup can easily cause $20,000 or more in damages. Most insurance companies offer coverage limits for this endorsement that range from $5,000 to $25,000. Considering how destructive and unsanitary this type of water is, opting for a higher limit is always a smart investment.

Hidden Water Damage and Service Line Coverage

Beyond backups, other endorsements offer vital protection for the problems you can't see lurking behind your walls or under your yard. These simple add-ons can turn a potential five-figure repair bill into a much more manageable claim.

Hidden Water Damage Coverage

This endorsement tackles the slow, hidden leaks that happen behind drywall or under floorboards. While the gradual water damage itself is still excluded, this rider helps pay for the "tear-out and access" costs. For example, if a pipe inside a wall has a slow leak, this coverage would pay for the plumber to open up the wall, locate the leak, and then repair the drywall when they're done.

Service Line Coverage

Your responsibility for utilities doesn’t end at your home’s foundation. You actually own the underground water and sewer lines that run from your house to the municipal connection at the street. If one of those lines cracks, collapses, or gets crushed by tree roots, the cost to excavate and repair it can be thousands. Service line coverage is a low-cost endorsement that covers these expensive external pipe failures.

Key Insight: The annual cost for these endorsements is often shockingly low, sometimes less than a hundred dollars a year. The return on that small investment becomes immense the moment you need to use one, preventing a catastrophic out-of-pocket expense.

Deciding which endorsements you need really comes down to assessing your home's unique risks. Do you have an older home with aging pipes? Is your house on a high water table where the sump pump runs constantly? Every property has different vulnerabilities, and understanding your specific policy's fine print is key. For instance, reviewing how different carriers handle claims, like Liberty Mutual’s coverage for water damage, can give you valuable context when you talk to your agent about these essential add-ons.

A Step-by-Step Guide to Filing a Water Damage Claim

The moment you see water pouring through your ceiling or pooling in the basement, panic sets in. It's a chaotic, overwhelming experience, and in that chaos, it’s easy to make mistakes that could sink your claim for homeowners insurance coverage for water damage.

Acting fast—but also methodically—is your best defense. This guide is your playbook for turning that stressful event into a structured recovery plan, ensuring you navigate the claims process for a fair and successful outcome.

Step 1: Immediately Mitigate Further Damage

Your very first responsibility, and one your insurance company absolutely expects, is to stop the water and keep things from getting worse. This is known as "mitigating the damage," and it's non-negotiable.

Start by shutting off your home’s main water valve. If the problem is an appliance like a washing machine, you can usually just turn off the local valve connected to it. Taking this first step proves to the insurer that you acted responsibly to minimize their loss.

Step 2: Document Absolutely Everything

Before you touch a single thing or start any cleanup, grab your smartphone. Meticulous documentation is the single most powerful tool you have when filing a claim.

- Take Photos and Videos: Capture the damage from every angle. Get wide shots to show the full scope and close-ups of specific ruined items. Record a video where you walk through the affected rooms, narrating what you see as you go.

- Document the Source: If you can safely see it, get clear pictures of the burst pipe, the failed washing machine hose, or whatever caused the mess. This evidence is crucial for establishing the "sudden and accidental" nature of the event.

Crucial Tip: Do not throw anything away until your insurance adjuster has seen it in person or you have their permission in writing. Discarding damaged property before it's documented is one of the fastest ways to get that part of your claim denied.

Step 3: Notify Your Insurer Promptly

As soon as you can, call your insurance agent or the carrier's 24/7 claims hotline. The sooner you report the damage, the faster the entire process can get started.

Have your policy number handy and be ready to give a clear, factual account of what happened. Stick to the facts—what you discovered and the steps you’ve already taken to mitigate. Avoid guessing about the cause or the full extent of the damage. And from here on out, keep a log of every conversation: note the date, time, the name of the person you spoke with, and a summary of what you discussed.

Step 4: Understand the Players Involved

Once you file the claim, you'll start hearing from different professionals. Knowing who works for whom is key to protecting your own interests.

The insurance adjuster sent by your carrier works for them, not for you. Their job is to assess the damage from the insurance company's perspective and determine what they believe is a fair payout.

You also have the right to hire a public adjuster, who is a licensed professional you pay to represent your side. They work for you to negotiate with the insurance company and maximize your claim settlement. It's also smart to get your own independent repair estimates from trusted restoration contractors to use as a benchmark.

Knowing the typical insurance claim timeline can also help you manage expectations and stay on top of the process. Being proactive turns a chaotic event into a manageable recovery.

Proactive Home Maintenance to Prevent Water Damage

The best claim is always the one you never have to file. While understanding your homeowners insurance coverage for water damage is critical, nothing beats proactive maintenance as your first and most powerful line of defense.

Taking simple, preventative steps does more than just protect your home from devastating leaks. It also demonstrates responsible ownership—a key factor insurers look for when you do need to file a claim. A consistent maintenance routine can stop the most common causes of water damage before they ever start, saving you from the stress, disruption, and expense of a major incident.

Year-Round Interior Checks

The systems inside your home work hard every single day, which makes them prime candidates for failure if they're neglected. Kitchens, bathrooms, and laundry rooms are the perfect places to start.

- Appliance Hoses: Once a year, get behind your washing machine, dishwasher, and refrigerator to inspect their supply hoses. Look for cracks, bulges, or brittleness and replace them every 3-5 years, even if they look fine.

- Fixtures and Caulking: Take a close look at the caulking around your showers, tubs, and sinks. A failing seal is a common culprit behind slow, hidden leaks that lead to wood rot and mold.

- Water Heater: Inspect your water heater tank for any signs of rust or corrosion twice a year. A slow drip from the bottom is a massive red flag that the tank is on its last legs.

Basement and Attic Inspections

Out-of-sight areas like basements and attics are where water problems can brew for weeks or months, causing extensive hidden damage before you ever notice them.

Key Insight: A small amount of effort in these forgotten spaces can prevent a massive headache. A sump pump that costs a few hundred dollars to replace can save you from $20,000 or more in basement restoration costs.

Make it a habit to test your sump pump before every rainy season. Just pour a bucket of water into the pit to make sure it kicks on properly. In the attic, look for any moisture stains on the underside of the roof sheathing, especially after heavy rain, as this is a tell-tale sign of a roof leak.

Seasonal Exterior Maintenance

Your home’s exterior is its armor against the elements. Keeping it in top shape is crucial for stopping water intrusion from storms and seasonal weather shifts. A simple seasonal checklist can make all the difference.

- Spring/Fall Gutter Cleaning: Clogged gutters are a primary cause of water damage. When they overflow, water runs down your walls, seeps into the foundation, and wreaks havoc on your roof.

- Winter Pipe Protection: Before the first freeze hits, disconnect all garden hoses and insulate any exposed exterior pipes and faucets to keep them from bursting.

- Roof and Siding Inspection: At least once a year, do a visual inspection of your roof for any missing or damaged shingles. While you're at it, check the siding for cracks or gaps where water could sneak in.

A little bit of routine maintenance goes a long way. The following checklist breaks down key tasks by season to help you stay on top of things year-round.

Home Water Damage Prevention Checklist

| Task | Frequency | Area of Home | Why It's Important |

|---|---|---|---|

| Inspect Appliance Hoses | Annually | Kitchen, Laundry Room | Prevents sudden bursts from washing machines, dishwashers, and refrigerators. |

| Clean Gutters & Downspouts | Twice a Year (Spring/Fall) | Exterior | Stops water overflow that can damage the roof, siding, and foundation. |

| Test Sump Pump | Twice a Year (Before rainy seasons) | Basement/Crawlspace | Ensures it will work during a heavy storm to prevent flooding. |

| Inspect Roof & Siding | Annually | Exterior | Catches missing shingles or cracks before they turn into major leaks. |

| Check for Leaks Around Toilets & Sinks | Quarterly | Bathrooms, Kitchen | Finds slow drips from failing seals or supply lines before rot sets in. |

| Inspect Water Heater | Twice a Year | Basement, Garage, Utility Closet | Identifies corrosion or small leaks that signal imminent tank failure. |

| Insulate Pipes | Annually (Before Winter) | Exterior, Basement, Crawlspace | Prevents pipes from freezing and bursting during cold weather. |

| Check Caulking & Grout | Annually | Bathrooms, Kitchen | Maintains a watertight seal around tubs, showers, and sinks to stop hidden leaks. |

By adopting this proactive mindset, you transform from a reactive victim of water damage to a prepared homeowner who is in control of your property’s well-being.

Frequently Asked Questions About Homeowners Insurance Coverage for Water Damage

When you're dealing with water damage, a lot of specific "what if" scenarios come to mind. Let's tackle some of the most common questions Los Angeles homeowners ask when trying to figure out their insurance coverage.

Q: Does homeowners insurance cover mold removal?

A: This is a huge point of confusion. The short answer is: sometimes. Your homeowners insurance will typically only pay for mold removal if it’s the direct result of a covered water event, like a pipe that suddenly bursts. Think of it as a domino effect—the covered water damage has to be the first domino. But even then, most policies have a strict, and usually low, limit for mold cleanup, often just $5,000–$10,000. Mold caused by slow, gradual leaks or high humidity from coastal fog is almost never covered.

Q: What should I do if my water damage claim is denied?

A: Getting a denial letter is frustrating, but it’s not always the final word. First, ask the insurer for the denial reason in writing. That document will point to the exact policy language they’re using. Once you know why they denied it, you can file a formal appeal with supporting evidence, like a plumber’s report proving a leak was sudden. If your insurer still won’t budge, consider hiring a public adjuster who works for you to negotiate a fair settlement.

Q: Is a leaking roof covered by insurance in California?

A: It all depends on why the roof is leaking. If it was a covered peril—like a Santa Ana windstorm that ripped shingles off or a fallen tree that punched a hole in it—then the resulting interior water damage is usually covered. However, the policy will not pay to fix the roof itself. If your roof is leaking simply because it's old, the shingles are worn, or it was installed poorly, the claim will almost certainly be denied as a maintenance issue.

Q: Does my policy cover water damage from an upstairs neighbor's condo?

A: Generally, yes. This usually falls under the "sudden and accidental" rule. Your policy should cover the damage to your unit (drywall, flooring, personal belongings). Your insurance company will then likely go after your neighbor's insurance company to get reimbursed for the payout, a process called subrogation. Document everything and file a claim with your own insurer immediately.

If you're facing a sudden water disaster and need immediate, professional help to handle both the cleanup and the tricky insurance process, Onsite Pro Restoration is on call 24/7. Our certified experts can be at your Los Angeles-area home in about an hour to start the restoration and meticulously document everything for your claim.

Get a free assessment by visiting us at https://onsitepro.org or calling our emergency line.